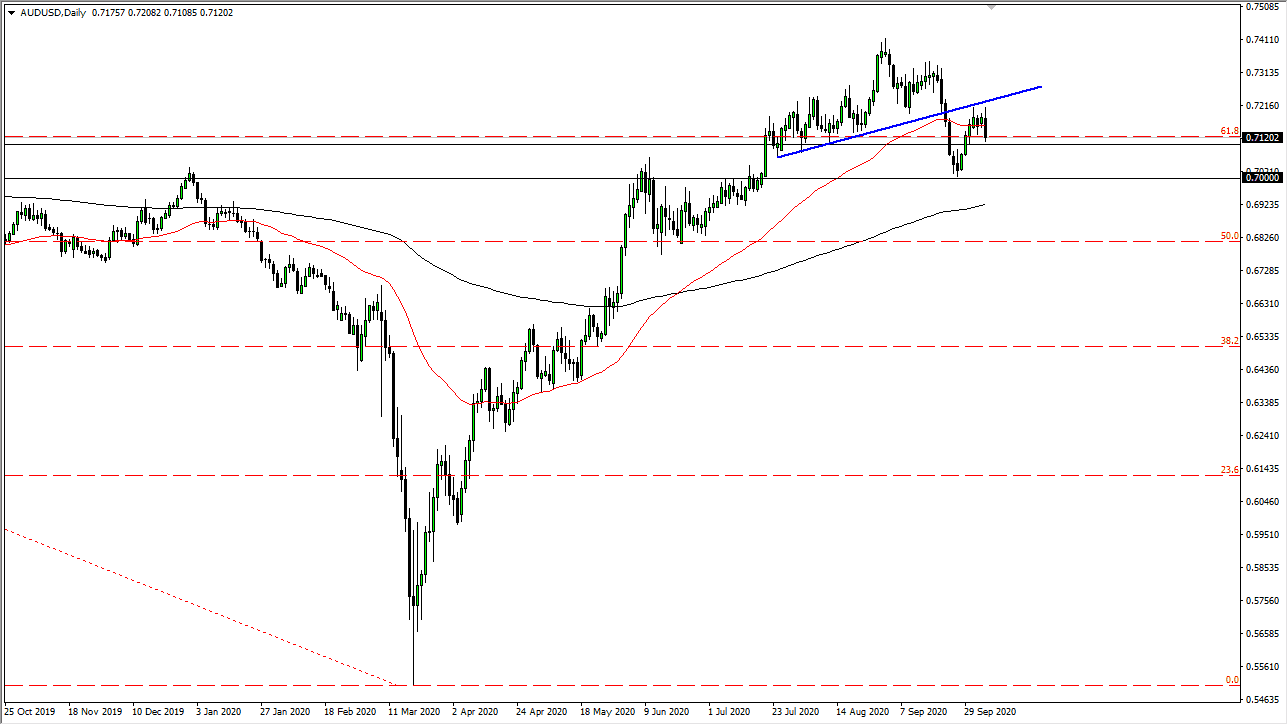

The Australian dollar initially tried to rally during the trading session on Thursday as we continue to see a lot of noise in general. The uptrend line has offered resistance on the way back up, as we retest the entire area. Donald Trump has suggested that his negotiator should stop trying to forge a stimulus deal until the election, which had an absolute flush of money running towards the US dollar. With that being the case, the Australian dollar reached down towards the 0.71 handle, an area that would obviously attract a lot of attention as it was the top of previous support. The area between 0.71 and 0.70 has been important more than once, and now it looks like we may go into this area to test whether or not we can break down a bit from here. I think that it is only a matter of time before we try that move, and if we do break down below the 0.70 level, this will suddenly be got much more interesting.

The Australian dollar has been difficult to trade, mainly because it has been a bit more resilient than many of the other currencies against the greenback. After all, the Australian dollar is highly levered to China, which is what everybody wants to throw money at. As long as that is going to be the case, the Australian dollar will get a bit of a pass when it comes to trading.

When you are looking to buy the US dollar, you are looking to do it against other currencies, because the Australian dollar has been rather bulletproof. However, if you are looking to sell the US dollar the Australian dollar makes a lot of sense as it has been so strong. Looking at the 50 day EMA slicing through the last couple of trading sessions suggests that we are essentially looking to go sideways and do nothing. I think that is probably going to change soon, but there is so much to chew through underneath that I just do not have any interest in shorting this market until we get a daily close below the 0.70 level. Market participants continue to be thrown around by headlines, and things that have absolutely nothing to do with economics, so this is probably a one-way trade in the sense that if you are getting rid of the greenback this is where you want to be.