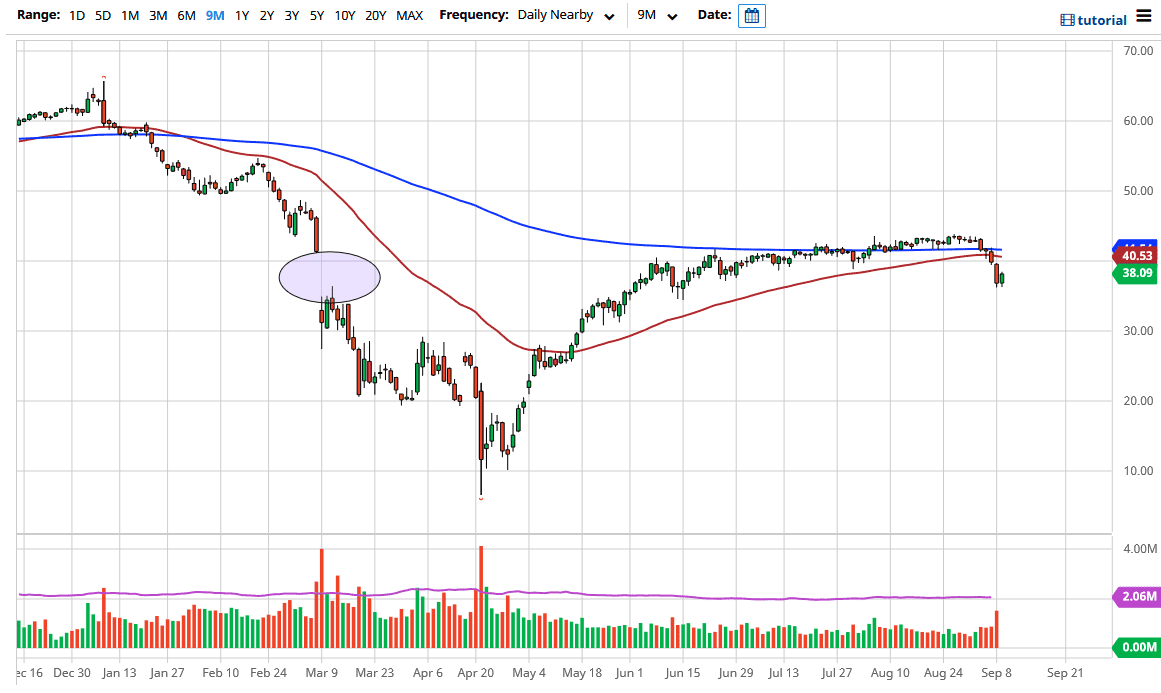

The West Texas Intermediate Crude Oil market bounced a bit during the trading session on Wednesday, as it had most certainly gotten a bit oversold. That being said, the market still has taken a very strong bashing to the head, and therefore it is likely that we will continue to go lower over the longer term. Ultimately, this is a market that will be paying close attention to the 50 day EMA, which is sitting just above the $40 level. The market has struggled over the last couple of days as we start to focus on lack of demand, especially after the Saudi oil minister suggested that prices were going to have to be lower for longer due to the fact that there were not enough buyers.

This is a new paradigm for the oil market because if the price gets too high, the Americans will just start pumping more. That being said, oil is going to behave much differently than it has in the past, and at this point, it almost looks a bit like gold was back in the 1980s, simply a market that probably gets sold into quite a bit. Do not be wrong, someday things will turn around but right now it is obvious to me that the market is struggling to keep its composure. I think at this point the rally that we have seen during the trading session on Wednesday will simply be an opportunity to sell from higher levels, so I will be looking at short-term charts in order to fade rallies that show signs of exhaustion.

To the downside, the $35 level should offer support, and then possibly the $30 level, assuming we go that low. Do not get me wrong, although I am bearish, I also recognize that eventually, buyers step back in. The US dollar rising and falling can have a completely inverse effect with this market as well, so that should be something worth paying attention to. All things being equal though, the US dollar is trying to reassert itself, which in and of itself will be bearish for this market. Beyond that, we have far too much crude oil in the world, so prices need to come down. I am a seller of short-term rallies and have no interest in buying now that we have made the impulsive move over the last week or so.