The West Texas Intermediate Crude market got absently crushed during trading on Tuesday as traders came back to work in Chicago and New York. Ultimately, with the Saudi oil minister suggesting that they are going to lower prices due to a lack of demand, this makes quite a bit of sense that the futures contract would fall rather significantly. At that point, I think it is only a matter of time before we would see the markets reach down towards the $35 level, possibly even down to the $30 level. In the short term, I like the idea of shorting small pops that roll back over.

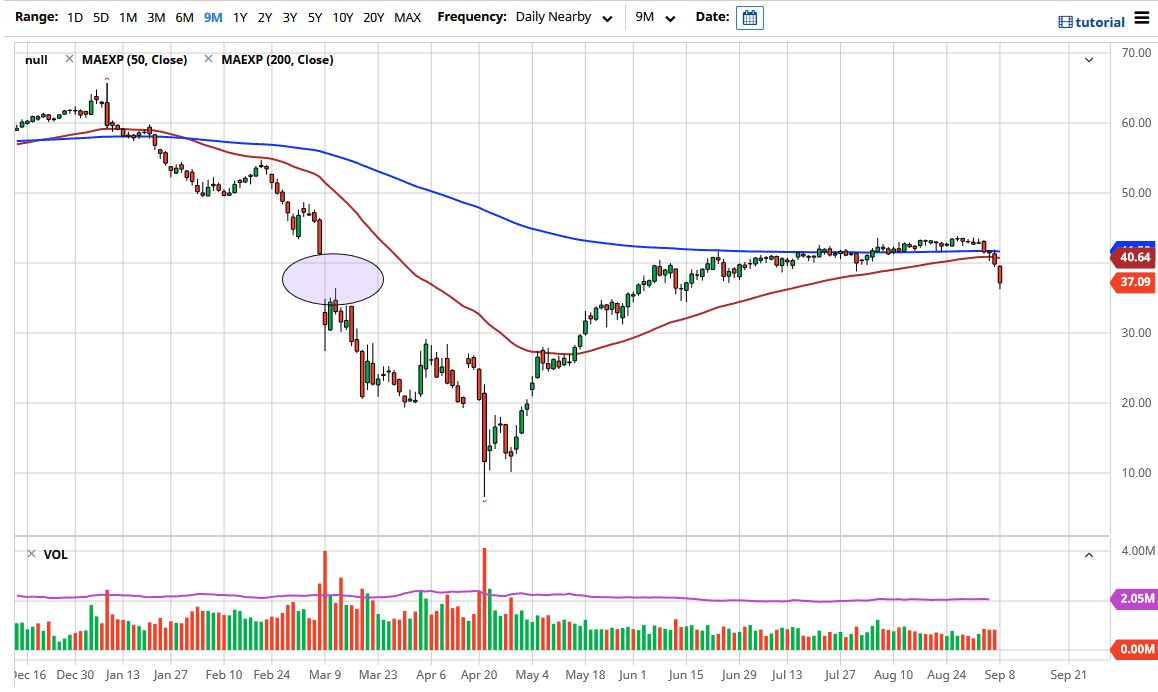

In other words, I am going to be fading exhaustion when it appears on smaller time frames. I also believe that the $40 level above will offer a significant amount of resistance due to its psychological importance, and of course the fact that there is structural importance there as well. Because of this, I will pay specific attention to the market in that area. At this point on, think it is only a matter of time before the sellers jump back in due to the fact that we are seen the US dollar strengthened as well, so that tends to work against the value of crude oil itself. In fact, it is not until we break well above the 200 day EMA, painted in blue on the chart, that I would be a buyer of this market. We have been grinding higher in a very slow and methodical manner for ages now and have finally made a bit of a decision as to directionality.

The biggest concern of course is the fact that demand just simply is not there. The hurricane did not do anywhere near enough damage to US production to drive down supply as well, so it appears that the fundamentals are starting to come back into play when it comes to crude oil, and it is not simply a “reflation trade” or something due to the US dollar. The good news of course is that it makes for easier trading, because we finally have some directionality to this market. The entire summer has been like watching paint dry, so at this point it should not be a surprise that we finally got some type of move. At this point, it certainly looks as if we have further to go.