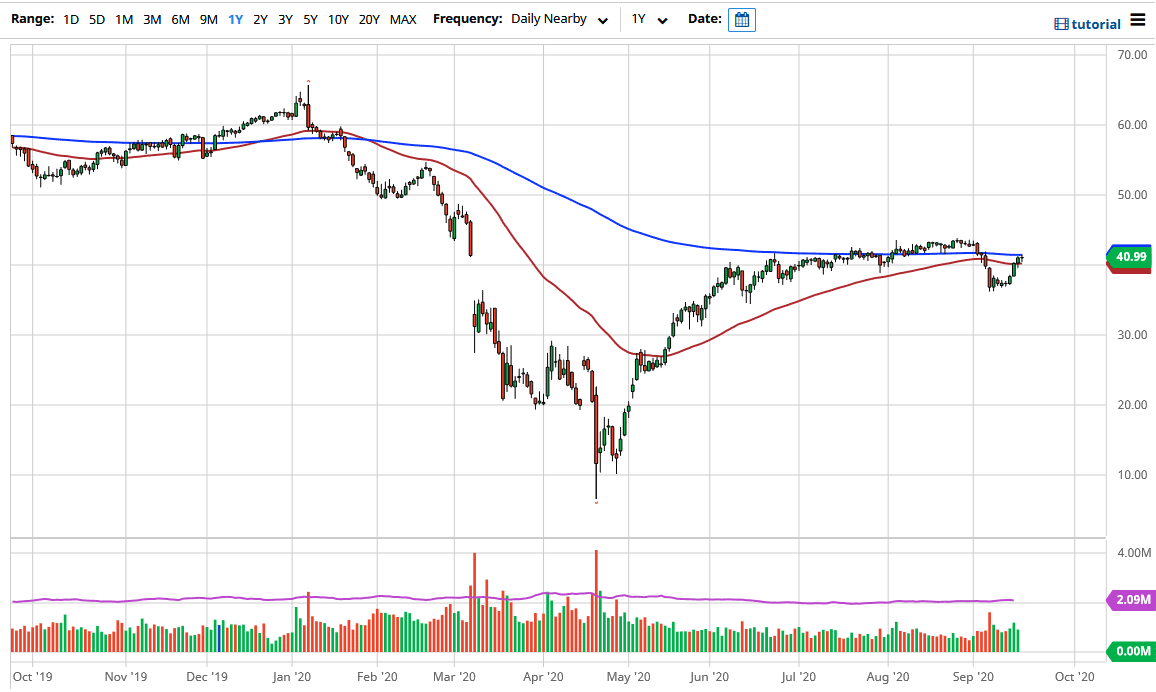

The West Texas Intermediate Crude Oil market initially pulled back a bit initially during the trading session but found some support at the 50 day EMA before turning around to reach towards the 200 day EMA. This is a market that I think will be very noisy in general, as we have recently seen a major selloff only to have the market turn right back around and try to take it out. That being said, there are a lot of questions about what is going on with the oil market, because we are seen so many crosswinds.

The 200 day EMA is going to attract a certain amount of attention but the $43 level above will also be important as it was where we had seen the market selloff from. Looking at this chart, you can see that we are in an area that is relatively important, and at this point in time, it is likely going to see a lot of decisions made in this area. The options markets are all over the place due to the fact that we had quarterly expiration, but I think at this point what we are going to see is some of the major concerns addressed.

For example, the US dollar is highly influential on this market, as it is priced in the greenback. If the US dollar rallies, then it could very well work against the value of the crude oil market, due to the fact that commodities in general suffer at the hands of the strengthening US dollar. Furthermore, OPEC has said that they are concerned about global demand going forward, so it is likely that the headwinds still prevail. However, some members of the Saudi royal family are suggesting that OPEC will continue to be involved in the futures market. In other words, volatility is about to get worse, not better. All things being equal, increasing volatility (OVX) is typically a bad thing for the oil markets, so I do think that it is only a matter of time before we see sellers. Having said all of this, if we do close above the $43 level on a daily chart, then you have to assume that we are going to go much higher. I believe that gravity eventually comes back into play here, and the sellers will return sooner rather than later.