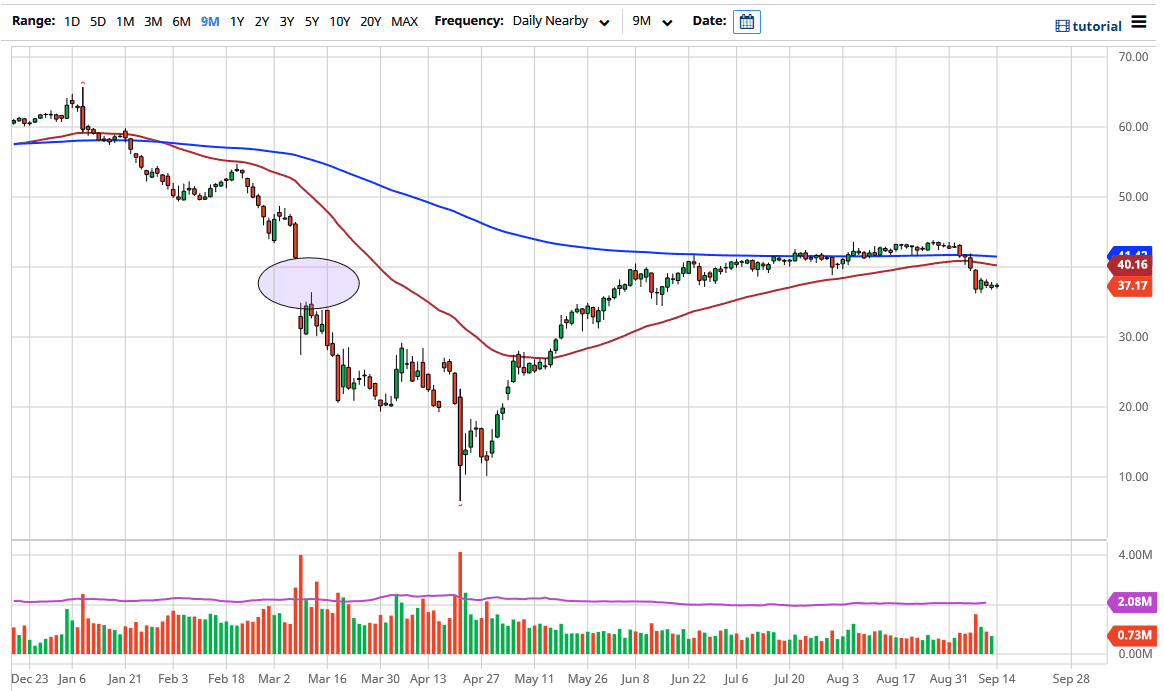

The West Texas Intermediate Crude Oil market has done very little during the trading session on Monday to kick off the week, but that should not be a huge surprise. After all, OPEC has recently suggested that demand is going to fall through the floor, and if that is going to be the case there is almost no way for this market to rally over the longer term. That does not mean we cannot rally though, so at this point, it is very likely that we will see the occasional rally, but more often than not you would be looking at a “fade the rally” type of scenario.

The 50 day EMA sits at the $40 level, and at this point, it should continue to cause quite a bit of resistance. I think at this point any time we get closer that there will be a lot of people interested in shorting this market. Having said that, it is likely that the market will break down quicker than that anyway. At this point, the $36 level has offered a bit of support and I think that breaking down below that level opens up the possibility of a move to the $35 level. The US dollar is starting to pick up a little bit of strength later in the day, so that could send the market lower as well because it will take less of those dollars to buy crude oil.

The $35 level underneath will be supportive, but I suspect that the massive pressure that we have seen probably opens up the possibility of slicing through that level, reaching down towards the $30 level. The $30 level underneath will be significantly supportive as well, so at this point, I like the idea of fading rallies underneath here as well. All things being equal, the market is likely to see a lot of negativity going forward due to the fact that not only is there is a significant lack of demand, but the reality is also that there are already countries in the OPEC purview that are looking to get out of the production cuts. This ends up being a self-fulfilling prophecy and a bit of the feedback loop. The candlestick for the last several days has formed a bit of a descending triangle, so that is also something that we need to pay attention to as well.