The West Texas Intermediate Crude Oil market has been relatively quiet over the last couple of days, and that is probably something that is necessary after the bloodbath that we have seen. As the Saudi oil minister suggested that they were going to have to sell oil at prices much lower than before, it really put a dent in this market as it showed just how little there is in the way of demand. With no demand, it is very difficult to imagine a scenario where crude oil prices can show strength.

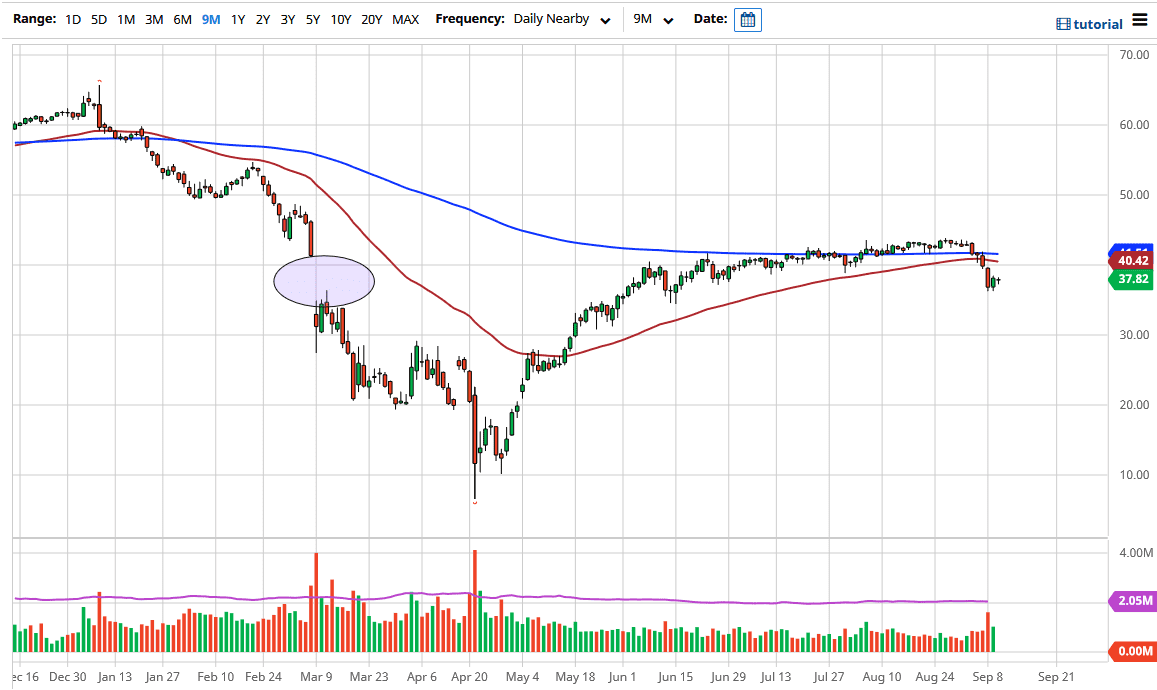

During the trading session on Thursday, we essentially went nowhere, but after plunging the way we did for several days, that should not be a huge surprise. Ultimately, markets cannot go in one direction forever and they do need to correct from time to time. I think ultimately if the market does in fact bounce a bit from here, I would be very interested in selling it near the $40 level, because it is an obvious large, round, psychologically significant figure in of course we have the 50 day EMA sitting just above it. That tends to attract a certain amount of technical trading, so it will be interesting to see how that plays out.

I will be looking for short-term signs of exhaustion that I can take advantage of, as this is a market that clearly has a lot to think about. To the downside, I believe that we may be looking towards the $35 level, and then possibly even the $30 level after that. I do think that we could eventually see a big flush lower, but in the meantime, I anticipate we are more likely to see a short-term bounce that we could be selling into on the first signs of weakness is much easier trade. After all, this is a market that I think given enough time needs to clear all the “easy money” out of it as it had been going sideways for so long. As far as buying is concerned, I would need to see a daily candlestick closing above the 200 day EMA to be enticed into doing that, something that would take a significant move to say the least as it is currently sitting at $41.65. The US dollar strengthening is going to do no good for crude oil either, so I think we are setting up for lower prices going forward.