The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Tuesday and even managed to hang on to the gains overall. However, on the shorter-term charts, we are already starting to see exhaustion, so I think it is only a matter of time before the sellers step in and start punishing this market. I certainly believe that there are plenty are technical areas worth paying attention to above as well, as we have seen a relatively strong breakdown of the markets over the last week or so.

Looking at the fundamentals out there, one of the biggest drivers of crude to the upside for a while now has been the idea of OPEC cutting production, thereby bringing down the supply of crude oil. However, we have recently seen the Iraqi government talk about how they wish to leave the production cut agreement, and therefore the first cracks in the ice started to show up. After all, if one of these countries leaves, it will cause a domino effect as so many of them will be looking to do the same as so many of the other members of OPEC make huge parts of their profits as a country from crude oil.

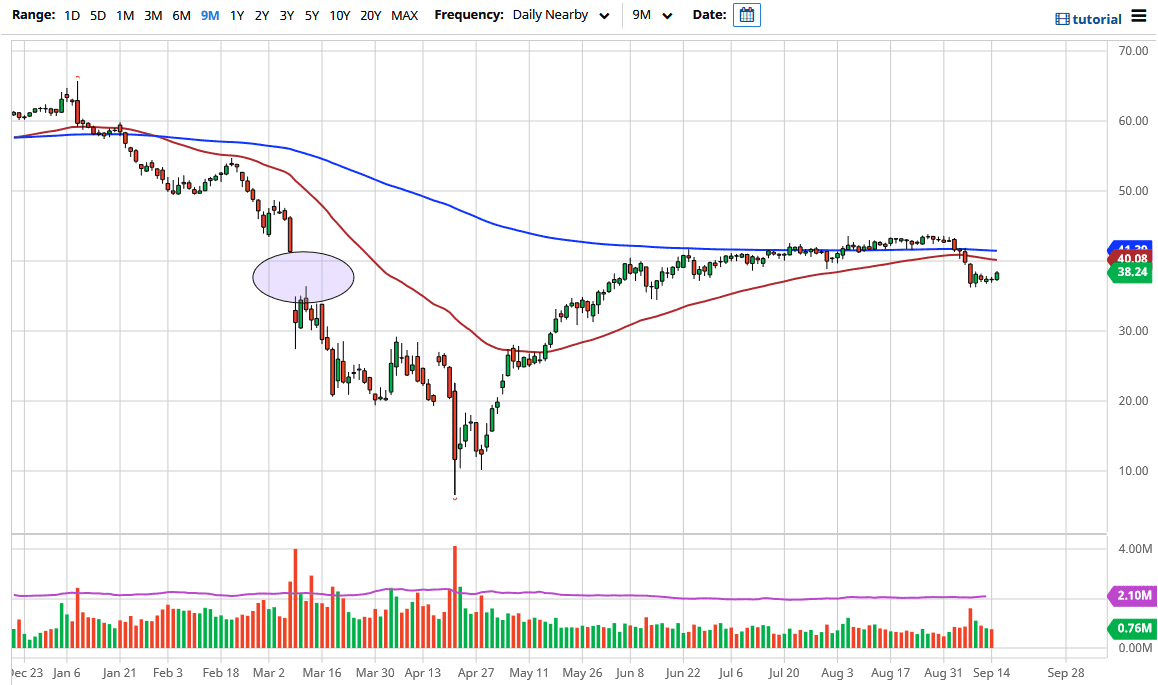

After that, we are starting to see signs of the US dollar perking up a bit, and the stronger the US dollar is, the more likely it is that the price of oil drops as it will take less of those US dollars to buy a barrel of oil. I do believe at this point, it is also worth taking a look at the $40 level, where the 50 day EMA currently sits. Not only is it a technical indicator that a lot of traders will pay attention to, but it is also a large, round, psychologically figure that it is sitting on. After the impulsive move that we have seen recently, it is clear the momentum has shifted to the downside for the longer-term move, at least as things look right now. However, if we were to turn around a break above the 200 day EMA, then you can start to have a different conversation. As things stand right now, I am a seller of short-term rallies as this market certainly looks as if it is ready to fall long term.