The West Texas Intermediate Crude market did very little during the day on Tuesday, as we stabilized a bit after the massive selloff on Monday. This in and of itself is somewhat of a bullish sign, but one would think that if the buyers were out there in full force, they would have been looking for an opportunity to pick up oil “on the cheap”, which was certainly being offered at the end of the day Monday. Because of this, I am not as impressed as I normally would be, because we had seen so much bearish pressure previously. At this point, I suspect that the market is simply trying to figure out what to do next.

That will almost certainly have something to do with the US dollar, which right now is chopping around back and forth against several other measuring sticks such as gold, the Euro, the Pound, etc. If the US dollar starts to pick up steam again, that will certainly weigh upon the oil markets and could cause a bit of negative pressure here. Furthermore, crude oil markets also need to deal with the idea that perhaps there is not as much demand for crude oil as once thought. This was highlighted 24 hours ago as a report came out suggesting that a lot less demand was coming out of China, which is a very nasty headwind for pricing power.

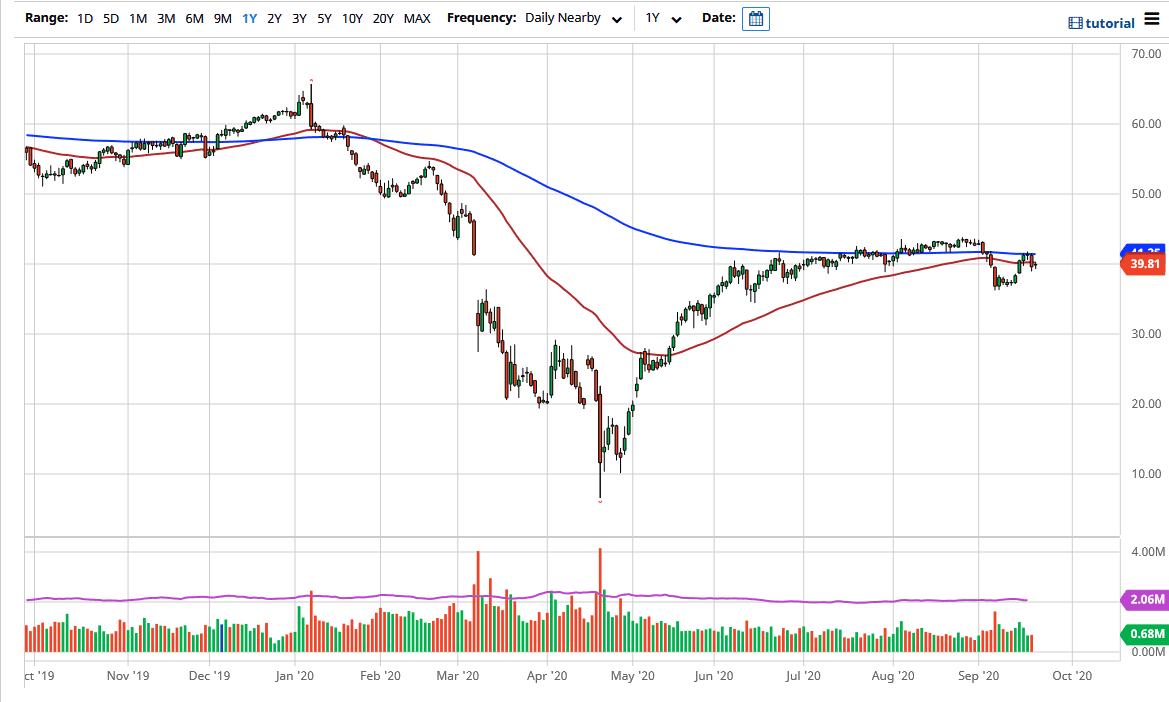

The 200 day EMA, which is colored in blue on my chart, is the barrier that I need to see this market break above in order to get bullish again. If it does not, then I believe that we are still in a “fade the rally” type of mentality, with the caveat that it is essentially a short-term trading environment right now. That nasty selloff on Monday certainly does not look like it is the end of the selling pressure, but that does not necessarily mean that we go straight down either. If we break down below the low from the session on Monday, then I suspect that this market goes looking towards the $37 level for its next target. Underneath there, the most obvious target would be $35 as it is a large, round, psychologically significant figure. With that being the case, I am certainly looking for selling opportunities but will probably have to do so from the 15-minute charts.