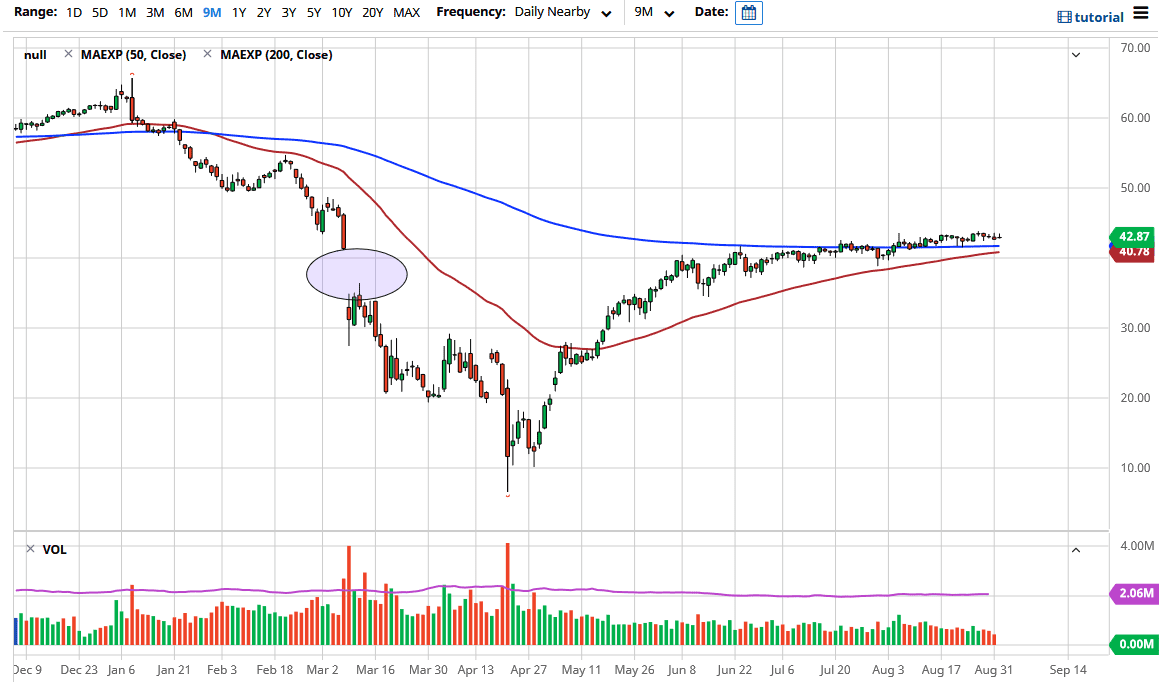

The crude oil markets were slightly bullish during most of the trading session on Tuesday in both Asia and Europe but have turned around to show signs of negativity once the open pit session started. Ultimately, we did up forming a bit of a shooting star, but that does not necessarily have me overly concerned. After all, we have been looking at the market going back and forth chopping around and trying to figure out where to go next for a while. I look at the 200 day EMA underneath as a potential buying opportunity, marked in blue on the chart. On the other hand, if the market was to break down below the red 50 day EMA, and perhaps even take out the $40 level, that is an area that I think would bring in a lot of fresh selling. Currently, there are so many different things moving the markets are now.

Looking at the US dollar, it did strengthen later in the day so that had a negative effect on the price of commodities on the whole, not just the West Texas Intermediate Crude Oil market. Because of this, one of the major catalysts to send the market higher has fallen by the wayside, at least for the short term. We also have OPEC cutting production and that continues to be a bit of a lift for the market. Beyond that, the hurricane damage was much less drastic to the industry than previously, so it does look like we are a little bit solid underneath. The biggest problem is the fact that there is no real demand at the moment, although as companies and economies open up, that should continue to help with that scenario.

I believe that given enough time, a short-term pullback should continue to offer buying opportunities and I do think that we grind higher from here. The market may ultimately go looking towards the $49 level, but it is going to take a while to get there. We have been in a “grind higher” for some time, and until we get some type of market-moving event, you can continue to look at this market as one that will go back and forth in a very short range. This is a day trading market, not something that you can hold for more than a few moments here and there.