The West Texas Intermediate Crude Oil market fell again during the trading session on Monday, but it should be noted that it was Labor Day in the United States and therefore you can only read so much into the price action. That being said, the last couple of sessions have been bearish and the fact that we are staying below the $40 level suggests that there is more pressure waiting for the market. The West Texas Intermediate Crude Oil market will continue to pull back from the expectations of supply shock due to the hurricane, as that has come and gone and did very little damage to the industry.

Furthermore, the Iraqi drillers one out of the production cuts, and that signifies a perhaps OPEC is ready to cave. If they do, then oil prices will certainly slump from there on out. There have been quite a few reasons for oil to go higher as of late, but the demand just is not there and eventually, that will come back into focus. With the crude oil markets moving with so many different headwinds, it is difficult to get a grasp on what has been going on. We have been grinding higher for quite some time, but the last couple of sessions have shown us a clear directionality to the downside. I do believe this is the beginning of something bigger, so I am looking to short the crude oil market on short-term charts. Do not get me wrong, I am not necessarily suggesting that we are going to completely collapse, just that there is obvious resistance above.

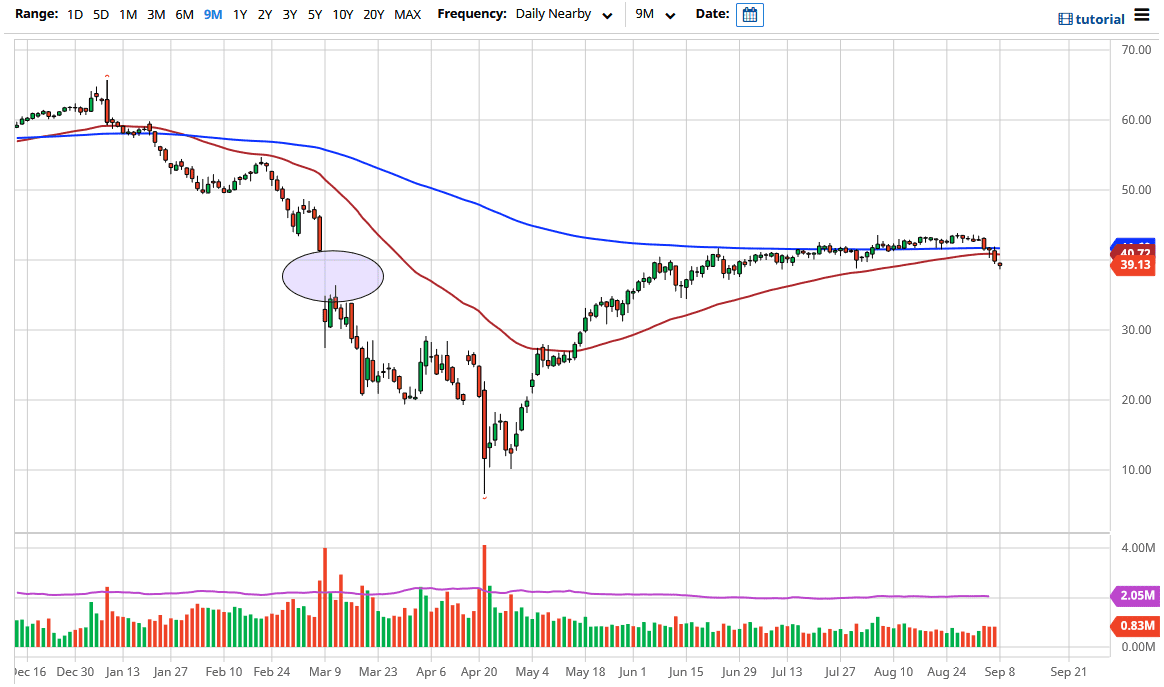

The first place I would expect to see a certain amount of resistance would be the $40 level. Above there, we also have the 50 day EMA which comes into play at the $40.72 level, and then finally the 200 day EMA which is at the highs from the Friday session. On signs of exhaustion from a short-term timeframe, I am more than willing to sell this market as I believe that we are more than likely going to be reaching towards the $35 level, which will be exacerbated if we do get some type of US dollar strength, although I do not necessarily think that the culprit. At this point, until the world’s economy picks up significantly, it is difficult to imagine a scenario where crude oil takes off to the upside for a sustained move.