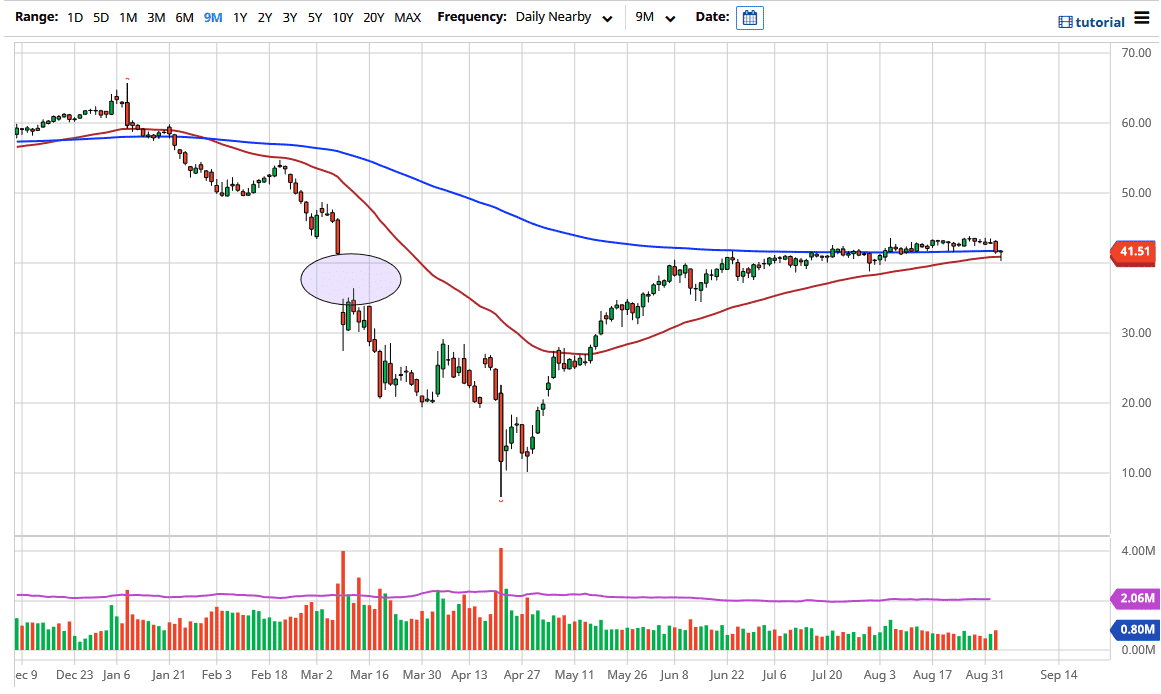

The crude oil markets have pulled back a bit during the trading session on Thursday as there has been a lot of volatility in the markets overall. However, it does look as if the $40 level is going to offer siIgnificant support. Because of this, I think that we are going to continue to see a lot of volatility, but the hammer does suggest that perhaps we will rally. It is very difficult to imagine that trading is going to be easy, because we have a lot of crosswinds going on at the same time.

The 50 day moving average is sitting just above the $40 level, so that continues to attract a lot of attention as well. Furthermore, we have the US dollar that is looking a little bit soft later in the day, as the candlestick for the West Texas Intermediate Crude Oil market looks suspiciously similar to the EUR/USD pair. Ultimately, I think that the market continues to bounce around back and forth in general, but with the jobs number coming out on Friday it is very likely that we will see an extreme amount of volatility in the United States dollar. If that is going to be the case, that will have a major effect on the crude oil market, and that of course people start to talk about the idea of whether or not there is going to be a significant amount of demand for the commodity. At this point, there are a lot of questions when it comes to that.

Further compounding the mass chaos is the fact that we had a flash crash of sorts during the session on Thursday, which translated into everything falling at one point. We have recovered from that, so it looks like stability has come back into the market. However, was not forget the idea that Iraq has suggested it wishes to stop with the production cuts, and if they start playing the market with crude oil, then the rest of OPEC countries will certainly do the same as they will not want to fall behind. That being the case, there is a lot of volatility just waiting to spring in the market, and if this point I suspect we are more than likely going to see a little bit of a short-term bounce, but if we break down below the $40 level, then it is likely that we would continue to go much lower, perhaps $35.