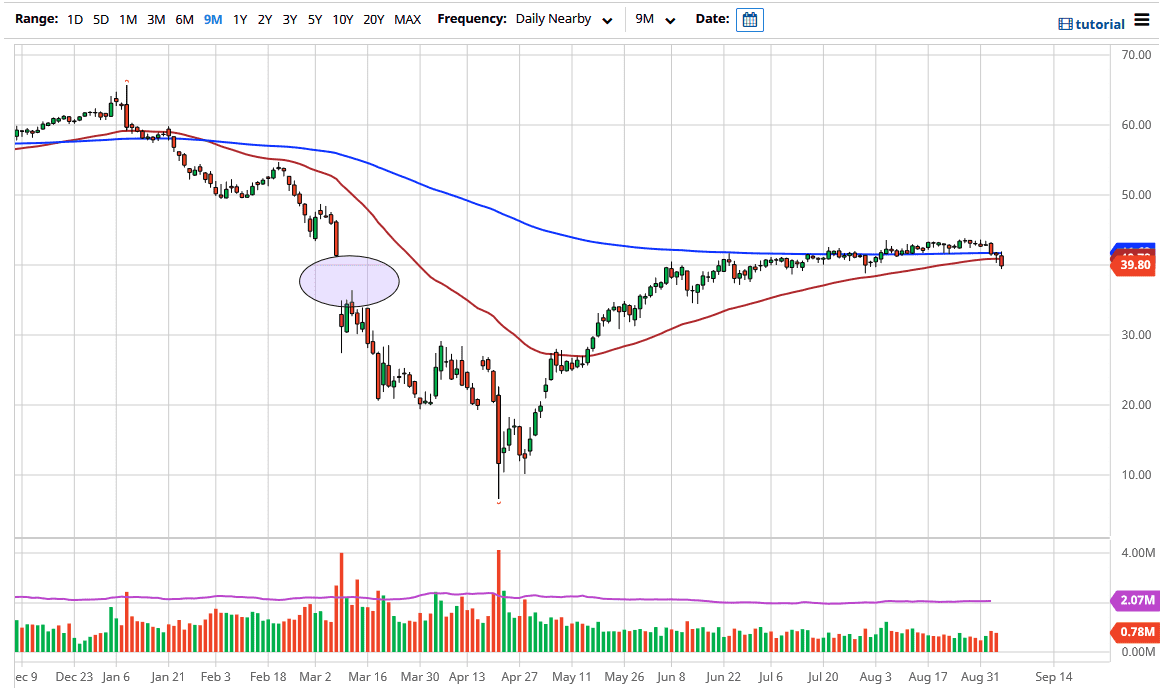

The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Friday, as we have broken the back of a hammer from the Thursday session, and perhaps even more importantly have broken down below the $40 level. By doing so, the market is likely to continue to go lower, as the $40 level is a crucial level that people will pay attention to as it is a large, round, psychologically significant figure. Breaking down below the bottom of that level is a very significant and symbolic gesture.

Rallies at this point should continue to see resistance extending towards the 200 day EMA, so that is an area that needs to be paid close attention to. If we were to break back above that level, then it is likely that the market goes much higher, perhaps to the top of the range, we have been in. However, this is a market that has finally made a significant move, and that is what it is worth paying attention to. With the Iraqis looking to get out of the production cut deal, it should show that there is real vulnerability when it comes to this marketplace, because there is no way that just one country will get the exception, so there is the possibility that the entire production cut deal falls apart.

Furthermore, we have to pay attention to whether or not there will be a huge demand burst from around the world, and right now we are not necessarily seeing that. There is an oversupply of crude oil and that should continue to be a major problem, and then if the US dollar were to strengthen, that would also cause major problems. With all of that, it is likely that we will see a lot of noise and perhaps choppiness but as traders have come back from the vacation season, we could start to see more volume jump into this market. Ultimately, I think it is only a matter of time before we make a bigger move and a breakdown at this point more than likely has this market looking towards the $35 level. The $30 level after that would be the next target. To the upside, the $43.50 level should offer a significant amount of resistance.