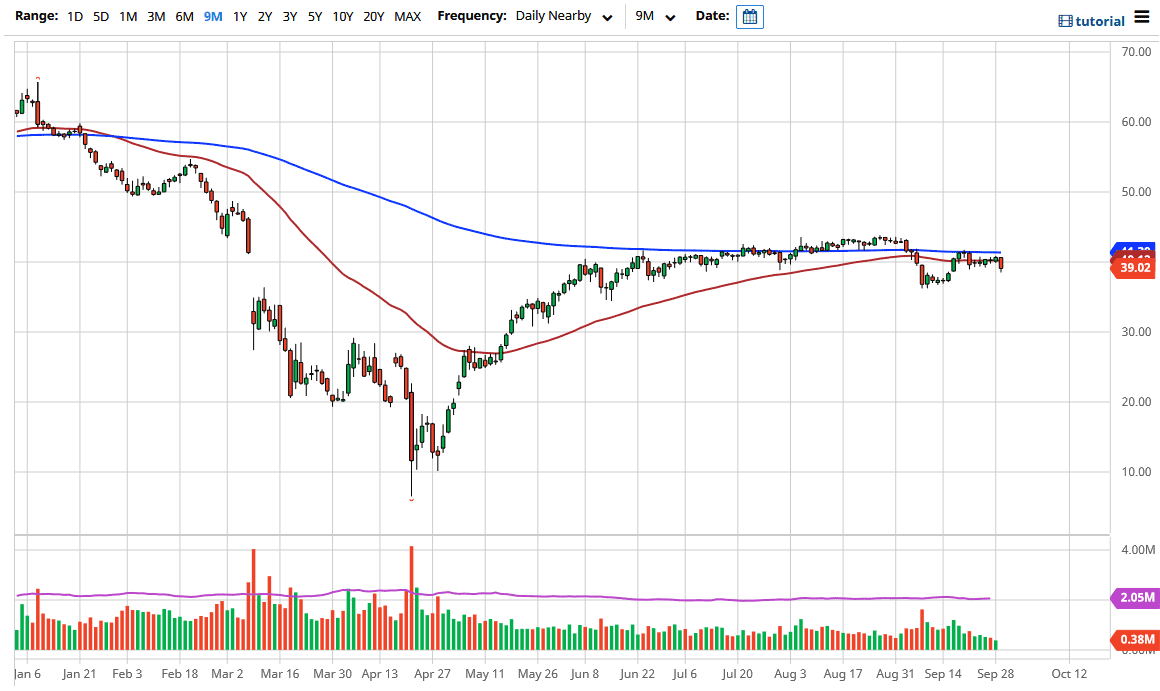

Crude oil markets have broken down slightly during the trading session on Tuesday, slicing down towards the $39 level. That being said, the market has been very noisy and therefore there is only so much you can do when it comes to reading into one candlestick. Because of this, reaching towards the $39 level is a negative sign and this is especially telling considering that the US dollar has been falling all day. If that is going to be the case, it shows that people are concerned about crude oil in general.

Russia is increasing oil production, so that being said it makes quite a bit of sense that we are going to see negative pressure. When I pay attention to this chart, I think it is only a matter of time before we go looking towards the $37 level. Rallies at this point I do not trust, and I do believe that eventually, we have to make a bigger move. I don’t know whether or not we are going to make that move sooner or if it is can it take some time, but either way, it certainly looks as if we are drifting a little bit lower.

Signs of exhaustion on short-term charts are likely to be taken advantage of, and it is not until we break above the 200 day EMA that I would consider buying. Even then, I would be a bit cautious but if we had a rapidly falling US dollar, that might be a catalyst to see this market go higher. Ultimately, I believe that we have to pay attention to the overall attitude of the US dollar and whether or not there is enough demand to rip through the supply. Demand is a major issue and if the Russians are going to be pumping out more, then it makes quite a bit of sense that the price will probably drop. Ultimately, this is a market that is looking for some type of catalyst to move in one direction or another, so having said that we need to pay attention to the next move. If we break down below the bottom of the candlestick for the trading session on Tuesday, it is likely that we are going to see much more selling.