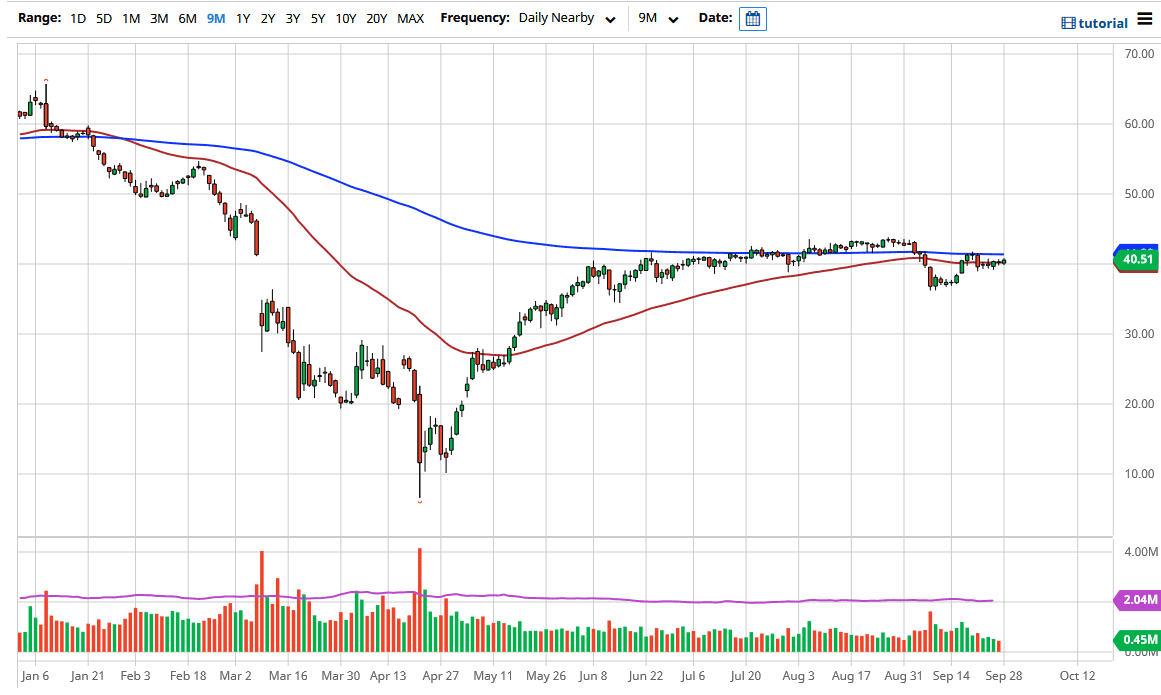

The West Texas Intermediate Crude Oil market continues to do very little as far as a range is concerned, as we have been dancing around the $40 level. This area also features the 50 day EMA so that of course will attract a lot of attention also. The US dollar has been all over the place during the last couple of days, so the market is likely to continue to see a bit of a mixed review when it comes to whether or not that is going to have significant influence.

The market has been flat for the most part of the last couple of months with the occasional grind in one direction or the other. Ultimately, I think that is going to be more of the same until we get a catalyst. The catalyst could be Friday when we get the jobs number, as it seems like the market is dancing around and trying to decide whether or not the focus on the US dollar, lack of demand, OPEC cuts, are a whole host of other problems. Unless you are a short-term trader your unlikely to find any type of reason to be involved in this market. The market seems to be focusing on little micro movements, and unless you are actually sitting their trading at the computer and watching the chart, you probably will not have much to do here.

However, I believe that eventually we will get some type of impulsive candlestick like we got last week, and that could produce some follow-through. The most recent one of course was negative, but at this point we are still kind of killing time and waiting for a reason to put money to work. At this point, I do not have any interest in trying to trade this for anything more than a short-term scalp in one direction or the other. For those who are looking for bigger moves, you should see an impulsive candlestick lead you in the proper direction. Currently, it looks as if the 200 day EMA is short-term resistance just above, while a breakdown below the lows of the last couple of sessions could send this market looking towards the $37.50 level underneath. The most part though, traders will find very little to do here unless they have the ability to go back and forth every 20 or $0.30.