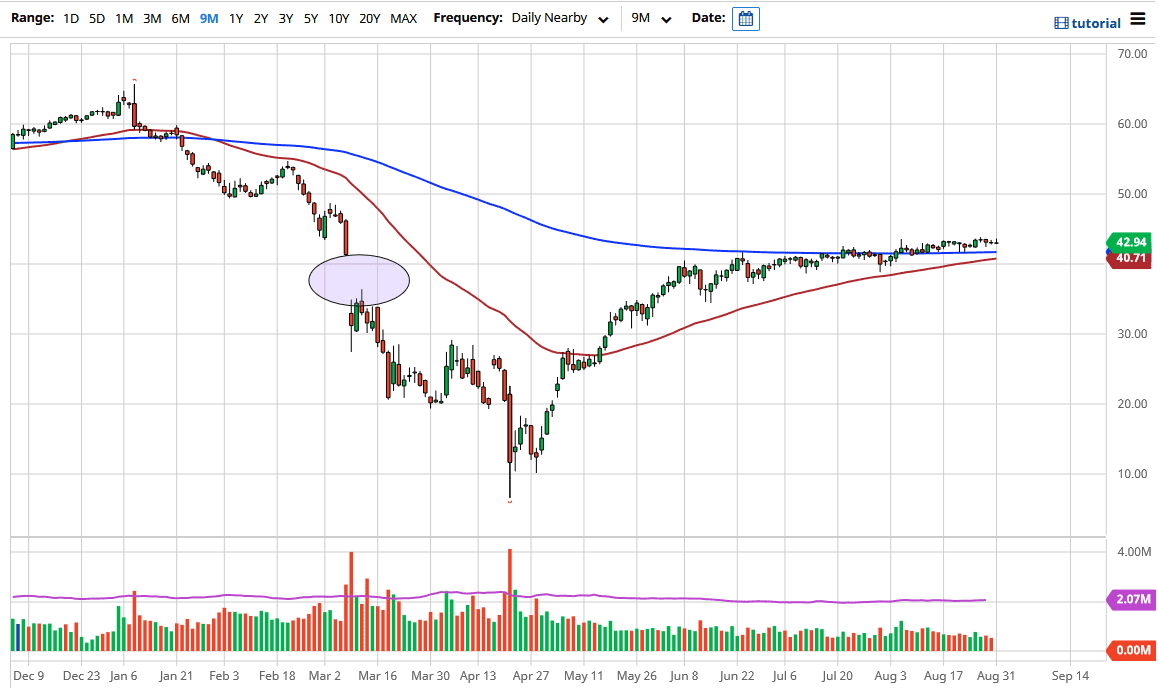

At this juncture, the market seems to be paying attention to the 200 day EMA underneath as support, just as the 50 day EMA is just below there. Given enough time, the 50 day EMA is very likely to cross above the 200 day EMA, forming the “golden cross” that a lot of longer-term traders pay so much attention to.

The West Texas Intermediate Crude Oil market, just like other commodities, is moving along the lines of a reaction to the US dollar. In other words, as the US dollar continues to find weakness, this has supported the crude oil market as it is going to take more of those US dollars to buy barrels of oil. At this point, the market is likely to continue to see buyers underneath especially between the two moving averages. The $40 level is also a major support level, and therefore it is likely that if we were to break down below there it would be a major breakdown in the market and could send the contract down to the $35 level, possibly even the $30 level. That being said, unless the US dollar suddenly spikes in value, I do not see that happening.

On the other hand, I find it easy to buy short-term pullbacks in this market as it continues to grind to the upside, albeit slowly. The market continues to be more of a short-term trading type of environment, and therefore I think that you will have to look towards 15 minute charts or something like that in order to pick up little $0.20 and $0.30 moves. Because of this, it is very likely that we are going to see more of this back and forth going forward, at least until we get some type of catalyst. Right now, demand of course is somewhat limited, but at the same time we are starting to come to the conclusion that perhaps it will start to pick up again. Furthermore, OPEC has stuck to its production quotas fairly well, so that is bullish. However, we will also see more shale production at these prices as well. The market is compressing, so the only thing you can do is play it from the short timeframe.