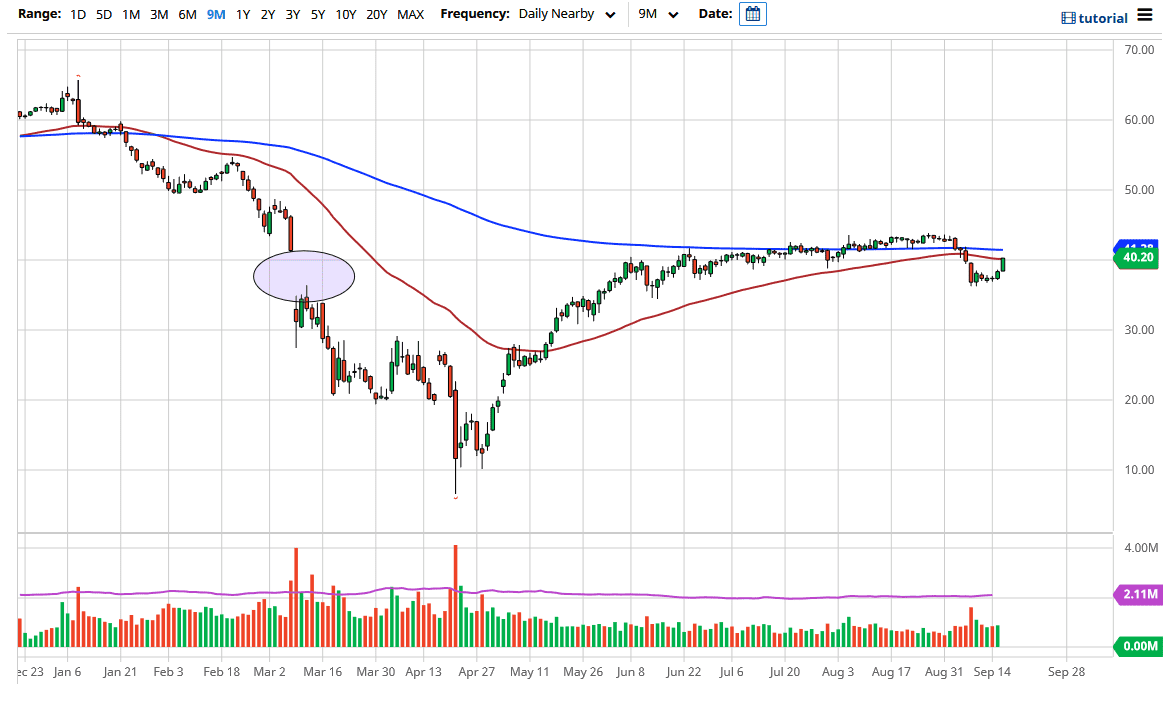

The West Texas Intermediate Crude Oil market has bounced rather hard during the trading session on Wednesday. As we continue to see a bit of a relief rally after the recent selling, a reaction to the better than anticipated inventory figures coming out of the USA. There is still a major concern when it comes to an oversupply of crude oil, and OPEC itself has suggested that demand will continue to weaken, and if that is going to be the case it is hard to imagine a scenario where crude oil certainly takes off to the upside. In this sense, I’m simply waiting for a sign of exhaustion that I can start selling again.

All that being said, I believe that it is only a matter of time before we have to make some type of a longer-term decision, and I also recognize that the recent move lower was the first significant move that we have seen in several months. It is either going to be a massive “fake out”, or a bit of a harbinger of what it is about to happen next. It certainly would make more sense that crude oil falls due to the fact that there is a lack of demand and a lot of uncertainty going forward. That being said, it should also be noted that the US dollar will have its say when it comes to this market, as a strengthening greenback can quite often work against the value of crude oil.

China is starting to heat up a bit, so that helps the idea of crude oil strengthening, but at the end of the day, there is still a massive oversupply of crude oil. Even if we do rally from here, I suspect that the market will struggle to make a fresh, new high, at least without some type of significant catalyst. To the downside, if we blow through the bottom of the candlestick lows from last week, that opens up the door to much lower trading, the $35 level being the initial target, followed by the $30 level. In the meantime, I am looking for short-term candlesticks that show signs of exhaustion that I can fade on rallies. If we were to break above the 200 day EMA and stay above there on a daily close, then I am more than willing to change my opinion and start going long.