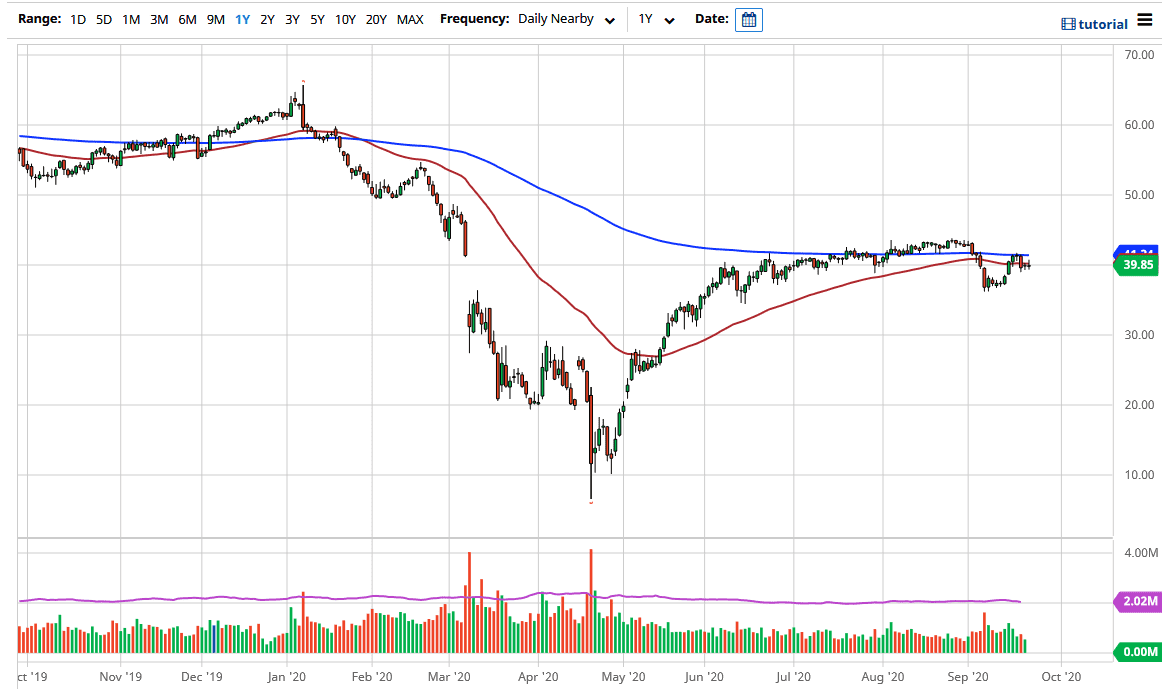

The West Texas Intermediate Crude Oil market continues to dance around the $40 level, as the market has nowhere to be. The 50 day EMA is flattening out so it looks like we are going back into that” watching paint dry” type of market, as we are simply going back and forth in a very tight range. All things being equal though, I am much more bearish than I am bullish as the US dollar seems to be picking up quite a bit of strength, and that will eventually make itself known here.

For what it is worth, there was a massive $0.75 spike in the middle of the day for no apparent reason, so I have the sneaking suspicion that somebody somewhere blew up. Forced liquidation is never a good thing for the market, so the volatility may be crushed even more considering that a lot of orders have suddenly been taken out. This of course is just my opinion and theory, and it does not really matter what caused anything, just know that the market did not go anywhere even though we had a huge, massive move.

A breakdown below the lows on Monday and Tuesday would open up further selling, reaching down towards the $37.50 level. Ultimately, if we break down below there, then it is likely that we go down towards the $35 level next. I have no interest in buying crude oil, at least not until we break above the 200 day EMA on a daily close at the very least. I anticipate that we will continue to see short-term selling on short-term charts to show signs of exhaustion. As for a bigger move, I do not really see that happening quite yet, but clearly we have no candlestick in which the base anything off right now. I would look towards the negativity in the market more than any type of positivity, because there has not been much in the way of conviction. As the US dollar continues to strengthen overall, that will of course put a lot of downward pressure on commodities in general, and a lot of people are concerned about whether or not there is going to be a significant amount of demand as economies around the world continue to struggle. Crude oil will probably continue to be overabundant.