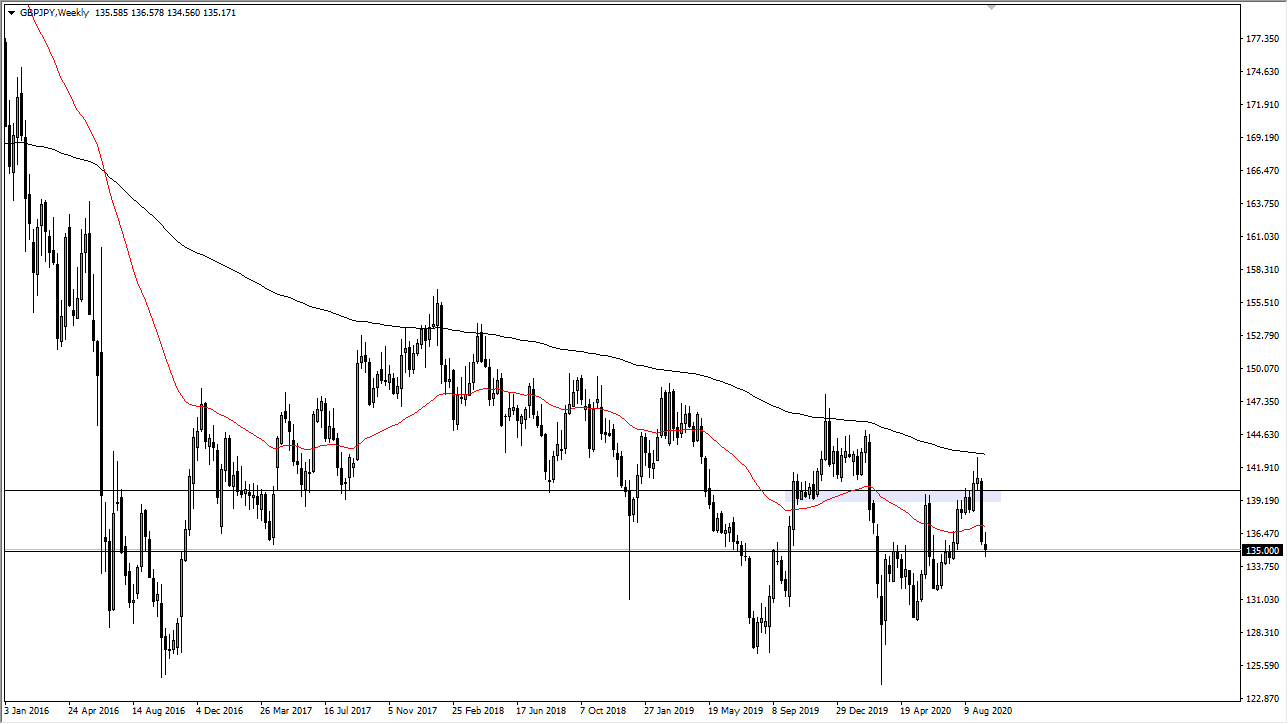

GBP/JPY

The British pound has gone back and forth during the bulk of the week against the Japanese yen, and quite frankly I think this is indicative of just how important area that we currently trading at is. The ¥135 level is a large, round, psychologically significant figure, and an area where we had seen resistance previously. With that in mind, I think it is going to be a very choppy week but follow whatever direction the market breaks out of this candlestick as it should lead for a move of at least 100 pips.

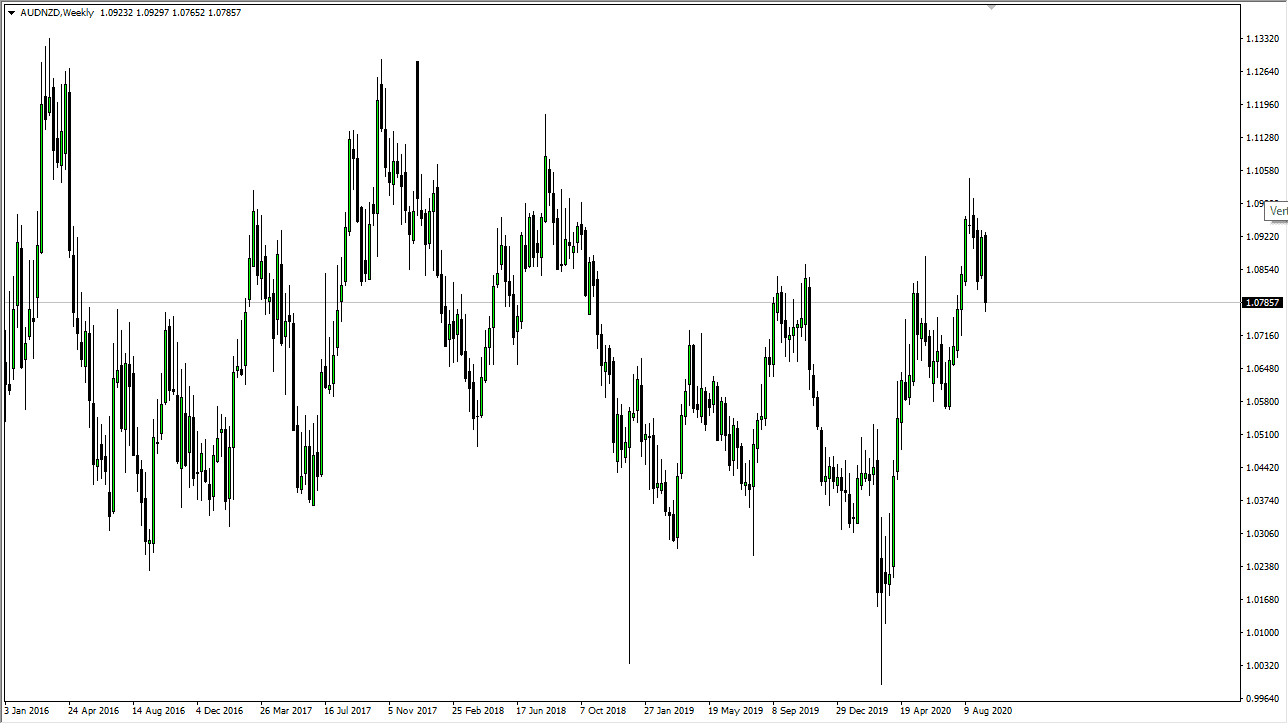

AUD/NZD

The Australian dollar has plummeted against the New Zealand dollar during the course of the week, breaking the ¥108 level to the downside. Ultimately, this is a market that had gotten a bit ahead of itself, but it still looks relatively well supported underneath. I think it is likely that we will see a bit of a bounce here, so look for supportive actions underneath, and when you look at both of these currencies against the US dollar, the Aussie dollar certainly looks stronger so it is a relative strength play at this point. Given enough time, I believe that we will find buyers later this week in this pair.

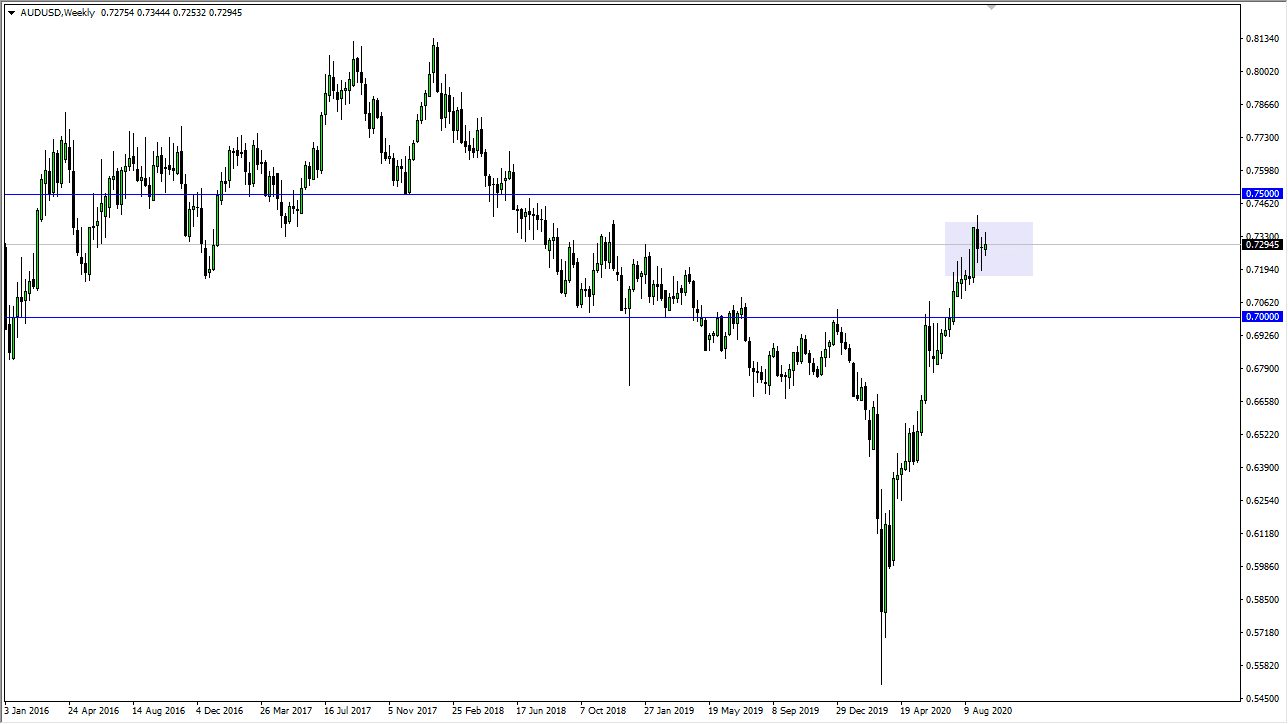

AUD/USD

The Australian dollar has rallied a bit against the US dollar during the trading week as the market broke above the 0.73 handle, showing signs of bullish pressure before rolling right back over. At this point, I believe that we are essentially forming a trading range due to the fact that we had formed a hammer during the previous week, only to form a shooting star this past week. In other words, we are going back and forth trying to kill time. Look at the 0.72 level as a potential support level, as the 0.74 level will be a potential point in time, the market is likely to simply bounce around in that area going forward.

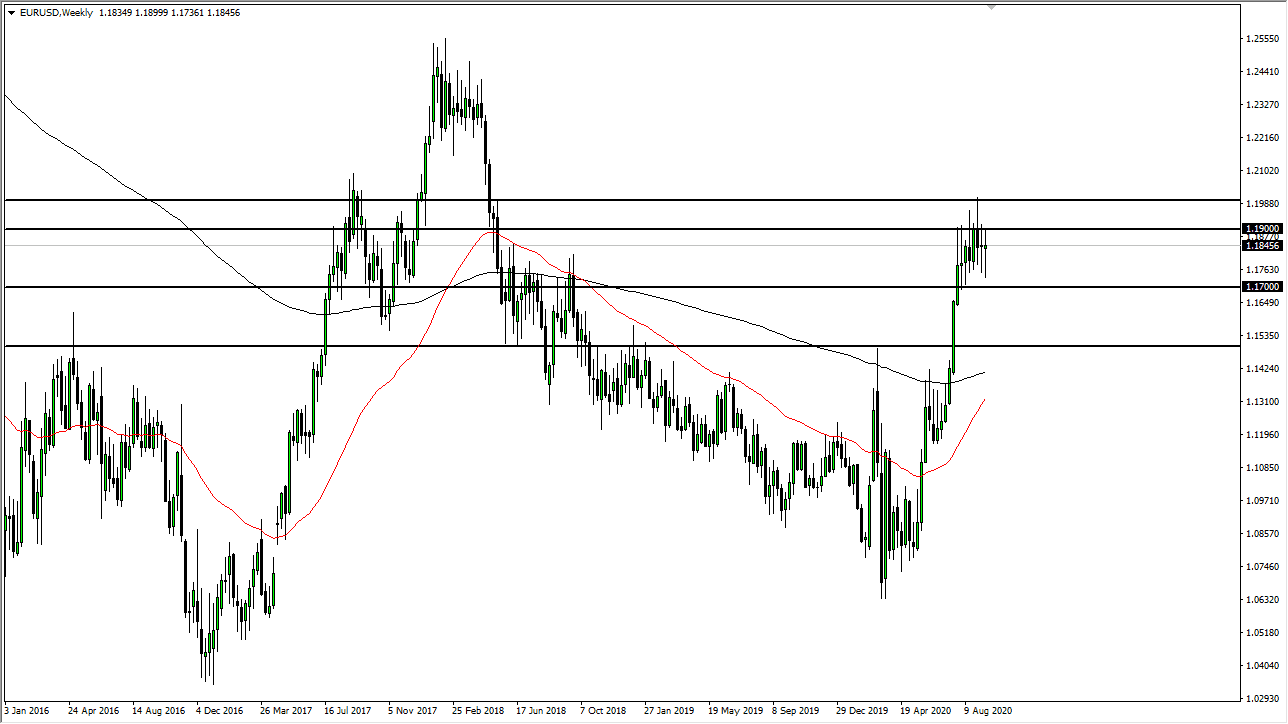

EUR/USD

The Euro has gone back and forth during the course of the week, testing the 1.17 level underneath, and the 1.19 level above. Just as we did during the previous week, the market ended up forming a very neutral candlestick and this shows that we probably do not have anywhere to be for a while. Having said that, I believe that the market probably finds itself running out of momentum, and that of course is something to pay attention to. It is not until we break above the 1.20 level that the market would be free to go much higher. Look for range-bound trading.