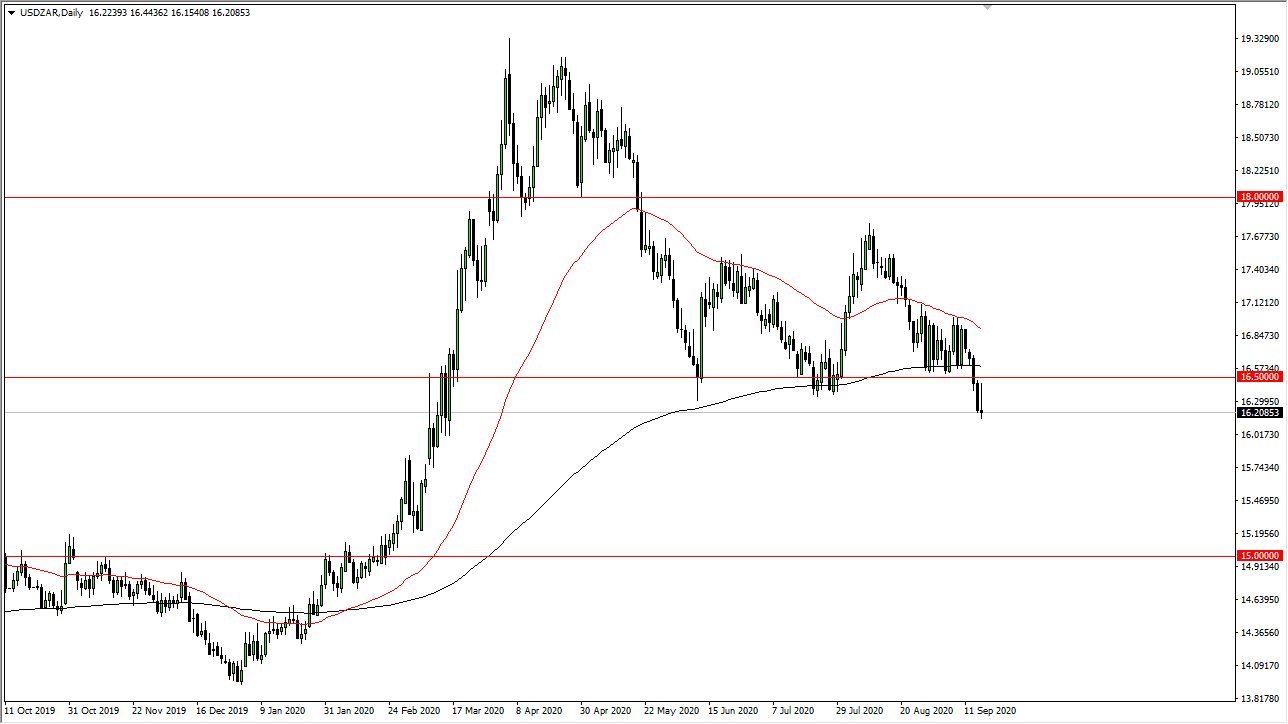

The US dollar initially rallied against the South African Rand but found resistance near the 16.50 Rand level. This was where we broke down from previously, and of course the 200 day EMA sits just above that. With that being the case, it is very likely that we continue to see a lot of back and forth and then eventually falling in this pair.

The inverted hammer that formed during the trading session since up an interesting scenario. On one hand, if we were to break down below the bottom of it, that should show plenty of negativity and it could unwind this position even further. After all, emerging market currencies had been crushed recently, and now it looks like we have made a major breakdown again, followed by confirmation later in the day on Thursday. That being said, the US dollar is trying to show itself as stronger now, and if that is going to be the case it is a bit difficult to understand how much longer the emerging-market trade can happen. Nonetheless, it is what it is and price at the end of the day is the most important thing.

If the market was to turn around a break above the 200 day EMA, then we could have a completely different conversation as the inverted hammer would be a bullish sign. Having said that, I think what we are going to see more likely than not it is a bit of a continuation, and we may even see a divergence with the South African Rand against other currencies, especially ones in Europe. If for no other reason, there is almost nothing in the way of yield out there, and traders may be looking at this pair as a way to gain some of that yield. Ultimately, this is a market that is ready to make a move one way or the other, if we drop to the downside is likely that we go looking towards the 15.50 Rand level, possibly even the 15 Rand handled given enough time. To the upside, the 17 Rand level as resistance but if we were to turn around a break above there, it would be extraordinarily bullish and change the entire trend for the long term. This would more than likely be a major “risk off” type of situation.