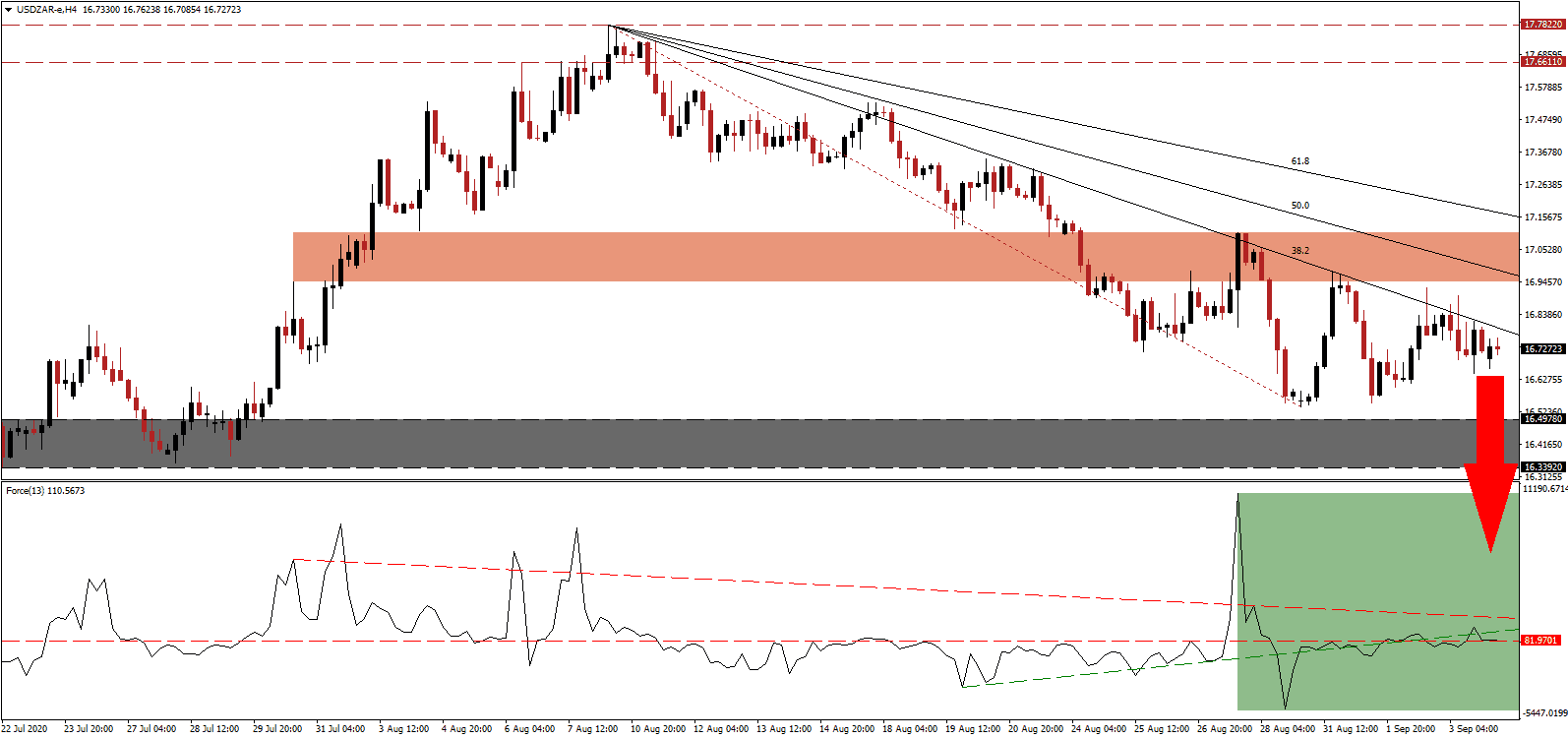

With South Africa reporting more than 2,000 new daily Covid-19 infections and strained public finances, the National Treasury commenced research into a wealth tax. Edgar Sishi, the Deputy Director-General of the National Treasury, briefed the National Economic Development and Labor Council on the necessity of zero-based budgeting. The National Treasury further cautioned that Africa’s most industrialized nation has no additional financial resources for the next three years, requiring government departments to review existing projects. The USD/ZAR is well-positioned to extend its corrective phase, driven lower by its descending Fibonacci Retracement Fan sequence.

The Force Index, a next-generation technical indicator, presently challenges its horizontal resistance level but remains below its ascending support level. Adding to downside pressures is the descending resistance level, as marked by the green rectangle. It is favored to push this technical indicator below the 0 center-line, granting bears complete control over the USD/ZAR.

Per a presentation from the National Treasury, the government needs to reduce spending by R250 over the next two years to avoid a potential debt crisis. The debt-to-GDP ratio may increase to 90%, with interest payments servicing debt to account for 39% of the budget. Reducing the government wage bill represents the bulk of planned savings. After the USD/ZAR completed a breakdown below its short-term resistance zone located between 16.9456 and 17.1058, as identified by the red rectangle, bearish pressures increased.

On a positive note, the manufacturing sector continues to recover, with the August Manufacturing PMI rising to 57.3, building on the momentum from July’s expansionary reading of 51.2. Expanding optimism is the 17.7 point increase in the new sales orders sub-component to 71.1. The USD/ZAR is anticipated to move into its support zone located between 16.3392 and 16.4559, as marked by the grey rectangle. An extension into its next support zone between 15.7482 and 15.9963 is likely.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 16.7250

- Take Profit @ 15.7550

- Stop Loss @ 16.9550

- Downside Potential: 9,700 pips

- Upside Risk: 2,300 pips

- Risk/Reward Ratio: 4.22

Should the Force Index eclipse its descending resistance level, the USD/ZAR could temporarily retrace its most recent sell-off. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level. Today’s NFP data will deliver the next short-term catalyst, and Forex traders should consider any advance as a selling opportunity, on the back of extended US Dollar weakness.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 17.0250

- Take Profit @ 17.1550

- Stop Loss @ 16.9550

- Upside Potential: 1,300 pips

- Downside Risk: 700 pips

- Risk/Reward Ratio: 1.86