South Africa reported a 51.0% GDP collapse for the second quarter, due to the Covid-19 related nationwide lockdown. Year-over-year, the drop was 17.1%, which follows an upward revised 0.1% expansion for the first quarter year-over-year. The quarterly data for the first quarter shows a 1.8% decrease, up from the initial print of a 2.0% drop. Africa’s most industrialized nation has now faced four quarterly contractions, making it the most severe recession in 28 years. It also lost the continent’s GDP crown to Nigeria in 2019. The USD/ZAR ended its counter-trend advance with a lower high, and the breakdown sequence is positioned to resume.

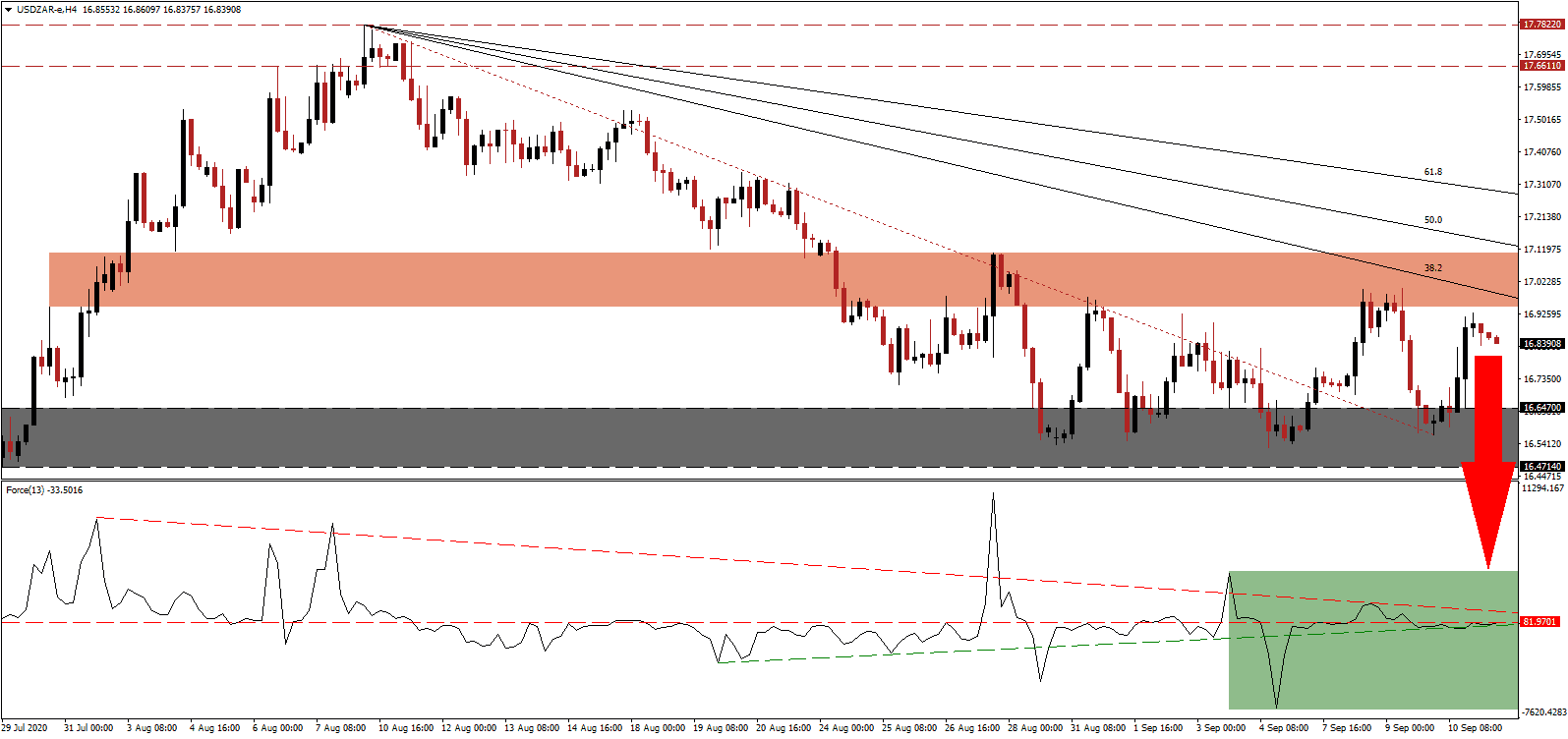

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level, as marked by the green rectangle. While the ascending support level applies upside pressure, the descending resistance level remains dominant, expected to force a breakdown. Bears are in control of price action in the USD/ZAR with this technical indicator in negative territory.

Lesetja Kganyago, the Governor of the South African Reserve Bank (SARB), confirmed room to lower interest rates if the severity of the Covid-19 pandemic warrants its due to muted inflationary pressures. The central bank forecast called for a 40.1% GDP plunge, making a 25 basis-point interest rate cut at the next meeting a distinct possibility. Following the rejection in the USD/ZAR by its short-term resistance zone located between 16.9456 and 17.1058, as marked by the red rectangle, bearish pressures accumulated.

Given the severity of the recession, South Africa is unlikely to return to pre-Covid-19 levels until 2024. President Cyril Ramaphosa pledged that his government would use the pandemic to create a new economy with a reform-based recovery strategy. He plans to unveil infrastructure projects and a focus on the domestic economy soon. The USD/ZAR is on course to retest its adjusted support zone located between 16.4714 and 16.64700, as identified by the grey rectangle. Expanding bearish pressures is the descending 38.2 Fibonacci Retracement Fan Support Level. An extension into its next support zone between 15.7482 and 15.9963 is likely to follow.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 16.8400

- Take Profit @ 15.7500

- Stop Loss @ 17.0400

- Downside Potential: 10,900 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 5.45

Should the ascending support level pressure the Force Index higher, the USD/ZAR could attempt a second breakout. Forex traders should consider any advance as a secondary short-selling opportunity amid intensifying US Dollar weakness. Risks of a double-dip recession in the fourth quarter continue to rise, magnifying bearish progress. The upside potential is reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 17.1500

- Take Profit @ 17.3000

- Stop Loss @ 17.0400

- Upside Potential: 1,500 pips

- Downside Risk: 1,100 pips

- Risk/Reward Ratio: 1.36