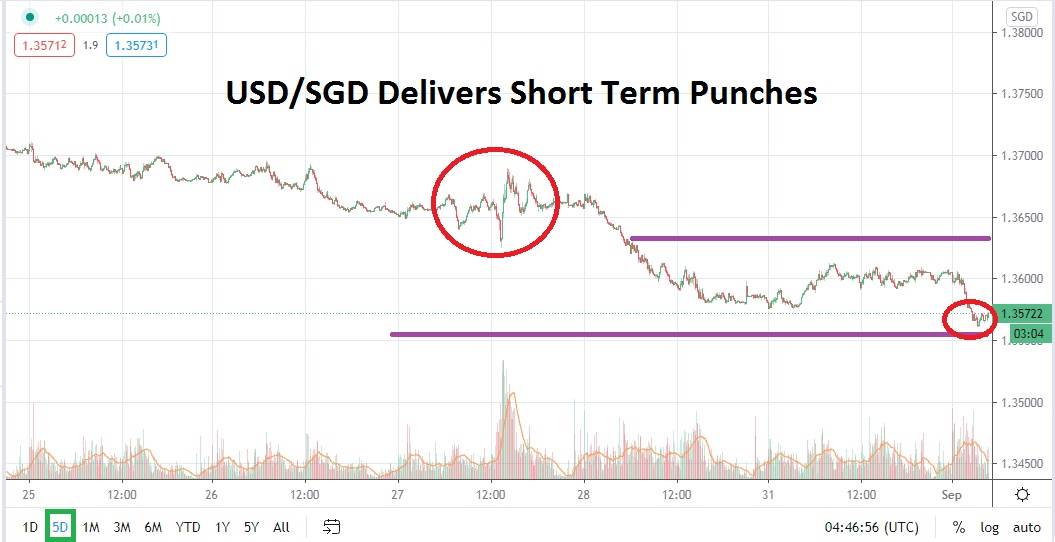

Experienced traders know that momentum can shift quickly in forex and the last three trading sessions for the USD/SGD has delivered this lesson well. Risk adverse trading crept into forex on Thursday, while traders took a pause and reflected on the gains made in global equity indices and took into consideration the potential impact of the US hurricane about to unleash. The USD/SGD did in fact reverse slightly higher and touched technical resistance. However, at some point on Friday before going into the weekend the USD/SGD promptly resumed testing its bearish trend.

The recent price action of the USD/SGD highlights another lesson for speculators which is that limit orders are necessary when trading forex short term, unless you have the ability to have a trading screen in front of you at all times. As of this morning the USD/SGD is testing support levels it has not traversed since late January.

The current price range of the USD/SGD between 1.35560 and 1.35720 puts the forex pair solidly within a testing ground it has not traded since early this year. Meaning the Singapore Dollar appears to be entering territory that has not been speculated on since pre-coronavirus fears trampled the global markets. Which brings up the question about the possibility of over exuberance and if speculators should assume a bullish reversal will develop that can be sustained.

Traders who follow the trend and like short term technical insights too, need to look at the mid-term momentum the USD/SGD has generated and consider the bearish selling of the forex pair has occurred as the US Federal Reserve has become extremely dovish. The weakness of the USD may stay around for a while. This doesn’t mean speculators should simply sell the USD against all currencies all the time, but it does underscore the fundamental belief additional bearish sentiment will be experienced.

While it may be hard to convince speculators short term there is a greater risk reward potential to sell the USD/SGD as critical support is tested today. The bearish trend when gazed at long enough may be enough to tempt the cynical. Short term traders do need to be on the lookout for sudden reversals higher which may test the 1.35750 to 1.35900 junctures, but if the USD/SGD begins to mount a bearish challenge on support near 1.35560 speculators may target the 1.35400 level as sellers.

Singapore Dollar Short Term Outlook:

Current Resistance: 1.35750

Current Support: 1.35560

High Target: 1.35930

Low Target: 1.35400