While Covid-19 infections are rising globally, Sweden conducted the most massive Covid-19 test sequence in the Nordic kingdom, with a positivity rate of just 1.2%, a pandemic low. With the Covid-19 virus poised to join seasonal influenza, creating a deadly combo each winter, Sweden did not implement a nationwide lockdown. It advised the public to practice social distancing, individual responsibility, and personal hygiene. It paid a heavy price with a death toll among the elderly, an error the government admitted, but for now, it appears the strategy yields the desires results. The USD/SEK spiked above its short-term resistance zone, but bearish pressures remain dominant, favored to result in a new breakdown.

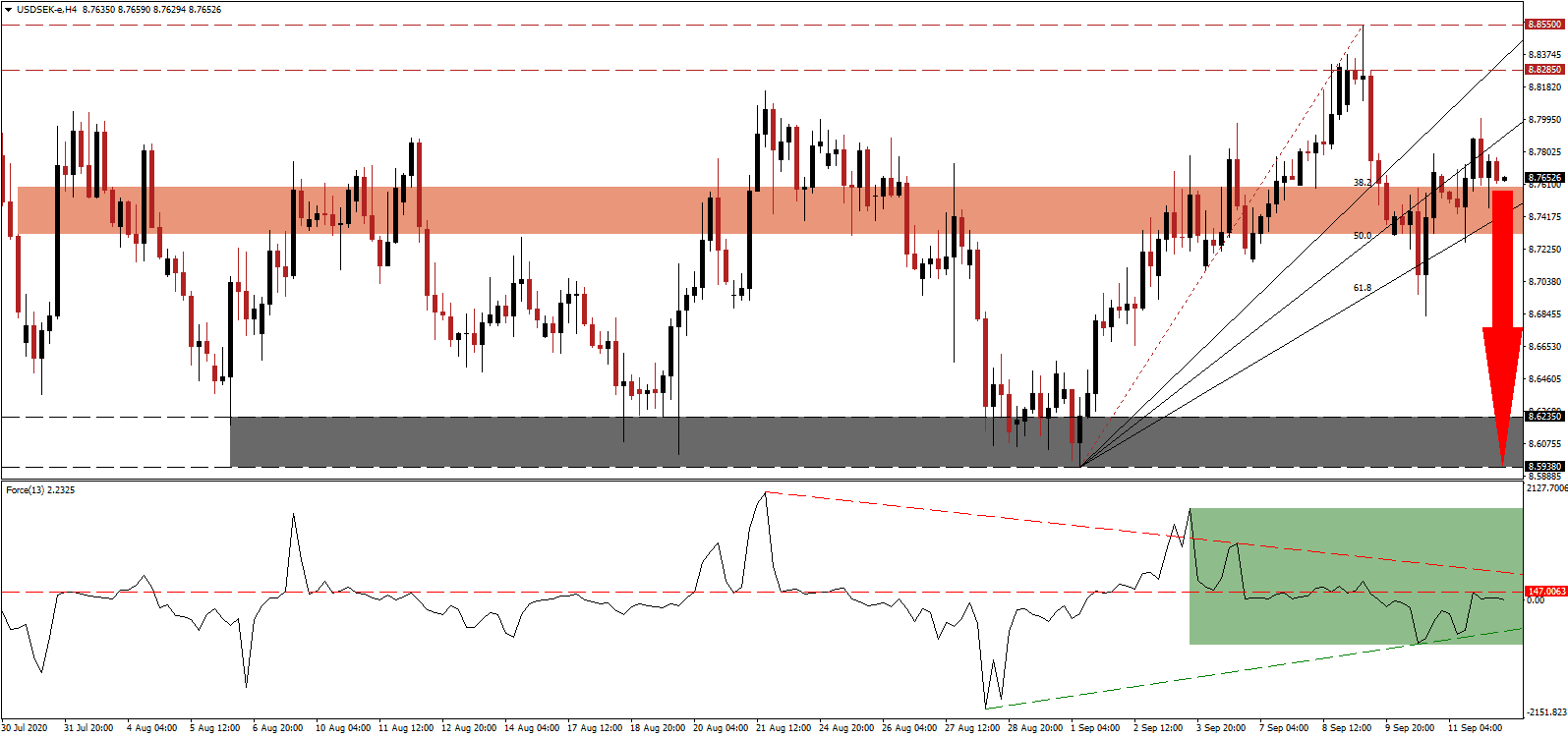

The Force Index, a next-generation technical indicator, recorded a lower high in negative territory but failed to eclipse its horizontal resistance level. With the descending resistance level magnifying bearish pressures, as marked by the green rectangle, a collapse below its ascending support level is likely. Bears wait for this technical indicator to cross below the 0 center-line to regain full control over the USD/SEK.

On top of the elevated death count, the Swedish economy struggles as much or more than its European counterparts. Almost 70% of the export-oriented economy depends on the EU and UK, resulting in a ripple effect Sweden cannot escape. The government announced an additional SEK5 billion in assistance to small businesses, capped at SEK120,000 per company, to replace lost income between March and July. The USD/SEK pushed trough its short-term resistance zone located between 8.7315 and 8.7594, as identified by the red rectangle, but is vulnerable to a swift reversal amid rising bearish pressures and a weak US Dollar outlook.

Adding a positive boost to the economic outlook for Sweden is the announcement of a SEK13.5 billion tax cut next year, primarily aimed at the low-and middle-class earners. Marginally offsetting the tax cut is higher than expected revenues from a new gambling tax. With Sweden under criticism for its approach to the Covid-19 pandemic, it appears to be on the right track. A breakdown in the USD/SEK below its ascending 61.8 Fibonacci Retracement Fan Support Level will clear the path for a collapse into its support zone located between 8.5938 and 8.6235, as marked by the grey rectangle.

USD/SEK Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 8.7650

Take Profit @ 8.5950

Stop Loss @ 8.8000

Downside Potential: 1,700 pips

Upside Risk: 350 pips

Risk/Reward Ratio: 4.86

Should the Force Index push through its descending resistance level, the USD/SEK may extend its breakout in the short-term. Due to ongoing and intensifying issues for the US economy and the US Dollar, Forex traders should take advantage of any advance with new short positions. The upside potential remains confined to its long-term resistance zone between 8.8285 and 8.8550.

USD/SEK Technical Trading Set-Up - Confined Breakout Extension Scenario

Long Entry @ 8.8200

Take Profit @ 8.8500

Stop Loss @ 8.8000

Upside Potential: 300 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 1.50