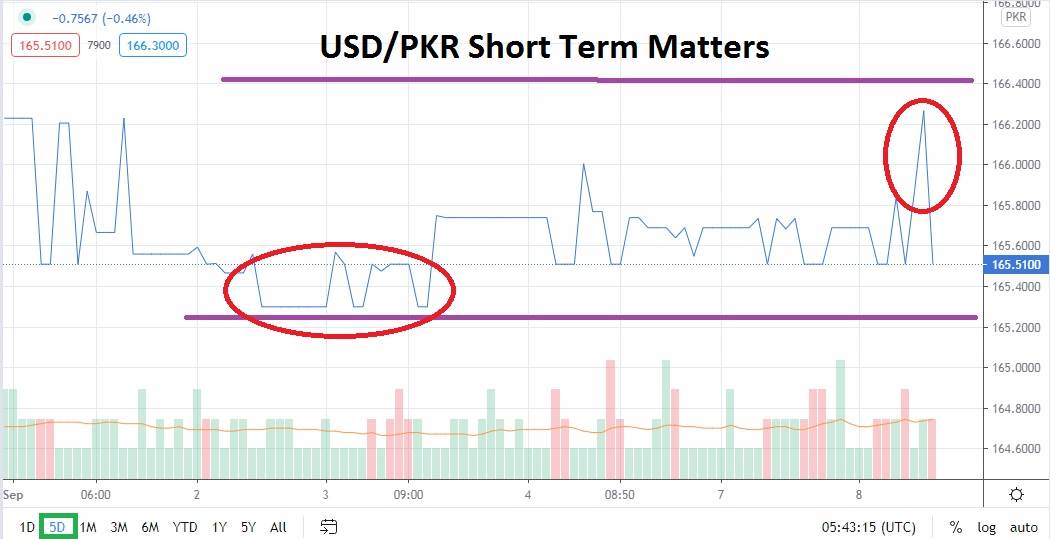

The Pakistani Rupee is managing to once again traverse near short term support levels which certainly look important via technical charts. The 165.2000 to 165.5000 support range has managed to hold the past week and this may intrigue speculators of the forex pair who like to swim its dangerous waters.

Transparency is not a huge ingredient of the trading puzzle for most retail forex participants of the USD/PKR. Knowledge is always important, but news flow from the nation is often done via official announcements that are open to interpretation. The Pakistan government has said its current economic conditions are tough due to coronavirus implications, but some spokespeople have indicated they believe businesses will see better revenues in the coming months.

Pakistan is also suffering from heavy rains that have hit the nation and caused flooding in some parts of the country the past week. An official visit from China was canceled recently too. Although the official statement said that China President Xi Jinping’s trip was postponed because of coronavirus concerns, there have been rumors a corruption scandal inside the Pakistan military may have played a role.

The economic relationship with China is growing deeper and this is highlighted by infrastructure projects which Beijing is supporting inside of Pakistan. However, the USD/PKR has actually been solidly hit by the onslaught of a long term bullish run in which the Pakistan Rupee has battled resistance levels on a steady basis. Speculators are certainly intrigued by the USD/PKR’s recent bearish trend lower and may believe now is an opportunity to see reversals higher. In other words, just because China is involved in Pakistan’s economic affairs the Pakistani Rupee has not suddenly started to shine like a star.

The ability of the USD/PKR to stay within what looks like a fairly stable range of 165.2000 to 166.2000 the past week raises suspicions based on historical trading evidence this ‘narrow’ band will not hold. Speculators who want to buy the USD/PKR and seek the potential for upwards momentum need to use limit orders. The trading volume of the Pakistani Rupee is not significant and it can be hit with sudden and violent spikes.

Buying the USD/PKR around the 165.5000 level with an adequate stop-loss could prove an opportunistic trade. Selecting the amount of leverage used when trading this forex pair is crucial to protect large momentum shifts in value. Patience and strong emotional character is essential when trading the USD/PKR too because anticipated moves can take a while to develop but the values can also change quickly. Trading the USD/PKR remains a playground for speculative traders who are experienced.

Pakistani Rupee Short Term Outlook:

Current Resistance: 166.4000

Current Support: 165.0000

High Target: 167.0000

Low Target: 164.5000