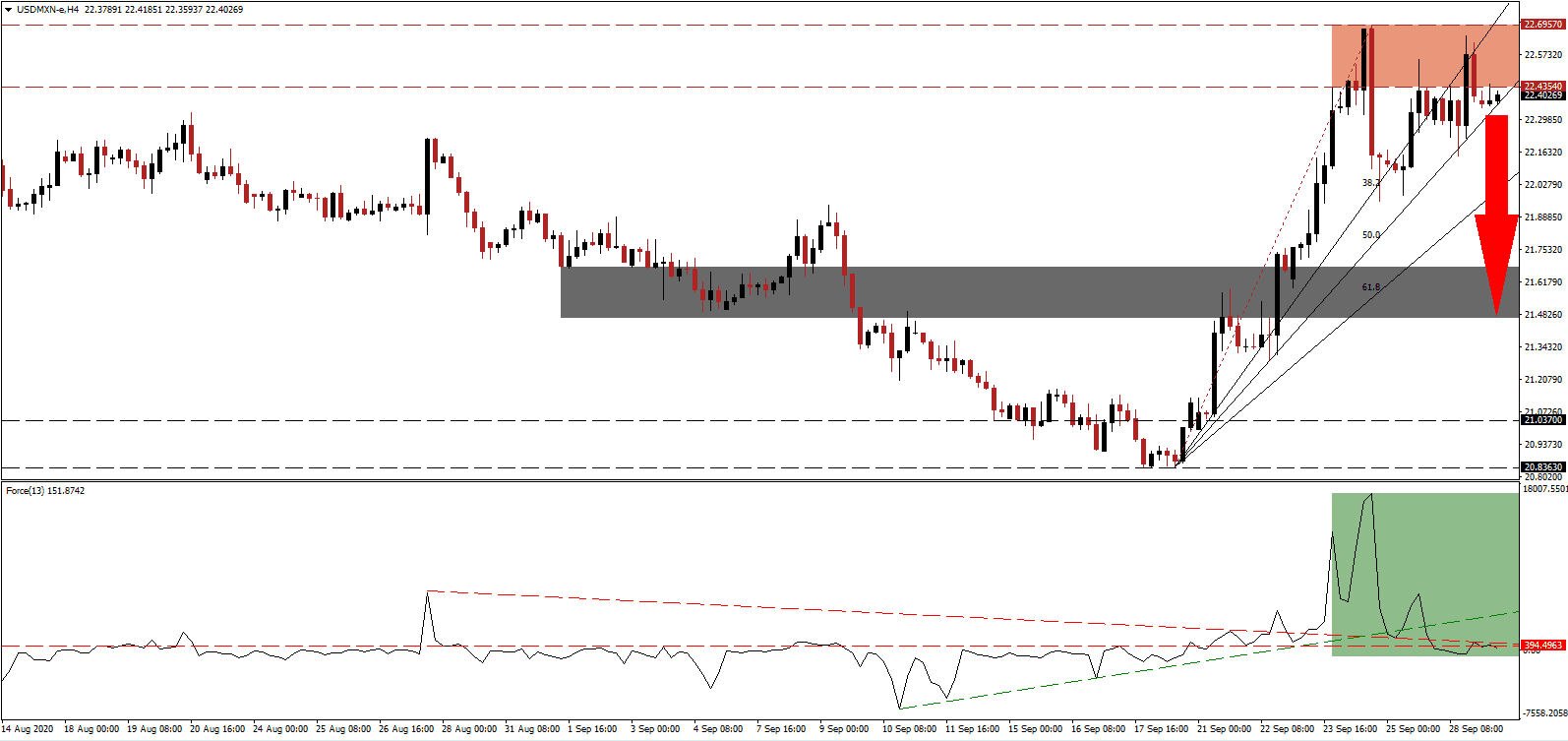

Despite heavy criticism of Mexican President López Obrador and his approach to the pandemic, Mexico remains on the right track economically. The Mexican Peso was the best-performing global currency in a basked of 140 since the end of June, a first for the Mexican Peso. The USD/MXN attempted a second breakout but recorded a lower high inside of its resistance zone, with bearish pressures expanding.

The Force Index, a next-generation technical indicator, confirmed the dominance of bearish momentum with a series of lower highs. It was followed by a collapse below its ascending support level, as marked by the green rectangle. Following the move below its horizontal resistance level, the descending resistance level is set to pressure this technical indicator below the 0 center-line, granting bears complete control over the USD/MXN.

Adding to positive developments is the first-ever sovereign bond tied to the UN sustainable development goals. They include the elimination of inequality, the promotion of financial inclusion, and the reduction of the gender gap. Gabriel Yorio, the Deputy Finance Minister, confirmed the issue was oversubscribed by five times and that Mexico raised $889.73 million, a much needed financial boost to public finances. After the USD/MXN was rejected for a second time by its resistance zone located between 22.4354 and 22.6957, as identified by the red rectangle, a breakdown extension is favored to accelerate the sell-off.

For the first time since March, the Instituto Nacional de Estadística y Geografía (INEGI) published the official unemployment rate, which stood at 5.2% in August. By comparison, the March unemployment rate was just 2.9%, while July clocked in at 5.4%. Mexico added 608,000 jobs, and INEGI noted that out of the 12,000,000 lost jobs since April, 7,800,000 resumed employment. A collapse in the USD/MXN below its steep ascending 50.0 Fibonacci Retracement Fan Support Level will clear the path for a sell-off into its short-term support zone located between 21.4660 and 21.6789, as marked by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 22.4000

- Take Profit @ 21.4700

- Stop Loss @ 22.6500

- Downside Potential: 9,300 pips

- Upside Risk: 2,500 pips

- Risk/Reward Ratio: 3.72

In case the Force Index pushes through its ascending support level, providing resistance, the USD/MXN could attempt a third push higher. Forex traders should consider any breakout attempt as a selling opportunity due to intensifying bearish pressures on the US Dollar. Political uncertainty and a weakening labor market add to downside pressures, resulting in limited upside potential provided by its intra-day high of 22.9074.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 22.7500

- Take Profit @ 22.9000

- Stop Loss @ 22.6500

- Upside Potential: 1,500 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: 1.50