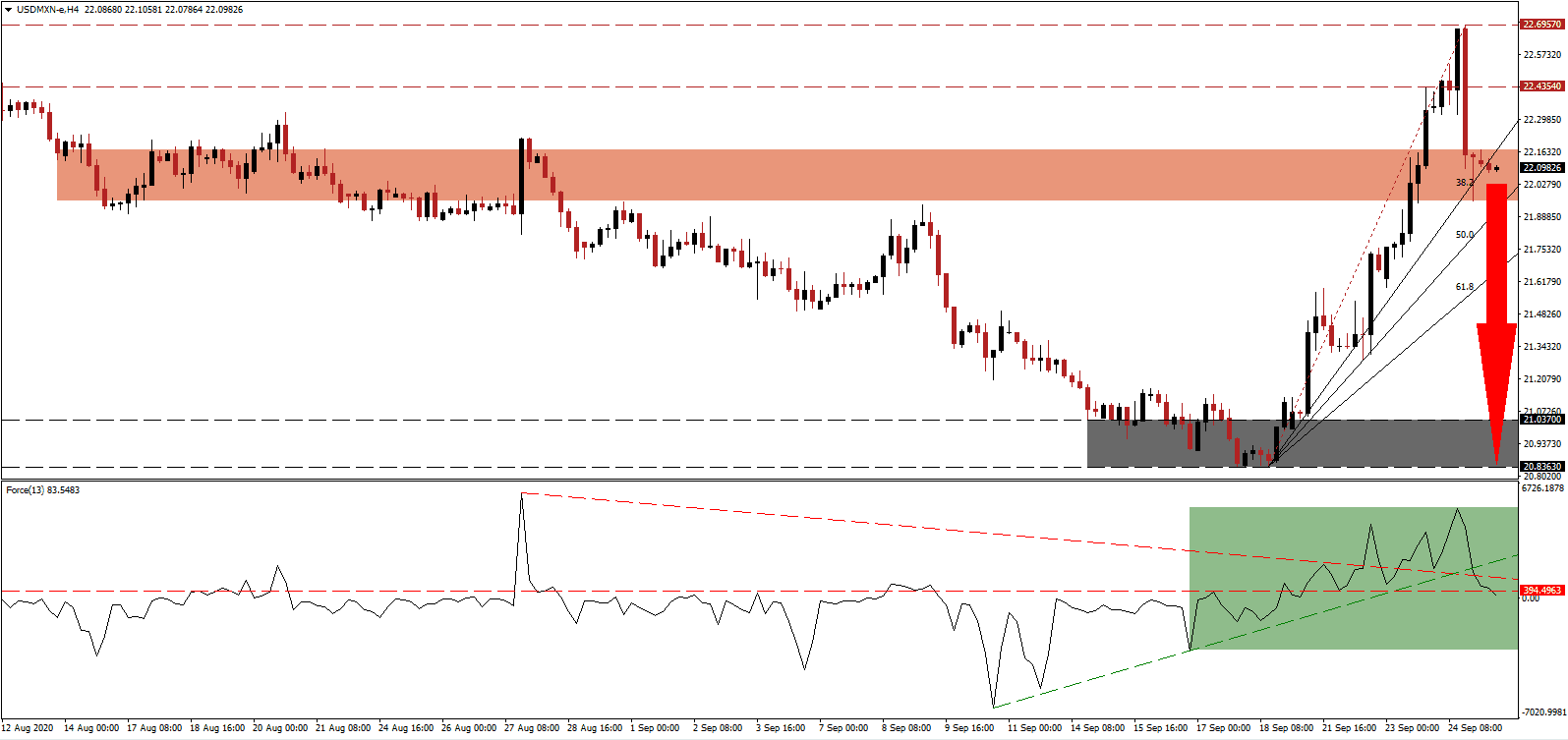

Mexico continues to report over 4,500 new Covid-19 infections daily, posing an ongoing health risk to Latin America’s second-biggest economy behind Brazil. With confirmed cases on the rise globally, the US Dollar witnessed a temporary counter-trend advance, which ran its course after the third week in a row to show a disappointing print for initial jobless claims. It confirmed that the US Dollar does not possess safe-haven status similar to the Japanese Yen or Swiss Franc, magnified by the long-term counter-productive monetary policy by the US Federal Reserve. Following a price spike in the USD/MXN, a swift collapse materialized with a new breakdown sequence likely to emerge.

The Force Index, a next-generation technical indicator, retreated from a lower high, signaling more downside ahead. After the contraction below its ascending support level, as marked by the green rectangle, bearish momentum intensified with a breakdown below its descending resistance level. This technical indicator is now piercing below its horizontal resistance level from where a move below the 0 center-line will grant bears complete control over the USD/MXN.

While the Banco de México delivered its eleventh consecutive interest rate cut, down 25 basis points to 4.25%, it remains well ahead of its US-counter part, and the zero-bound policy pledged until at least the end of 2023. The Mexican central bank noted recovery in the economy with an uncertain outlook. Adding to positive developments is the relaxation of financial rules for bank and financial intermediaries, announced by the Secretaría de Hacienda y Crédito Público (SHCP). Following the collapse in the USD/MXN, it is now retesting its previous short-term resistance zone located between 21.9569 and 22.1697, as identified by the red rectangle, with a bearish momentum build-up.

Another long-term bullish catalyst to consider is the criticized fiscal responsibility Mexican President López Obrador attempts to maintain at a time many countries added to an already unsustainable debt burden, led by the US. Countering financial stress for many Mexicans are remittances, forecast to increase by 8.1% in 2020 to $39.4 billion. The USD/MXN is well-positioned to collapse below its steep Fibonacci Retracement Fan sequence and plunge into its support zone located between 20.8363 and 21.0370, as marked by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 22.1000

- Take Profit @ 20.8400

- Stop Loss @ 22.3000

- Downside Potential: 12,600 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 6.30

A breakout in the Force Index above its ascending support level could lead the USD/MXN into a short-term retracement of its price action collapse. With the US economy continuing to show underlying weakness and rising Covid-19 infections with reduced government assistance, the upside potential is reduced to its intra-day high of 22.6957. Forex traders should consider any advance as a selling opportunity.

USD/MXN Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 22.4400

- Take Profit @ 22.6400

- Stop Loss @ 22.3000

- Upside Potential: 1,400 pips

- Risk/Reward Ratio: 1.43