Mexico is on course to cross the 700,000 infection level over this weekend, as the death toll nears 72,000, the fourth-highest globally. Cases around the world are on the rise amid relaxations of restrictions and a growing public that ignores ongoing warnings by healthcare officials. As cooler temperatures approach, a surge in Covid-19 cases, together with the seasonal influenza flu virus, is set to overwhelm many healthcare systems. The outcome could be worse than the previous peak, ensuring the health-and-economic crisis will intensify. More downside in the USD/MXN is likely, pending a new breakdown.

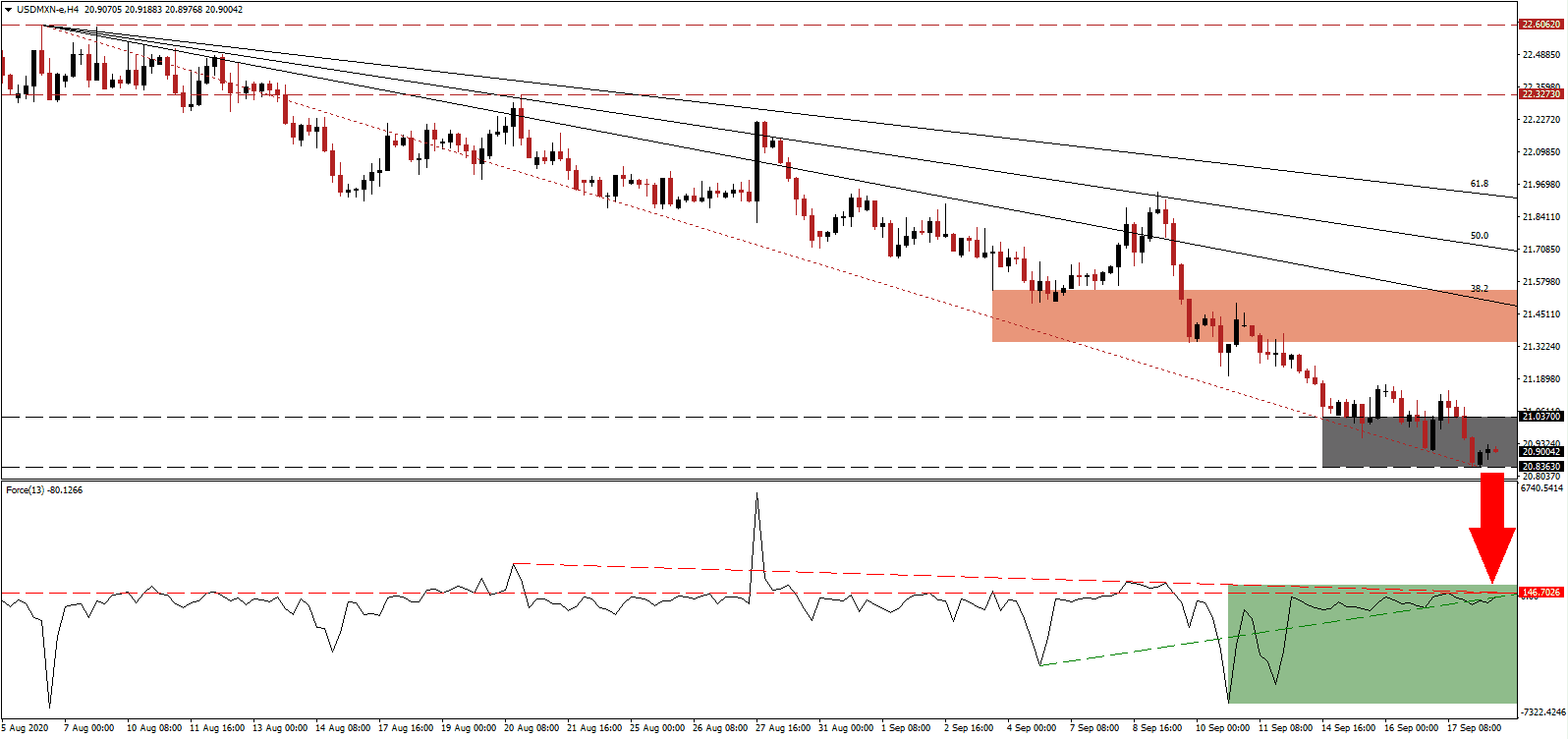

The Force Index, a next-generation technical indicator, flatlined below its horizontal resistance level, invalidating the positive divergence amid a lack of bullish momentum. It also slid below its ascending support level, adding to growing downside pressures. With the shallow descending resistance level crossing below its horizontal level, as marked by the green rectangle, this technical indicator is positioned to slide deeper into negative territory, solidifying bearish control over the USD/MXN.

While August saw the addition of 92,390 tax-paying formal jobs, per data from the Instituto Mexicano del Seguro Social (IMSS), it compares to the loss of 833,100 since January. It does not account for the informal job market, which some estimates suggest accounts for nearly 50% of the Mexican workforce, and lost over twelve million jobs. Following the breakdown in the USD/MXN below its short-term resistance zone located between 21.3352 and 21.5443, as marked by the red rectangle, bearish pressures accumulated.

El Banco de México has a best-case scenario for 2020, with a GDP contraction of 8.8%. Since new Covid-19 cases are on the rise, the worst-case outlook calling for a drop of 13.0% cannot be dismissed. Mexican President López Obrador claims the economy began its recovery in June, while the Mexican business community urges closer ties with China to boost investment and reduce reliance on the US. The descending Fibonacci Retracement Fan sequence maintains the bearish chart pattern, and the USD/MXN is positioned to extend its correction below its support zone located between 20.8363 and 21.0370, as identified by the grey rectangle. The next support zone awaits between 19.8919 and 20.2760.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 20.8950

- Take Profit @ 19.8950

- Stop Loss @ 21.1950

- Downside Potential: 10,000 pips

- Upside Risk: 3,000 pips

- Risk/Reward Ratio: 3.33

A breakout in the Force Index above its ascending support level, serving a resistance, may lead to a short-term reversal. Given the intensifying weakness in the US labor market and the increase in Covid-19 infections, bearish pressures on the US Dollar remain dominant. Forex traders should sell any price action reversal with the upside potential reduced to its descending 50.0 Fibonacci Retracement Fan Resistance Level.

USD/MXN Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 21.3750

- Take Profit @ 21.7050

- Stop Loss @ 21.1950

- Upside Potential: 3,300 pips

- Downside Risk: 1,800 pips

- Risk/Reward Ratio: 1.83