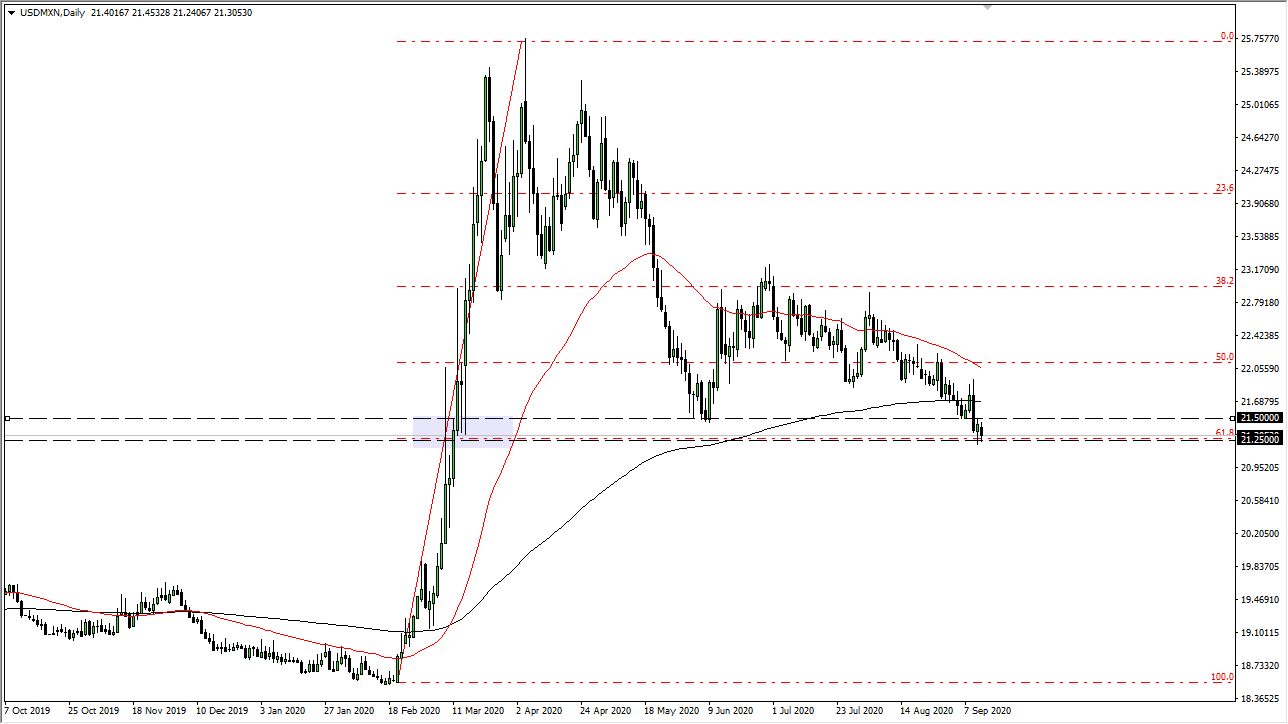

The US dollar has fallen again during the trading session on Friday against the Mexican peso, testing the hammer that had formed on Thursday. That sets up an interesting scenario going into the weekend because this could represent either that the market is going to prove this area to be very supportive, or that we are suddenly going to see a major “risk-on” type of move as far as currencies are concerned.

Taking a look at the technical analysis, the 21.25 pesos level also coincides nicely with the 61.8% Fibonacci retracement level. This could suggest a significant amount of support, but it should be noted that we have broken below the 200 day EMA somewhat significantly, and therefore it probably comes into play sooner or later that the market is trying to catch its breath and bounce but faces headwinds above. At this point in time, it is anybody’s guess but it is worth noting that this market seems to be diverging a little bit from the overall risk appetite. I am sitting here watching the Mexican peso gain strength while the equity markets are getting hammered.

Ultimately, I do think that this is a scenario where we start to see a major move happen, and it must be noted that breaking down below the bottom of the hammer from the previous trading session would be extraordinarily bearish. That probably opens up a very big longer-term move, although it does appear that the US dollar is strengthening against other currencies such as the Canadian dollar and the Euro as we close out the week. Perhaps this is a move towards yield, but at this point, the technicals are more or less in a “do or die” situation.

Having said that, it would not take much to spook the market and have everybody running towards the US Treasury market again, which is denominated in US dollars, thereby driving up the price and value of the US dollar against almost everything else. Hang on, it is about to get very volatile around the FX world in general, and this pair will not be any different to say the least. I think that given enough time, we will get a clear and concise signal that we can take advantage of. Right now, it is essentially a “binary trade”, seeing which side of the hammer from Thursday we breakthrough.