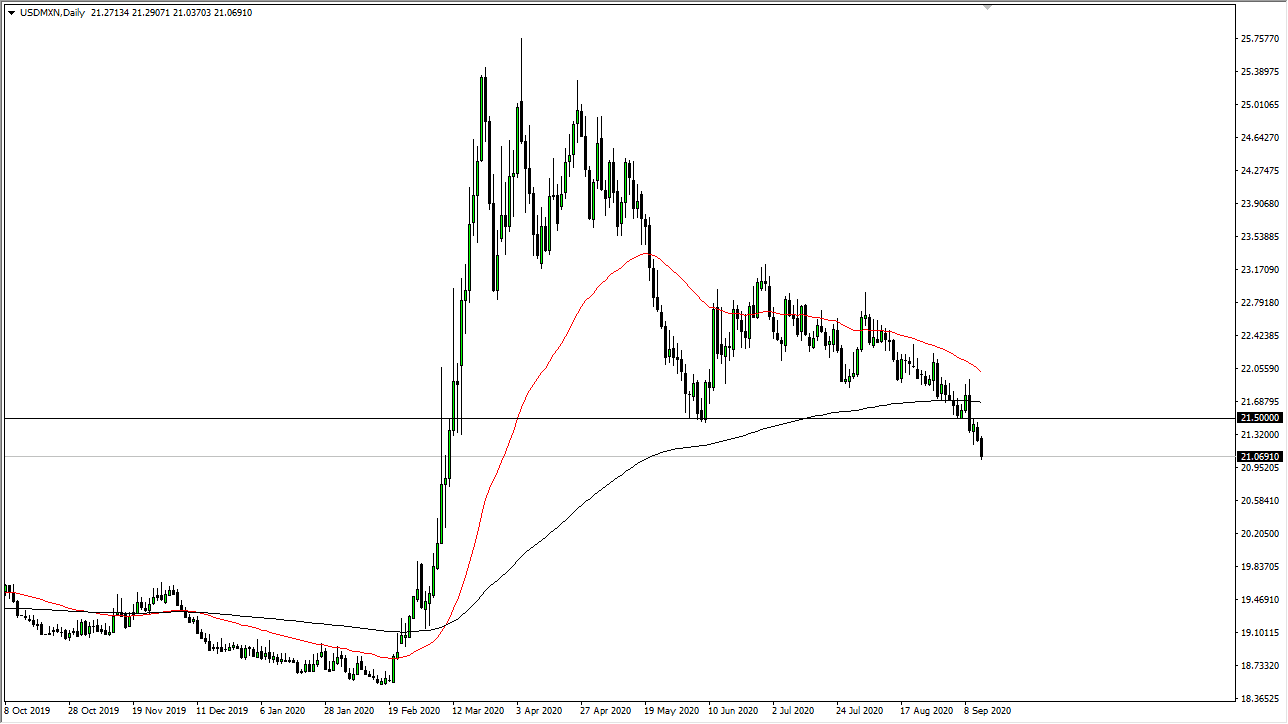

The US dollar has fallen again during the trading session on Monday against the Mexican peso, reaching down towards the 21 pesos level. This is the continuation of a rather strong breakdown, and the fact that we have broken below the hammer from the Thursday session suggests that we still have plenty of momentum. This is a bit surprising, as there seems to be a bit of concern when it comes to risk appetite, and this typically will favor the US dollar against emerging market currencies such as the peso, South African Rand, and so on.

Nonetheless, we are firmly below the 200 day EMA and a support level, so I think that it is only a matter of time before we go looking towards the 20 handle. That short-term rally should probably be sold into as long as we can stay below that 200 day EMA, which is currently trading right around the 21.75 pesos level. That being said, perhaps this is a run towards yield, as there are almost non-in places like the United States right now and central bank actions are pushing people out on the risk spectrum.

I do not necessarily think that we will fall right away, and the fact that oil seems to be struggling is also another head-scratcher when it comes to this pair because the Mexican peso does tend to move right along with oil as a lot of the oil rigs in the Gulf of Mexico are Mexican, and not necessarily American. All things being equal though, the greenback was extraordinarily strong against the peso for some time, so there may continue to be an unwinding of the trade which may have gotten a little bit out of hand over the last couple of years.

To the upside, it is not until we break above the black 200 day EMA that I would be interested in going long of this market because the negativity that we have seen as of late is not only surprising, but it is very telling as to which direction this market will end up going. By moving the way, it lets us know that sellers are firmly in control when it comes to this pair. If crude oil starts to rally, that may move this market even quicker to the downside, although that would be a bit of a surprise as OPEC has suggested demand is dropping.