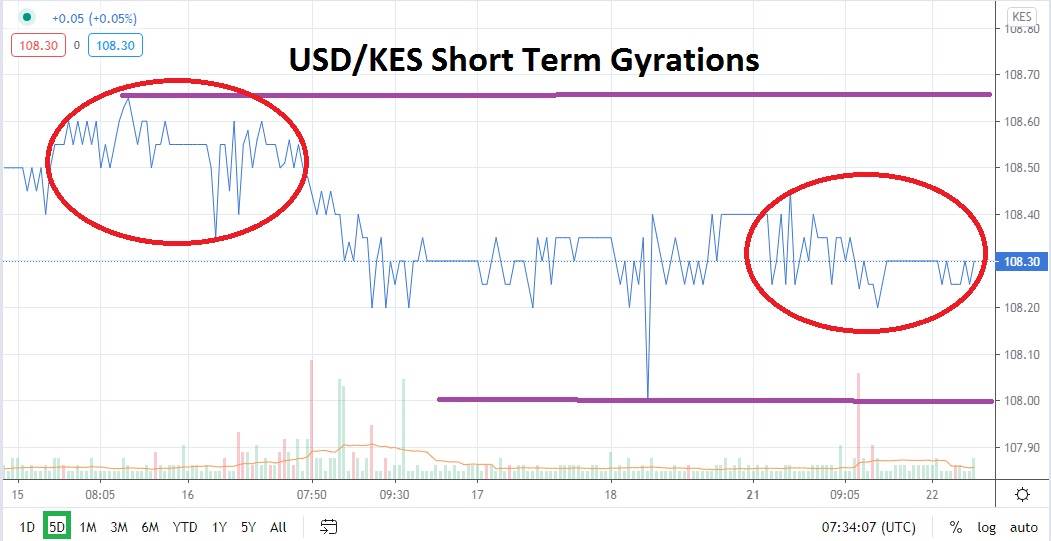

The Kenyan Shilling is displaying a strong tight trading range short term, but one that often sees the sudden emergence of spikes gyrate its value momentarily. A long bullish trend is clearly evident within the USD/KES and speculators looking for a sudden and prolonged bearish movement to occur better have good inside information which allows them to confidently sell the forex pair. Most speculators likely do not have sufficient good inside data to use as trading guideposts within the Kenyan Shilling, so we must consider what we see via technical charts.

The 108.500 level appears to be rather capable resistance and a high watermark of 108.600 has proven strong three times in the past month and a half. Support has proven effective recently near the 108.200 juncture since the 4th of September, but it must be noted that occasional spikes below this level have been displayed and one took place yesterday when the USD/KES touched the 107.930 mark below.

Trading volume within the USD/KES is not spectacular, the forex pair is a playground for speculative traders who are experienced and know how to use risk management. This includes the proper placing of limit orders when trading the forex pair. Placing a live market order for the Kenyan Shilling can be compared to simply burning money because it is hard to predict where your price fill will be unless you are using strict limit orders. This happens because volumes are low within the USD/KES.

A look at a one month chart for the USD/KES highlights support levels that are incrementally raising within the forex pair. And a look at a six-month chart shows the USD/KES has also suffered from an extended bullish run higher. This has happened as fears about coronavirus implications have escalated, but it must be added that longer-term charts also show a strong bullish trend for the USD/KES. This has been delivered steadily as Kenya suffers from a reputation because of corruption envelopes economic life in the nation.

Interestingly, as many other emerging market currencies have shown the ability to create some bearish momentum against the USD after fears of coronavirus became less severe, the USD/KES has not produced the same effect. The forex pair remains tangled in a bullish run upwards in which the resistance levels prove vulnerable long term. Several attempts at puncturing resistance around the 108.500 level have failed within the past four weeks, but traders may believe buying the USD/KES with limit orders near support around the 108.200 mark and looking for renewed tests of resistance levels may be a good speculative trade.

Kenyan Shilling Short Term Outlook:

Current Resistance: 108.500

Current Support: 108.200

High Target: 108.600

Low Target: 107.950