Japan revised its second-quarter GDP lower, from an initial collapse of 27.8% to 28.1%. Capital expenditures led the revision, from a preliminary drop of 1.5% to 4.7%, in a sign that Covid-19 impacted a broader part of the economy. While the constitution of Japan did not allow for the implementation of a lockdown, the highly civilized and disciplined society voluntarily complied with the government's plea to shut down businesses and practice social distancing. The country of over 126,000,000 recorded just over 73,000 confirmed infections and a relatively low death toll above 1,400. After the USD/JPY reversed its breakdown back into its short-term resistance zone, a new sell-off is expected to materialize.

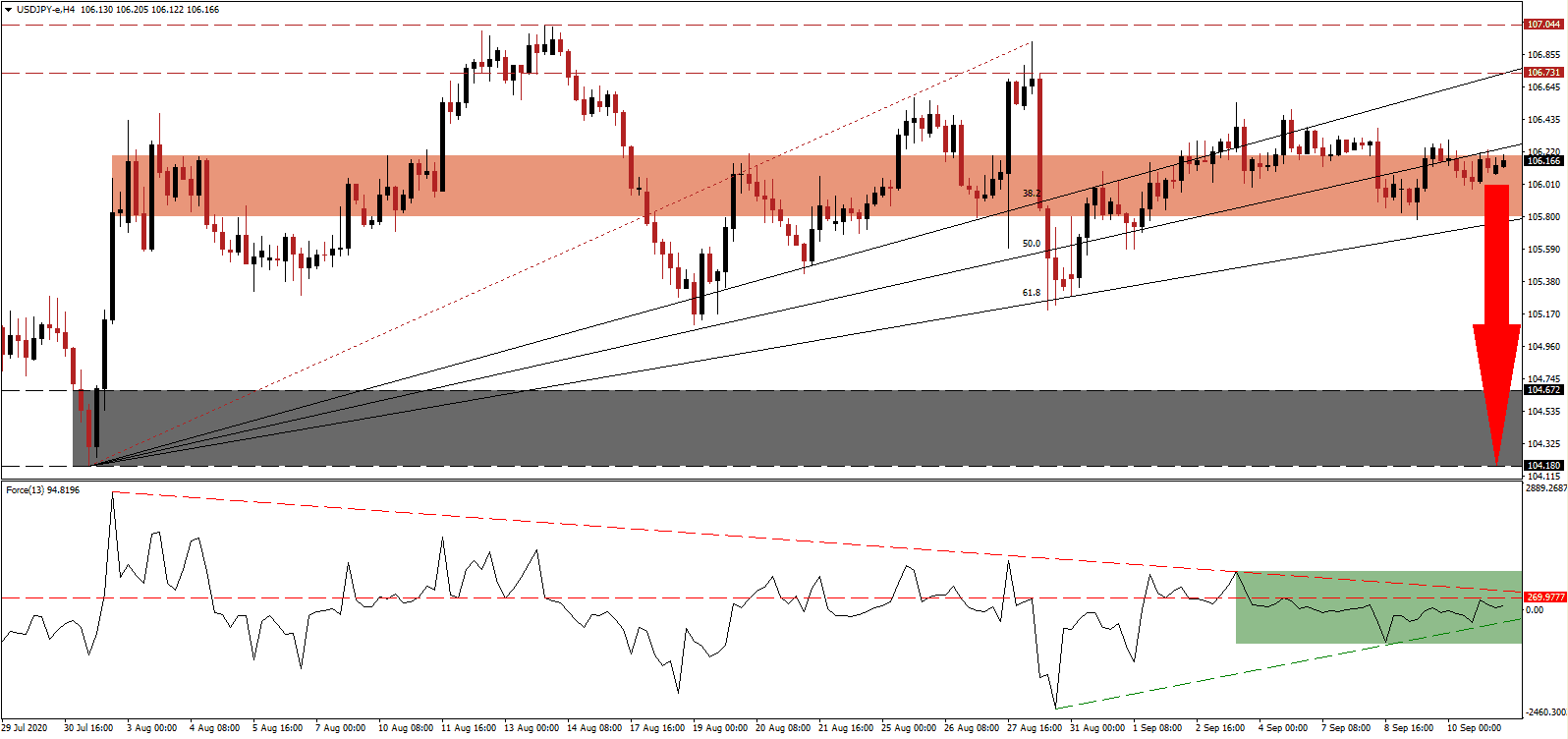

The Force Index, a next-generation technical indicator, advanced off of its new multi-week low but remains below its horizontal resistance level. Adding to bearish momentum is the descending resistance level, as marked by the green rectangle, favored to pressure it below its ascending support level. Bears wait for this technical indicator to cross below the 0 center-line to regain complete control over the USD/JPY.

Expectations for the current fiscal year, ending in March 2021, call for a 5.6% GDP decrease, followed by a 3.3% expansion for the fiscal year 2022. Chief Cabinet Secretary Yoshihide Suga, the frontrunner to become the next prime minister, vows to expand spending under his reign. It would follow the more than $2 trillion in stimulus Japan unveiled to battle its most severe downturn since World War II. Bearish pressures expanded after the USD/JPY reversed back into its short-term resistance zone located between 105.801 and 106.199, as identified by the red rectangle.

Despite economic challenges, the Japanese Yen is the primary safe-haven currency. With many countries bracing for a second Covid-19 infection wave, together with seasonal influenza, demand for the Japanese Yen is likely to remain elevated. More clarity over economic policy will be available following the September 14th announcement concerning the new prime minister. A breakdown in the USD/JPY below its ascending 61.8 Fibonacci Retracement Fan Resistance Level will clear the path for a sell-off into its support zone located between 104.180 and 104.672, as marked by the grey rectangle.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 106.150

- Take Profit @ 104.200

- Stop Loss @ 106.600

- Downside Potential: 195 pips

- Upside Risk: 45 pips

- Risk/Reward Ratio: 4.33

In case the Force Index spikes above its descending resistance level, the USD/JPY may attempt a breakout. Given the ongoing weakness in the US labor market, with almost 30 million receiving benefits, and new initial jobless claims rising last week, Forex traders should consider any advance as a selling opportunity. US Dollar weakness is well-positioned to extend. The upside potential is limited to its intra-day high of 108.161, a previous peak that initiated a massive correction.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 107.150

- Take Profit @ 108.100

- Stop Loss @ 106.600

- Upside Potential: 95 pips

- Downside Risk: 55 pips

- Risk/Reward Ratio: 1.73