For two weeks in a row, the USD/JPY performance was disappointing, as the pair continued to move in limited ranges amid a more downward tendency. It then closed last week’s transactions around the 106.15 support, as investors still preferred the Japanese yen as a safe haven in light of the continuing tensions with The United States and concerns about the future of the stimulus of the third-largest economy in the world from the COVID-19 consequences. On the economic side, data showed that US consumer inflation improved more than expected in August.

A report issued by the US Labour Department showed that US consumer prices rose slightly more than expected in August. The report stated that the Consumer Price Index rose 0.4% in August, with used car prices rising the most in 51 years. And that's after rising 0.6% for two months in a row. Economists had expected consumer prices to rise by 0.3%. Excluding food and energy prices, core consumer prices were still up 0.4% in August after a 0.6% increase in July. Core consumer prices were expected to rise by 0.2%.

There are still sectors that showed larger price increases, led by a 5.4% rise in used car prices, the largest monthly gain since March 1969. New car prices did not change in August, but analysts expect prices to rise in the coming months, reflecting the shortage of supplies. Car production was completely closed during the spring season as the pandemic shut down large sectors of the economy.

Overall, US inflation remains below the Fed's 2% target. Last month, and for that reason, bank officials changed their inflation policy to say they were prepared to allow inflation to exceed the 2% target for some time to compensate for the many years in which the central bank failed to reach the 2% target. Because of this change, many economists believe the Fed will leave the benchmark interest rate, which affects consumer and business loans, at a record low close to zero at its meeting this week - and in the foreseeable future - as it tries to bolster the country from the recession brought by the COVID-19 pandemic.

Elsewhere, the Bank of Japan said that Japan's producer prices rose 0.2% month over month in August. This was in line with expectations, down from 0.8% in July. On an annualized basis, producer prices fell 0.5% - again matching expectations after a 0.9% decline the previous month.

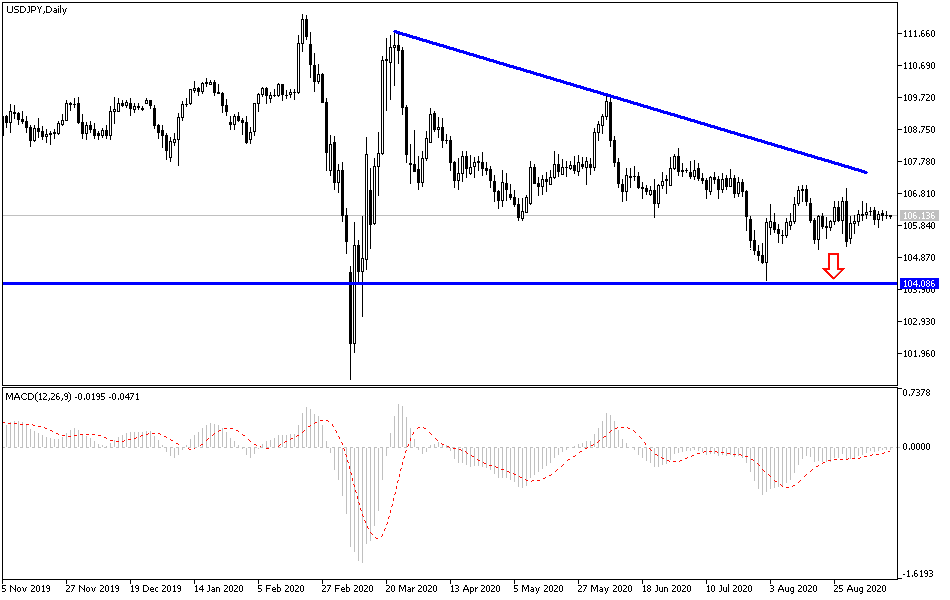

According to the technical analysis of the pair: No change in my technical view of USD/JPY, as despite recent stability, the general trend is still downward, and the loss of momentum to correct upwards may push the pair back to the support levels at 105.75, 105.00, and 104.30, respectively. There will be no chance for a bullish correction and a reversal of the current bearish outlook without the bulls crossing the 108.00 resistance. There are no significant US economic data releases today, from Japan, the industrial production rate will be released.