Rebound gains for the pair during yesterday's session did not exceed the 106.15 resistance before settling down around the 105.88 support in the beginning of trading today, and before the announcement of the first important American jobs issues. The pair did not react much with the better than expected US ISM manufacturing PMI reading. Before that, it was announced that the manufacturing sector in China will continue to grow in August, at a faster pace, according to the latest survey from Caixin with a reading of 53.1, better than the 52.8 in July, and further above the 50 level that separates growth from contraction.

Chinese commodity producers faced another increase in average input costs in August. Although the rate of inflation was not as strong as it was in July, it remained strong overall amid reports of rising raw material costs.

From Japan, the manufacturing sector continued to contract in August, albeit at a slower pace, according to the latest survey conducted by Jibun Bank, and the manufacturing PMI recorded an improvement at 47.2. Better than the reading of 45.2 recorded in July, and despite the improvement it is still below the 50 level that separates growth from contraction. On the individual level, the past month witnessed the slowest decline in production and new orders since the beginning of this year. Export sales fell at the weakest rate in seven months, while there was only a modest decline in employment.

From the United States, the ISM manufacturing PMI reported a better reading at 56.0 in August from 54.2 in July, and better than expectations for a reading of 54.5, and as long as the reading is above 50, the sector’s growth will remain intact. Commenting on the findings, the head of the ISM Manufacturing Business Survey said, “After the Coronavirus (COVID-19) led the manufacturing activity to its lowest level ever, the sector continued to recover in August, the first full month of operations after restarting supply chains and making adjustments for employees to return to work.

As for the US/Chinese tensions: Amid the US administration’s intention to push the US TikTok app to be sold to an American company, China continues its efforts to prevent this from happening by taking further measures to restrict US companies that want to acquire the app. China may try to stall until the US presidential election in November.

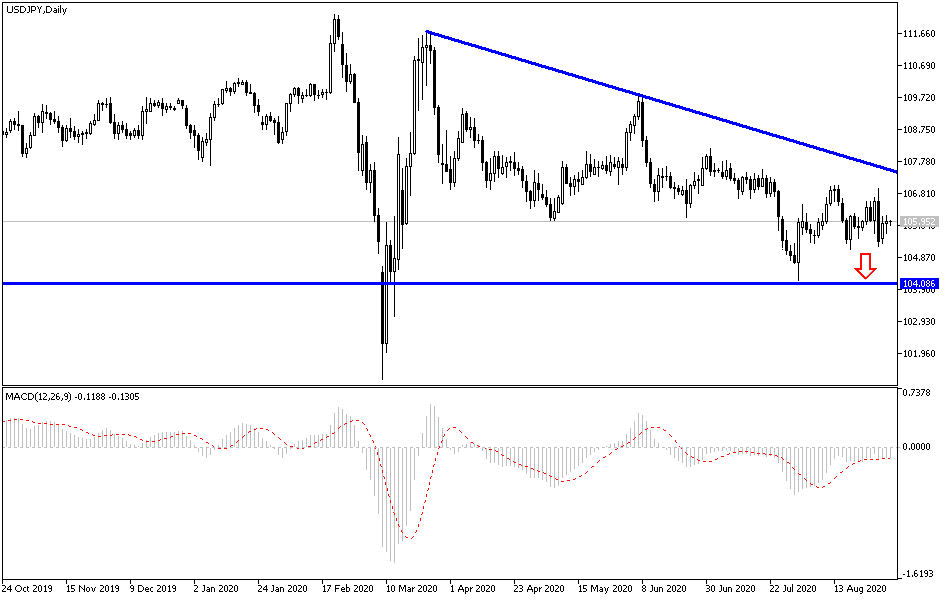

According to the technical analysis of the pair: There is no change in my technical view of the USD/JPY, as the general trend is still downward, and stability below the 106.00 support stimulates the bears to control performance and supports the move towards stronger support levels, with the closest ones currently are 105.80, 104.90 and 104.00. Despite the bearish stability and pressure on the US currency, I still prefer to buy the pair from every lower level. I still see that the 108.00 resistance is a first run-up to the bulls controlling the performance because it will motivate the bulls to go towards the 110.00 psychological resistance, which is the most important peak to make a shift in the general direction.