There is no doubt that the recent sell-off pushed the USD/JPY price towards its lowest level in a month and a half, reaching the 104.78 support, where it is stable around at the time of writing. The weaker USD against JPY remains the preferred safe haven for investors in times of heightened global geopolitical tensions as it is now. The pair remained under pressure despite the US currency gains after the US Federal Reserve announced its monetary policy yesterday. Which kept interest rates at their historically low level, with a promise to keep them there at least until 2023. The path of the COVID-19 pandemic will continue to affect the policy of the bank and the rest of other global central banks.

For his part, Fed Chairman Jerome Powell said in his press conference that followed the bank’s decision that while the US economy is recovering more quickly than expected, the labor market is still affected and the outlook is uncertain. The unemployment rate has declined steadily since spring but remains around 8.4%. "Although we welcome this progress, we will not lose sight of the millions of Americans who are still unemployed," Powell said.

US Federal Reserve officials said in a set of quarterly economic forecasts that they expect to keep interest rates at zero until 2023. In a statement issued after its two-day meeting, the bank said it would not raise borrowing costs until inflation reaches 2% and it appears likely that “Moderately exceeds” this level for an extended period. US Federal Reserve projections show that policymakers do not expect inflation to reach this target until the end of 2023.

From Japan, the country's trade surplus widened in August as the pandemic hit a wide range of industries and depleted consumer demand. The 15% decline in exports from the previous year was outpaced by a 20% decrease in imports, although exports to China increased by 5%. Both exports and imports with the United States fell by more than 20%, helping to reduce the politically sensitive trade surplus by 20% to 373 billion yen ($3.5 billion).

Many Japanese manufacturers provide chemicals, equipment, and components for assembled products in China. Strong exports helped drive growth in recent years, but it has struggled as the Chinese economy slows and the pandemic spreads. The pace of decline in exports has slowed with the easing of epidemic-related closures in China, the United States, and Europe. Exports declined 28% year-on-year in May, 26% in June, and 19% in July. Exports in August totaled 5.23 trillion yen ($ 49 billion), exceeding 4.98 trillion yen in imports ($ 47 billion), leaving a surplus of 248 billion yen ($ 2.4 billion). That compares with a deficit of 152.2 billion yen a year ago.

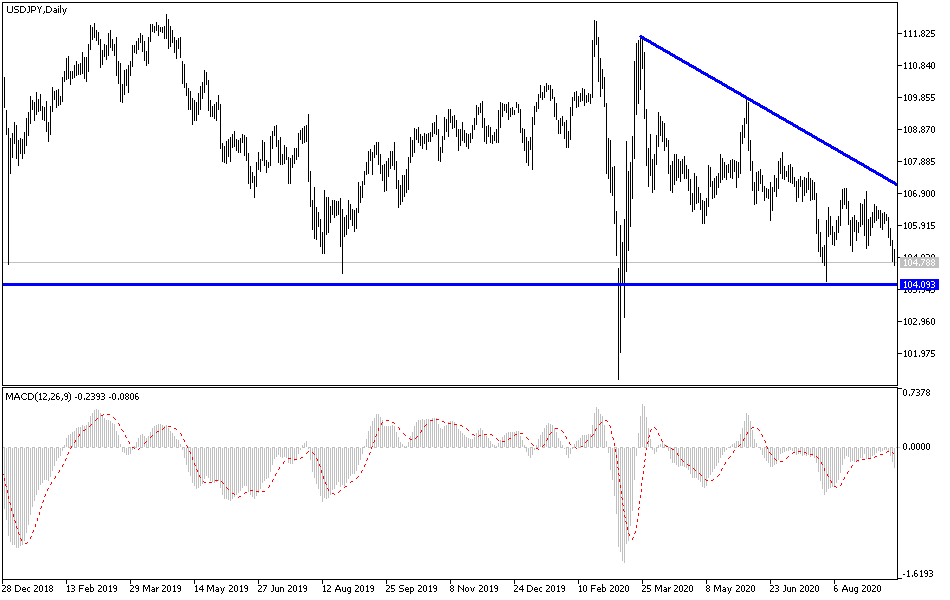

According to the technical analysis of the pair: The recent selling of the USD/JPY has pushed technical indicators into strong oversold areas and therefore it is better to think about buying now, and the closest support levels for the pair to do so are at 104.75, 103.90 and 103.00, respectively. On the upside, as I frequently mentioned before, there will be no real break of the current downtrend for the pair without crossing the resistance barrier at 108.00. Otherwise, the general trend will remain to the downside. Tensions in relations between the United States and China, the path and effects of the Coronavirus, and Trump's future in the upcoming presidential elections will remain the most influential factors on the performance of the USD/JPY pair in the coming weeks.

Regarding today's economic calendar data: From Japan, the Japanese central bank will announce its monetary policy, and from the United States of America, jobless claims, reading of the Philadelphia industrial index, building permits and housing starts data will be released.