Amid expectations of the announcement of a sharp and record contraction in the Japanese economy today, in the era of Corona, the USD/JPY receives these important data with the return of bears' control, as the pair stabilized around the 106.25 level at the time of writing. The recent rebound gains did not cross the 106.55 resistance despite the dollar's strength against the rest of the other major currencies, which confirms the strong investor appetite for the Japanese yen as a safe haven at the expense of the dollar, which reaped record gains since the beginning of the first COVID-19 wave. The US central bank’s policy shift was a compelling reason for how much more the bulls were struggling to achieve.

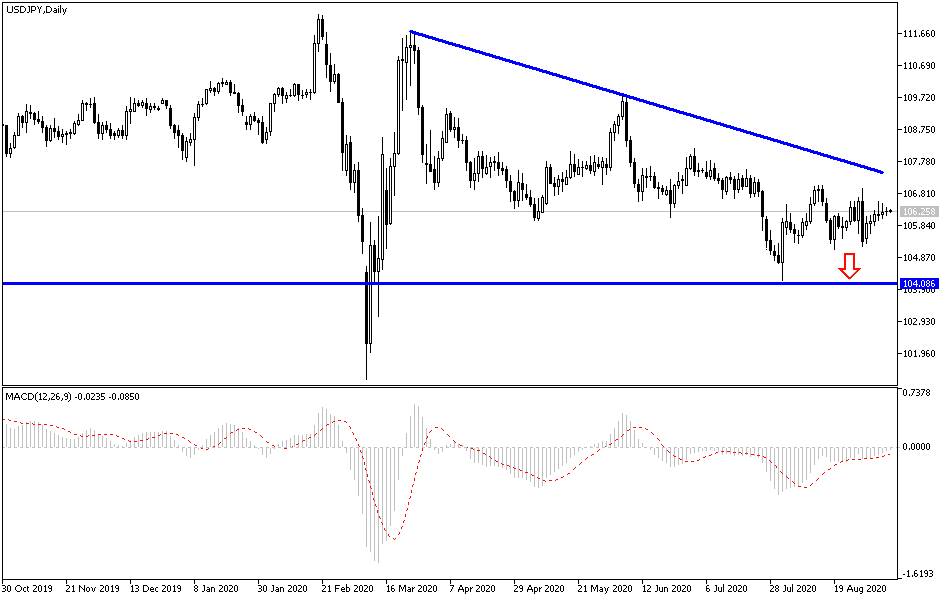

Commenting on the recent USD/JPY pair’s performance, Richard Perry analyst at Hantec Markets says that the pair's rally is losing momentum. Even with the dollar gaining ground across major currency pairs by the end of last week's trading, it was interesting to see little real momentum in the bullish USD/JPY move. The technical analyst believes that the 107.00 resistance may be an opportunity to resume selling, especially with the pair losing enough momentum to start testing higher levels. On the other hand, it is expected to move towards the 105.10 support if it stabilizes below the 106.00 support.

With the continued U.S lead of global Covid-19 cases and death numbers, whether in the first or in the second wave, it was necessary for the US administration to present more stimulus plans to prevent the US economy from collapsing. With the end of some stimulus plans, talks between top Democrats and the Trump administration stalled last month and remained off the right track, with the bipartisan unity that drove nearly $3 trillion in the COVID-19 Rescue Act into law this spring replaced with toxic partisanship and a return to dysfunction in Washington.

Expectations in July and August that a fifth bipartisan pandemic response bill will eventually be passed despite mounting hurdles will be replaced by real pessimism. Recent talks related to COVID-19 between the main players did not lead to anything worthy, which caused increased investor anxiety regarding the status of the largest economy in the world, especially since the deadly disease is still present and is still reaping more human and economic losses, and in addition to the non-stopping trade dispute with China.

According to the technical analysis of the pair: In light of an American holiday yesterday, it was natural for USD/JPY to stabilize in a very limited range, and we may see some activity today with the announcement of the Japanese GDP growth rate. In general, stability below the 106.00 support will remain supportive of the bears dominating the performance, and accordingly, the pair will be ready to test stronger support levels, with the closest ones currently at 105.65, 104.80, and 103.90, respectively. On the upside, as I frequently mentioned before, the 108.00 resistance will remain an important catalyst for the bulls to control the performance.