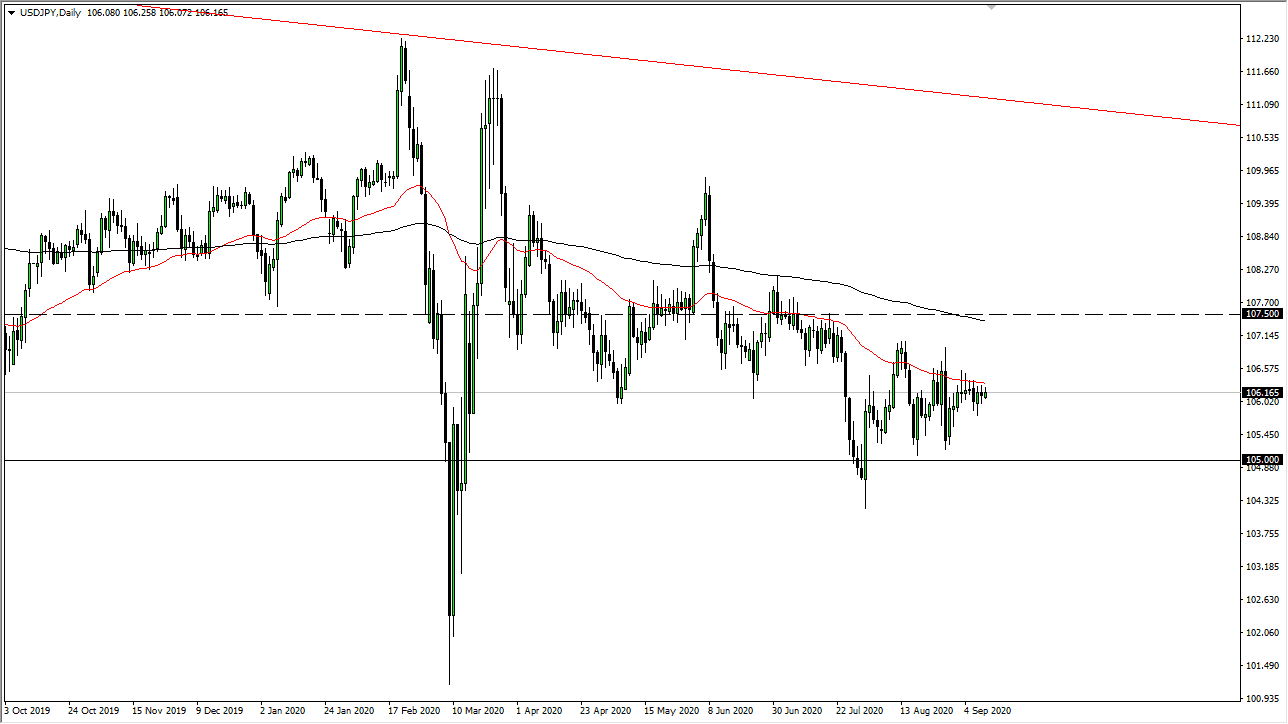

The US dollar has so far been relatively buoyant during the week and Friday was not any different. Having said that, the 50 day EMA above continues to offer significant resistance. With that, I believe that fading short-term rallies will probably continue to be the way going forward as this market is so slow at the moment. Obviously, it cannot go sideways forever but as long as it is in this mood, you might as well take advantage of short-term back-and-forth type of trading. Scalpers must absolutely love this market right now, and I will be the first person to admit that I have taken a few trades here and there based upon that thought process, fading short-term rallies.

When you look at the longer-term chart, although it has not exactly been a major breakdown, it does suggest that we are grinding lower. I think we will probably target the ¥105 level given enough time, which was a major support level previously. If we were to break down below there, it opens up a move of about another 60 pips to the downside, where we would also see significant support. Breaking that area then opens up the ¥102 as a possibility for a target level. On the other hand, if we were to rally from here and clear the 50 day EMA, I think there are plenty of places where we could run into trouble above. The first place that comes to mind is the ¥107 level, and then the 200 day EMA which sits just below the structurally important ¥107.50 level, an area that has been important more than once.

When you zoom out on the chart, you can see that there is a bit of a wedge forming, so more than likely we are going to end up seeing some type of impulsive move that you can follow. The question now is whether or not the US dollar strengthens enough to make a difference over here, or if this might be the one diverging currency pair in that “risk-off” scenario where the Japanese yen strengthens against the greenback? I think the one thing you can count on is that a bigger move is coming, but until then 20 to 30 PIP increments seem to be how the market wants to move in and you might as well take advantage of this scenario.