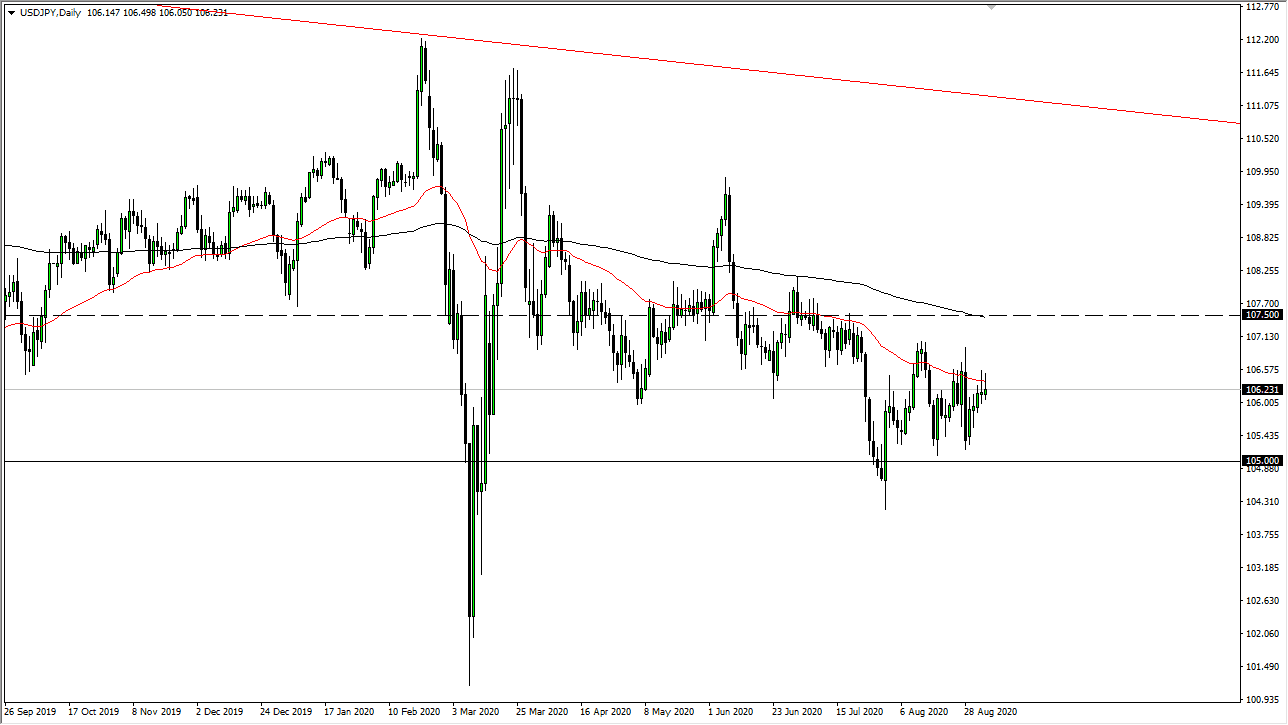

The US dollar has initially tried to rally during the trading session on Friday, but above the 50 day EMA we have seen a significant amount of resistance. After a job summer that was a little bit better than anticipated, the reality is that the Federal Reserve will continue to loosen monetary policy and therefore it should continue to drive the US dollar lower. The market forming a shooting star for this session just as it did for Thursday, so this tells me there is a massive amount of resistance in that area. Ultimately, this should send this market much lower, perhaps reaching down towards the ¥105 level.

The 50 day EMA continues to offer resistance, and that should extend all the way to the 200 day EMA. This market has been grinding back and forth for some time, and therefore it is likely that we will continue to respect the overall boundaries. However, at the end of the day the Federal Reserve seems to be racing to the bottom much quicker than the Bank of Japan is, and as long as the US dollar continues to falter in general, then I think it makes quite a bit of sense that we roll over and go looking towards the ¥105 level. If we can break down below there, then the market is likely to go looking towards the ¥104 level, which had previously been massive support. If we break down below there, then it is likely that the market could go down to the ¥102 level.

As far as buying is concerned, I do not have any interest in doing so, at least not until we break above the ¥107.50 level, which also features the 200 day EMA. In other words, this is a market that is a “fade the rallies” type of situation. In fact, I fully believe that sometime early next week we will see this market break back down towards the bottom of the range, and therefore I think we continue to see a lot of short-term selling opportunities. As far as longer-term trades are concerned, I do not think that the market offers that opportunity anytime soon, so you need to keep it to the short-term charts but use the daily chart as a way to define the overall range that we will be in.