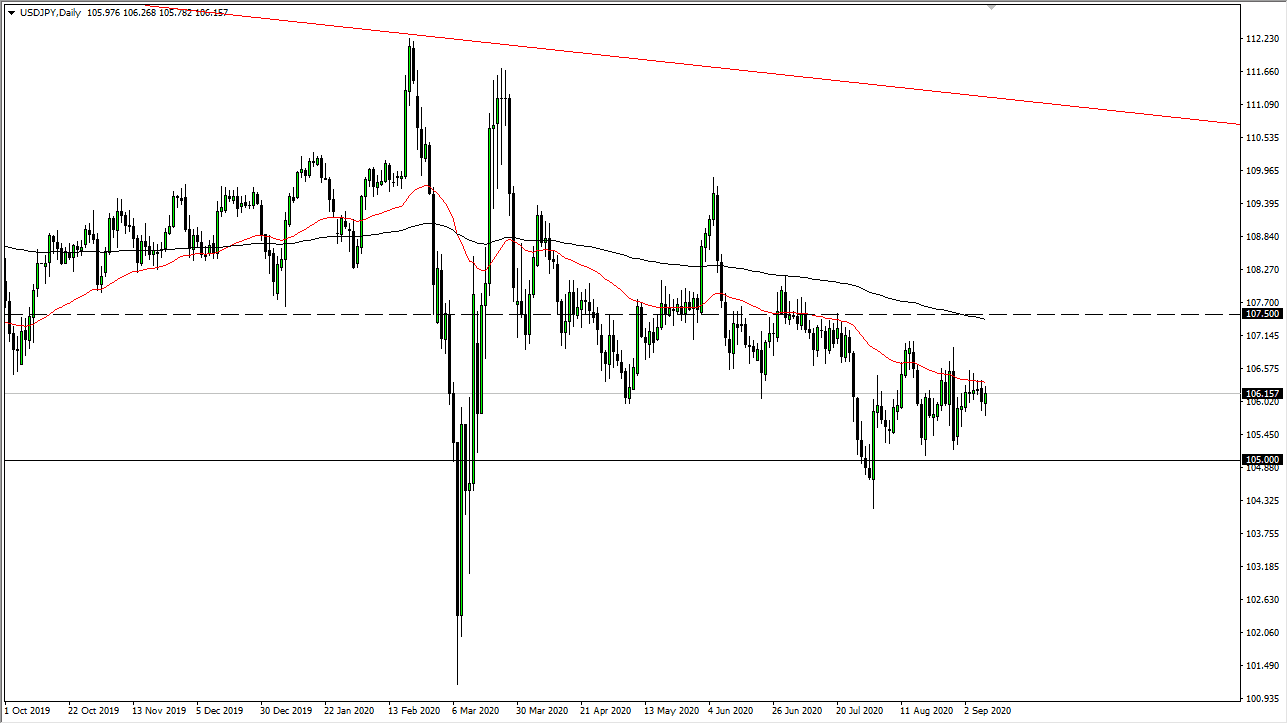

The US dollar initially fell during the trading session on Wednesday but then turned around to rally towards the 50 day EMA again. That being said, the market has been grinding sideways for some time, and the 50 day EMA is an area that has been important more than once. With that being the case, the market needs to recognize that as resistance, and therefore it is likely that we will continue to sell off from here. I believe that the market could probably drop down towards the ¥105 level, but it is going to take some time to get there.

The US dollar continues seeing a lot of selling pressure, as people worry about the Federal Reserve flooding the markets with liquidity. With that being the case, I think that it is only a matter of time before the US dollar loses a strength, even against the Japanese yen. This is especially obvious in other markets such as the Euro and the British pound, but the Japanese yen itself is starting to strengthen against the greenback which tells you just how loose the monetary policy is coming out of the Federal Reserve. That being said, the Bank of Japan is also very loose with its monetary policy, so I would expect a lot of choppy behavior and back-and-forth trading in general.

Above, the ¥107 level, followed by the ¥107.50 level both offer selling pressure, as the 200 day EMA is crashing through the latter of the two numbers. That is an area that has been structural resistance in the past so it would not be a surprise at all to see it hold up to scrutiny at this point. In the short term, we are much more likely to see selling than buying, because we would need to see massive US dollar strength in something akin to a “risk-on in the United States only” type of environment to see this pair rally. The shape of the candlestick is somewhat bullish, but there are a couple of shooting stars just to the left of where we are right now so I would not read too much into that candlestick for what it is worth. I think choppiness will continue to be the main theme here, and it is only a matter of time before the sellers get involved and push the greenback lower.