The US dollar has fallen rather hard against the Japanese yen during trading on Monday to kick off the week, which should not be a huge surprise considering that we continue to see the US dollar lose ground. However, you should also be noted that both of these central banks are extraordinarily loose with their monetary policy, so it is not as if one is going to be drastically stronger than the other, at least not in the current regime.

It is in this scenario that the Japanese yen may strengthen a bit due to what the Federal Reserve is doing, as they liquefy the markets. Furthermore, if we continue to see a lot of fear out there in the investing world, a lot of people use the Japanese yen as a safety currency. Although the US dollar is also considered to be a safety currency, the Japanese yen is considered to be the ultimate one. In other words, there is no clear directionality when it comes to central banks, so this will probably be a series of knee-jerk reactions to the downside every time we get a little ahead of ourselves.

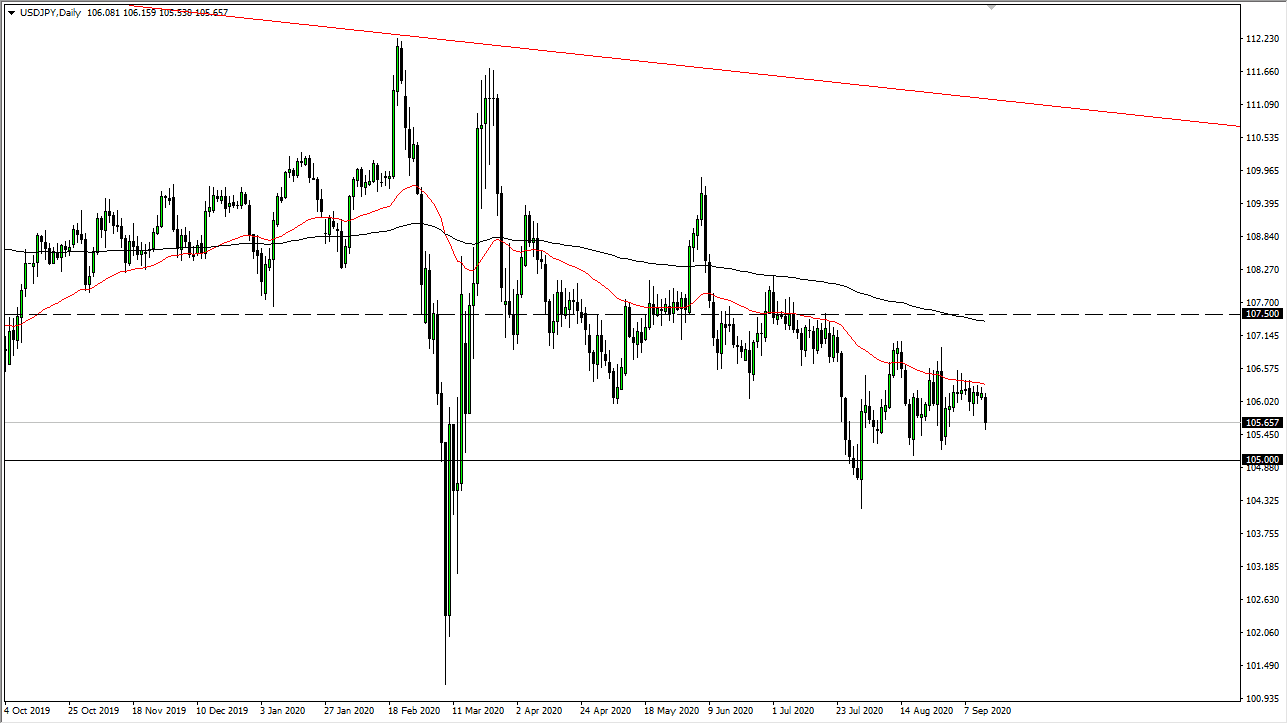

From a technical analysis standpoint, the 50 day EMA continues to offer significant resistance. Rallies towards that area will continue to be sold into, as we simply cannot seem to hold gains above it. Even if we did, at that point then I would start to look at the ¥107 level as a potential resistance barrier as well, finally followed by the ¥107.50 level, which is much more structurally resistive. To the downside, the ¥105 level continues to be a support barrier, but if we break down below there then you would have to assume that we are going to go testing the lows that were made several weeks ago at the ¥104.33 level. This market continues to be very choppy overall but I believe that fading short-term rallies will continue to be the best way going forward, as we are seeing a lot of wicks Pierce the 50 day EMA, but not able to hold above there, which is something that you should be paying attention to. In that scenario, short-term charts are preferable, because they give you an opportunity to trade this market multiple times without risking a lot of money.