The US dollar has fallen most of the session on Tuesday, but as we have seen across the Forex world, the US dollar gained a little bit of strength later in the day, especially during the New York session. That being said, we did bounce a bit and reached above the ₹73 level during the day, and I think it is only a matter of time before we get a little bit of a bounce.

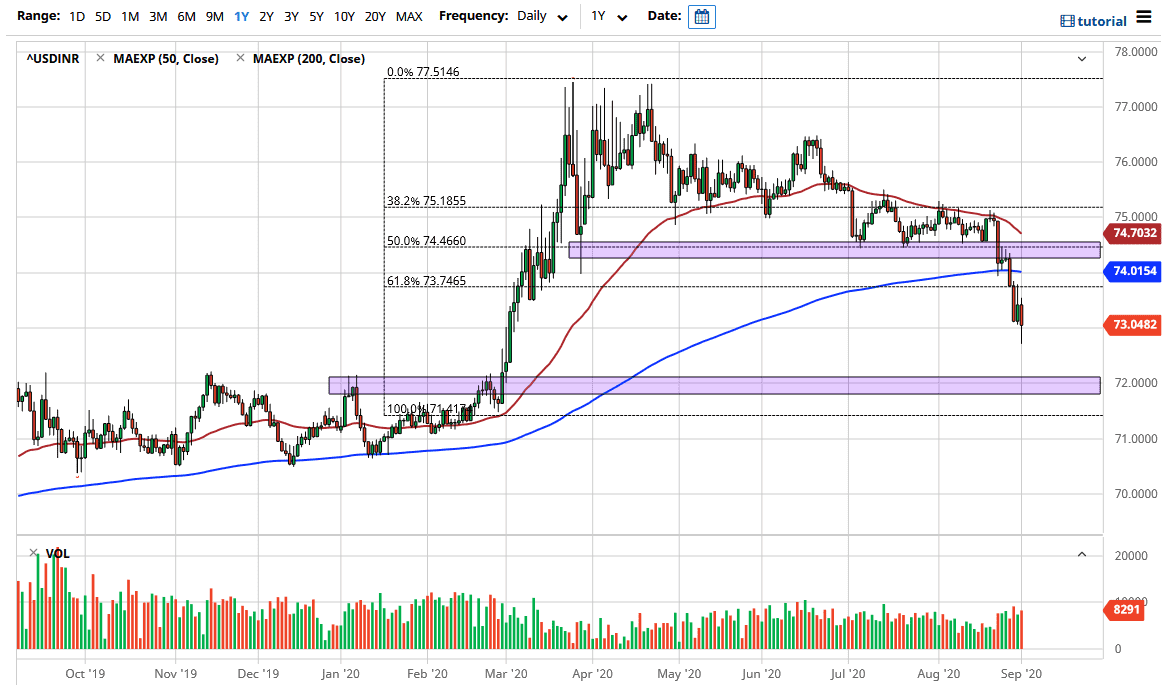

The reality is that I would not be a buyer of this pair and I think it is only a matter of time before the sellers return. The 200 day EMA is currently sitting at the ₹74 level, and anything close to that could be a nice selling opportunity at the first signs of exhaustion. This would be a simple “break down and then retest” of the previous support level. You can see that underneath I have the ₹72 level marked, and that is my longer-term target. That being said, the candlestick from the trading session on Tuesday is somewhat of a hammer, while the candlestick from the Monday session is somewhat of a shooting star. Typically, this means that you get some type of bouncing around in the short term as traders try to decide which direction this market goes in.

When you look at the Forex world, the US dollar is a bit oversold in general, and that’s not only here but in other places like the Euro, Pound, and Canadian dollar. If that is going to be the case, then it will translate to a slightly higher US dollar over here as well. That does not mean that we are changing the trend just simply that we are perhaps having to “revert to the mean” as the market continues to see the Federal Reserve out there flooding the markets with liquidity. No trade can go in one direction forever, and the trading session on Tuesday was probably a big sign of that old adage.

However, if we were to break down below the lows of the Tuesday session, then I think it opens up the door for the market to not go down towards the ₹73 level. Simultaneously, you should see the Euro, Pound, and Canadian dollar all strengthen against the US dollar, not to mention the other emerging market currencies that I follow here at Daily Forex like the South African Rand, Mexican peso, and Brazilian real. At this point, the FX markets are simply trading based upon the dollar and nothing else.