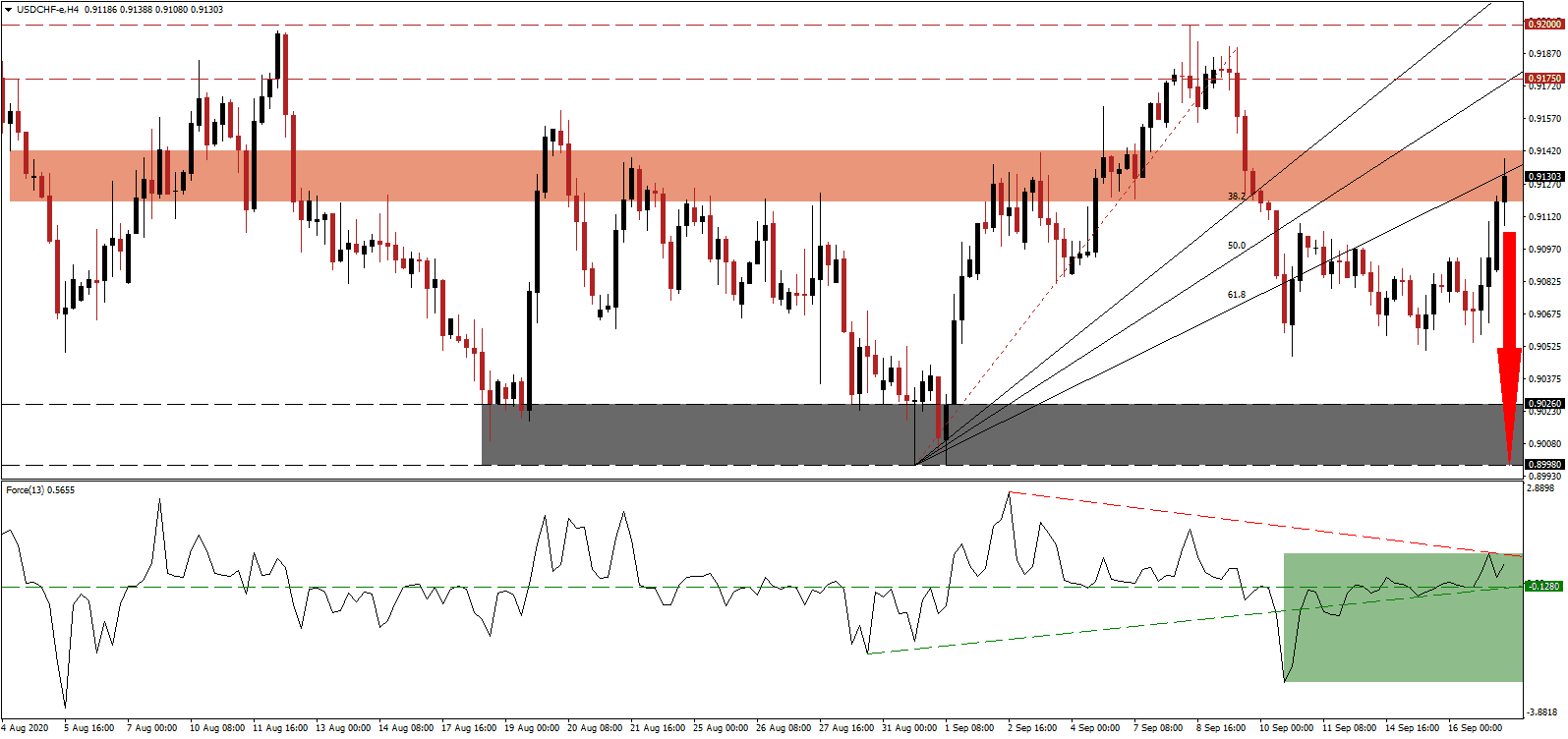

A new study released by Swiss-based Horizon Group ranked the post-Covid-19 recovery to-date. Switzerland placed fourth place, trailing only Finland, Norway, and Germany. The study credited world-class governance, high levels of social capital, and resilience. One potential drawback for the wealthy Alpine nation is its dependence on international markets, also referenced as an asset. The USD/CHF embarked on a counter-trend reversal but has now reached its short-term resistance zone, favored to ignite a profit-taking sell-off.

The Force Index, a next-generation technical indicator, recovered from a new multi-week low and reclaimed its ascending support level. Bullish momentum sufficed to convert its horizontal resistance level into support, as marked by the green rectangle. The descending resistance level rejected this technical indicator, now positioned to correct below the 0 center-line, allowing bears to regain control of the USD/CHF.

Per the Expert Group from the Swiss Federal Government, in its interim assessment, the economy performs better than previously expected. It resulted in an upward revision to the 2020 GDP forecast form a drop of 6.2% to a decrease of 5.0%. The 2021 outlook calls for a growth rate of 4.9%. After the USD/CHF reached its short-term resistance zone located between 0.9119 and 0.9142, as marked by the red rectangle, it faces rejection by its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

Adding to positive developments is news that the UK and Switzerland seek to create a financial services pact, granting professionals freedom of movement between the two global financial centers. It also aims at the EU inflexibility after locking the Swiss tock market out of EU markets and struggling to negotiate a trade deal with the UK. The USD/CHF is vulnerable to a new breakdown sequence, magnified by rising demand for safe-haven currencies amid a resurgence of the Covid-19 virus. Price action can retrace into its support zone located between 0.8998 and 0.9026, as identified by the grey rectangle.

USD/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.9130

Take Profit @ 0.9000

Stop Loss @ 0.9160

Downside Potential: 130 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 4.33

A sustained breakout in the Force Index above its descending resistance level could allow the USD/CHF to push farther to the upside. Yesterday’s US Federal Reserve meeting concluded with a pledge to not raise interest rates throughout 2023. It confirms the expected economic and US Dollar weakness. Forex traders should sell any advance, with the upside potential limited to its resistance zone between 0.9175 and 0.9200.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9175

Take Profit @ 0.9200

Stop Loss @ 0.9160

Upside Potential: 25 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 1.67