The USD/ARS continues to trade within a death spiral. Speculators who have the ability to buy the USD/ARS and hold onto the forex pair and withstand carrying charges should maintain their bullish stance. The Argentine Peso has seen a relentless loss of value long term and this trend is unlikely to diminish anytime soon.

Traders need to keep in mind the forex rate they are trading on their platforms is the official Argentina government exchange rate, which does not reflect the real cash price of the USD/ARS when it is being traded on the black market in the shops of Buenos Aires. Citizens of Argentina face an official policy of capital controls which limit their purchases of US Dollars to $ 200.00 per month as of the 15th of September. However, those who can exchange their Pesos for the USD on the black market have not stopped their pursuit of the greenback in order to protect their assets.

Argentina reported a drop in gross domestic product yesterday of nearly minus -20% percent for the second quarter. While the economic implications from coronavirus can certainly be blamed on the discouraging decrease of the GDP number, the government of Argentina must be blamed too because of blundering policy and corruption. People who do not have the ability to exchange their Argentine Pesos to the US Dollar face an incredible inflation rate which has essentially been quantified close to 40% for the calendar year since August of last year.

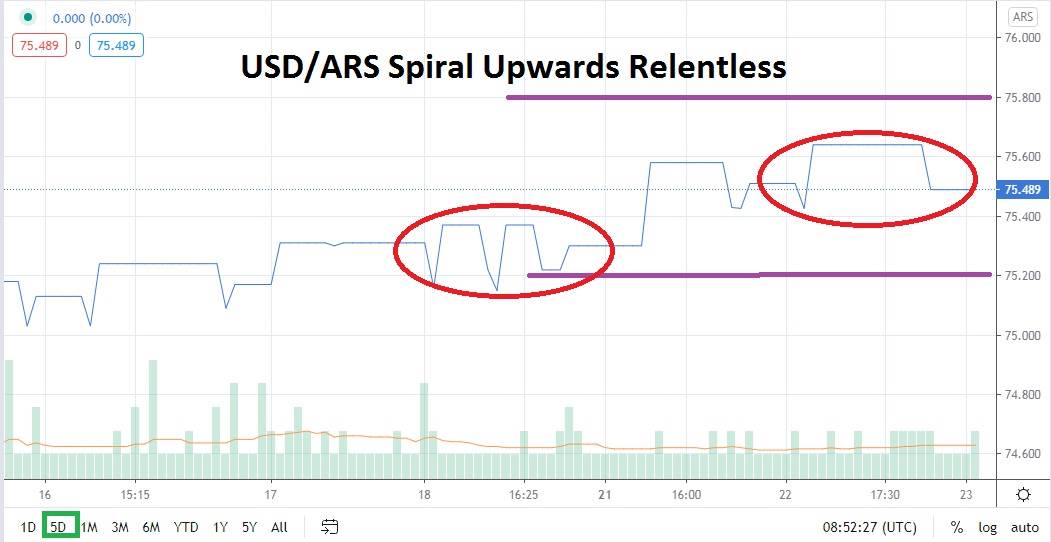

Traders who want to buy the USD/ARS and chase the almost constant loss of value within the forex pair should be careful. There is a chance the USD/ARS can spark a sudden reversal downwards and if a speculator uses too much leverage they can certainly be knocked out of a trade quickly. However, buying the USD/ARS in trading platforms using limit orders near the 75.400 to 75.500 levels should be considered when risk management is used properly.

Traders must be wary of carrying charges within the USD/ARS for positions held overnight. They should check to see what the charge from their broker will be for the ability to hold onto their positions if they plan on long term endeavors. Buying the USD/ARS remains the only logical trade within this forex pair.

Argentine Peso Short Term Outlook:

Current Resistance: 75.700

Current Support: 75.200

High Target: 75.800

Low Target: 75.100