Argentina is a welfare recipient that cannot get enough help and is never satisfied with its financial arrangements. After seemingly putting to rest the debts it failed to pay on time and making agreements with financial institutions recently, the Economy Minister of Argentina Martin Guzman has said the nation needs another 40 billion in IMF loans so it can repay debt which will be largely due in 2022 and 2023.

However, topping off the request, the Economy Minister added that Argentina does not want to pay the IMF anything for loans until 2024 in order to stabilize the nation’s fiscal problems and grow the economy.

On the surface that may appear to be a logical request. However, Argentina as a nation has defaulted on debt so many times that any lender who steps in with money needs to be aware the chances of being repaid in a timely fashion and be given what is exactly owed is less than a 50% chance. Argentina is a problematic country because of the level of corruption which engulfs the nation. Please note I am writing that sentence as an absolute, it is not a subjective thought.

The current government and its officials blame the past government for the current mess regarding economic conditions, but this is a song that has been heard before in Argentina. Pointing fingers and blaming past administrations alleviates suspicions that current government offices are not working properly. This might work in many places and even be true, but in Argentina, it is almost laughable. Those who rule now have ruled in the past and while the names may have changed corrupt practices have never gone away.

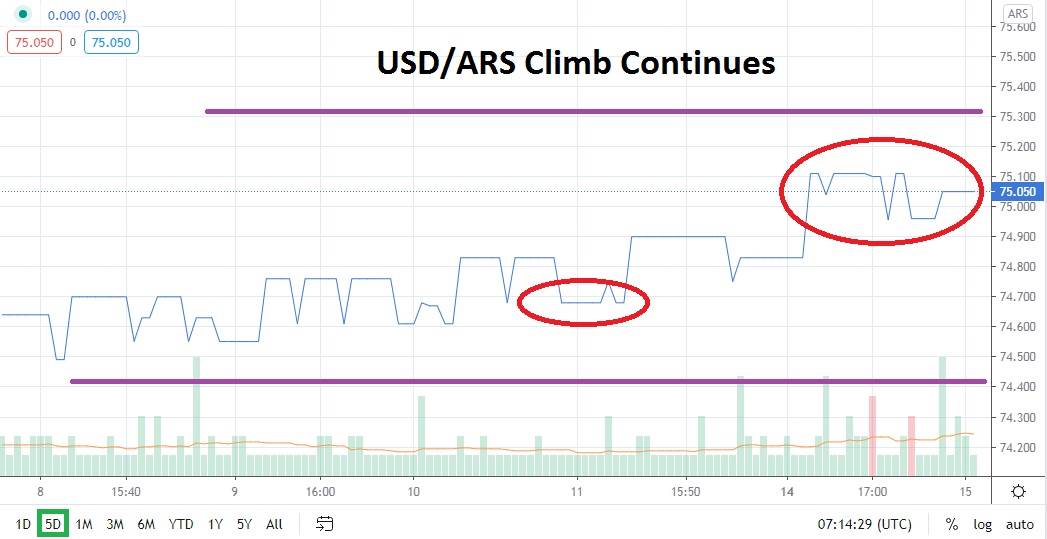

So how do the above statements help you trade the USD/ARS? Take a look at nearly any technical chart, short term, or long term and you will notice the climb upwards. The USD/ARS has been suffering from a bullish climb upwards for years and this trend is not likely going to stop for a while. As of this morning, the USD/ARS is testing resistance near the 75.100 level. Support is near the 74.800 mark.

Speculators buying the USD/ARS must be wary of any reversals downwards because they can certainly happen. However, if a trader has patience and the ability to potentially hold on to positions overnight and withstand carrying charges, buying the USD/ARS with limit orders near current support levels of 75.000 and looking for more upside action is the logical calling card.

Argentine Peso Short Term Outlook:

Current Resistance: 75.100

Current Support: 74.800

High Target: 75.600

Low Target: 74.500