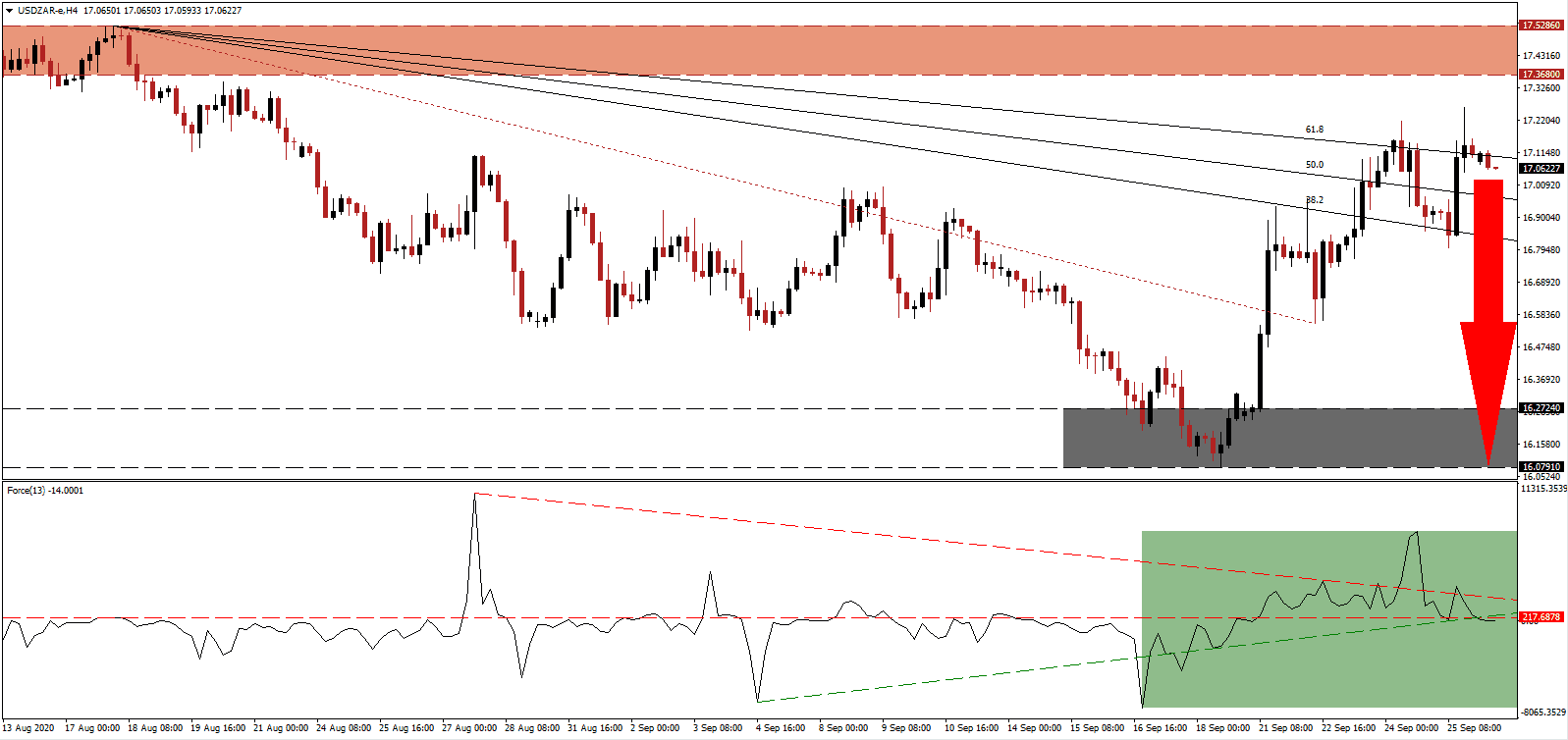

With Covid-19 cases dominant but slowing across South Africa, President Cyril Ramaphosa warned world leaders at the UN General Assembly that the pandemic set back African development. He called on the suspension of interest payment on the debt of African countries until Covid-19 is under control. South Africa requested and received a controversial bailout from the US-based International Monetary Fund (IMF). President Ramaphosa urged the global community to fulfill the UN’s 2030 Agenda for Sustainable Development. The USD/ZAR ended its healthy counter-trend advance just below its resistance zone, from where rising bearish pressures may force more selling.

The Force Index, a next-generation technical indicator, briefly spiked above its descending resistance level before collapsing below its horizontal resistance level. Adding to downside momentum is the contraction below its ascending support level, as marked by the green rectangle. This technical indicator moved below the 0 center-line, granting bears to resume complete control over the USD/ZAR.

Zwelini Mkhize, the South African Minister of Health, disbanded the 51-member Ministerial Advisory Committee on Covid-19, headed by epidemiologist and infectious diseases specialist Salim Abdool Karim. Disagreements between the government approach to the pandemic and the scientific community widened, resulting in the planned reconstitution. Breakdown pressures in the USD/ZAR expanded after it failed to challenge its continuously revised resistance zone located between 17.3680 and 17.5286, as marked by the red rectangle, partially driven by upside exhaustion in the US Dollar amid a negative outlook.

After the South African Reserve Bank (SARB) kept interest rates unchanged at 3.50% last week, Governor Lesetja Kganyago cautioned that no amount of quantitative easing would address the labor skill-shortage holding back the country’s economic potential. He points out structural problems, including the Eskom issues plaguing the economy since 2008. President Ramaphosa pledged to recalibrate the economy, hailing the pandemic as a chance to change the old world order. A breakdown in the USD/ZAR below its descending 50.0 Fibonacci Retracement Fan Support Level is favored to pressure this currency pair back into its support zone located between 16.0791 and 16.2724, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 17.0625

- Take Profit @ 16.0800

- Stop Loss @ 17.2625

- Downside Potential: 9,825 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 4.91

A breakout in the Force Index above its descending resistance level may inspire the USD/ZAR to push higher. Forex traders should take advantage of any advance from present levels with new net short positions. The outlook for the US Dollar remains increasingly bearish, amid misguided monetary policy, excessive debt, and a weak labor market. Price action is unlikely to move above its resistance zone without a catalyst.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 17.3500

- Take Profit @ 17.5100

- Stop Loss @ 17.2625

- Upside Potential: 1,600 pips

- Downside Risk: 875 pips

- Risk/Reward Ratio: 1.83