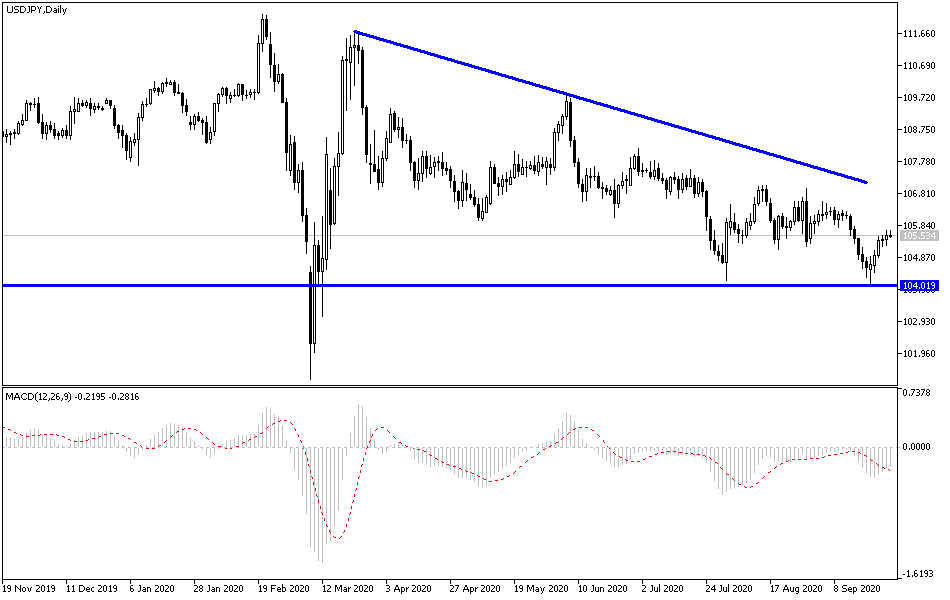

After six trading sessions in a row, the USD/JPY attempted a bullish correction, gains stalled around the 105.69 resistance before stabilizing around 105.39 at the time of writing. This confirms that the pair is still in need of more momentum to complete the upward correction or to return to the path of its sharp descending channel, which is still in place on the long run. The US jobs numbers this week and the debate between US President Trump and his rival Biden may provide enough and needed momentum for forex traders to move the pair along one of the two lanes.

Commenting on the debate that the markets are waiting for, Derick Halbini, Head of Market Research of International Markets in Europe and MENA area said: “Investors will remember Trump's strong performance in TV debates four years ago, and Biden is vulnerable to slips, so there is a plausible scenario for Biden’s poor performance this week which increases the likelihood that Trump closes the gap in Opinion polls, which in turn raise the odds, from a worst-case scenario to a very close election result, with disputed votes in battlefield states and unsolved results for weeks". "Biden's poor performance this week could undermine the strength of the US dollar against the major G10 currencies, especially against the Japanese yen," he added.

Before the important debate, there were reports that US President Trump had paid only $750 in federal income taxes in the year he ran for president and his first year in the White House, according to a report in the New York Times. Trump, who has fiercely guarded his tax files, is the only president in the modern era who has not made them public and has not paid federal income taxes in 10 of the past 15 years. Details of the tax returns released on Sunday complicate Trump's self-portrayal as an intelligent, patriotic businessman, and instead reveal a series of financial losses and income from abroad that may conflict with his responsibilities as President of the United States. The US president's financial disclosures indicated that he earned at least $434.9 million in 2018, but his tax returns reported a loss of $47.4 million.

For his part, Trump rejected the report, calling it "fake news" and asserting that he had paid taxes, although he did not provide details. He also pledged that the information about his taxes "will be fully disclosed," but he did not provide any timetable for their disclosure.

The US non-farm payrolls report for September, which will be announced next Friday, may also have an impact on the USD demand and the course of the forex currency market before the weekend. The payroll will provide insight into how the US labor market recovery has continued until September, the second month in which households were without enhanced welfare benefits, which were expected to have a negative impact on consumer-facing businesses and could at some point affect the labor market. Expectations indicate that the US economy could provide a total of 900,000 new jobs, to follow August, which recorded 1.371 million jobs, and that the unemployment rate in the United States would drop from 8.4% to 8.2%.

USD

USD

According to the technical analysis of the pair: No change to my technical view of USD/JPY, despite the attempts of a bullish rebound, the bears’ control is still stronger in the medium and long term. There will be no real shift in the negative outlook of the pair’s performance without breaching the 108.00 resistance. In return, returning to move below the 105.00 and 104.65 support levels will interest bears to push the pair to a stronger support level.