Today's signals for the USD/JPY pair

- Risk 0.75%

- Trades must be taken between 08:00 New York and 17:00 Tokyo time today only.

Sell Trading Ideas:

- Sell position after bearish price action reversal on the H1 timeframe immediately upon the next touch of 105.10 or 104.55.

- Stop losses at one point above the local swing high.

- Move your stop loss to break even when the trade is in 20 pips of profit.

- Take 50% of the position as profit when the trade is in 20 pips of profit and allow the remainder of the position to run.

Buy trading ideas:

- Buying position after the bullish price action reversal on the H1 timeframe, immediately after the next touch of 105.85 or 106.30.

- Place stop losses at one point below the local swing low.

- Move your stop loss to break even when the trade is in 20 pips of profit.

- Take 50% of the position as profit when the trade is in 20 pips of profit and allow the remainder of the position to run.

The best way to define a "price action reversal" is for an hourly candle, such as a pin, Doji, outside, or even a vertical candle, to close higher. You can take advantage of these levels or areas by observing the price action that occurs at these levels.

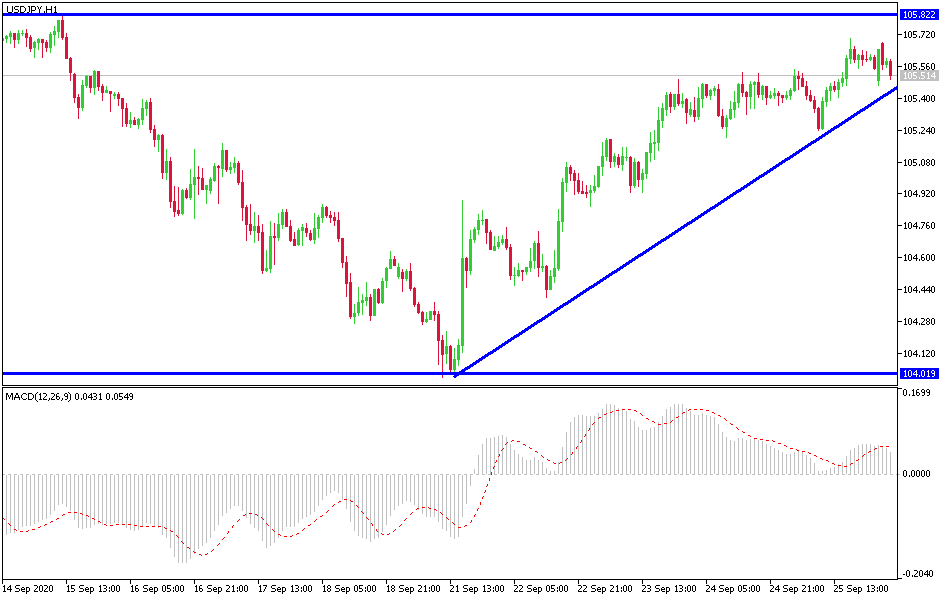

USD/JPY Analysis

As I mentioned before, despite the weak recent USD/JPY upward bounce attempts, as it did last week, it stopped the collapse path that pushed the pair recently to 103.99 support, its lowest level since last March. The upward reversal did not exceed the 105.68 resistance. Despite the US central bank indication regarding the future of US interest rates, it will continue to hover around the historically lowest near-zero levels, at least until 2023. However, the US dollar kept reaping more gains. As investors turn to the US currency as a safe haven at the expense of the Japanese currency, it is a traditional safe haven for investors in times of uncertainty. The dollar’s gains were aided due to the weakness of global stock markets led by Wall Street, the continuing lack of renewed financial support from Washington, ambiguity on the part of the Fed’s policymakers, and concerns about the Coronavirus infection breaking out in Europe.

During the past week. Fed Chairman Jerome Powell said that interest rate makers have done "all the things we can think of" and that the recovery could suffer without action from lawmakers. This was after Fed Member Charles Evans and the bank’s governor in Chicago said that interest rates may rise before reaching the average inflation target of 2%, in what appears to be a contradiction to the bank's new strategy.

Powell also said that the average new inflation target would see rates remain at current levels for a while even after inflation rises above the 2% target.

Commenting on the USD performance and the future, Zach Bandel, senior analyst at Goldman Sachs, said: "We still expect the US dollar to weaken at the end of the year and beyond, due to the high valuation and negative real interest rates. To the end, our conviction to the global economic recovery will rise if polls indicate a greater likelihood of the Democrats sweeping in the November election - and financial markets are likely to focus on Trump and Biden's first debate on Tuesday to indicate which direction the race might be heading.” Some analysts believe that investors will remember the strong performance of Trump during television debates four years ago, and Biden is vulnerable to missteps, so there is a plausible scenario for Biden's poor performance this week, which increases the likelihood that Trump closes the gap in the polls, which in turn raises odds and expectations.

Technically: the USD/JPY's reluctance to move below the 105.00 support gives hope for a halt to the recent downward path and will strengthen the bulls' control if the pair crosses the 106.60 resistance. and then move to 108.00. Loss of momentum, as is the case recently in close trading sessions, means that the bears will have control over the performance as is the case on the long term.

Today's economic calendar has no important economic data affecting the Dollar or the Yen.

Today's economic calendar has no important economic data affecting the Dollar or the Yen.