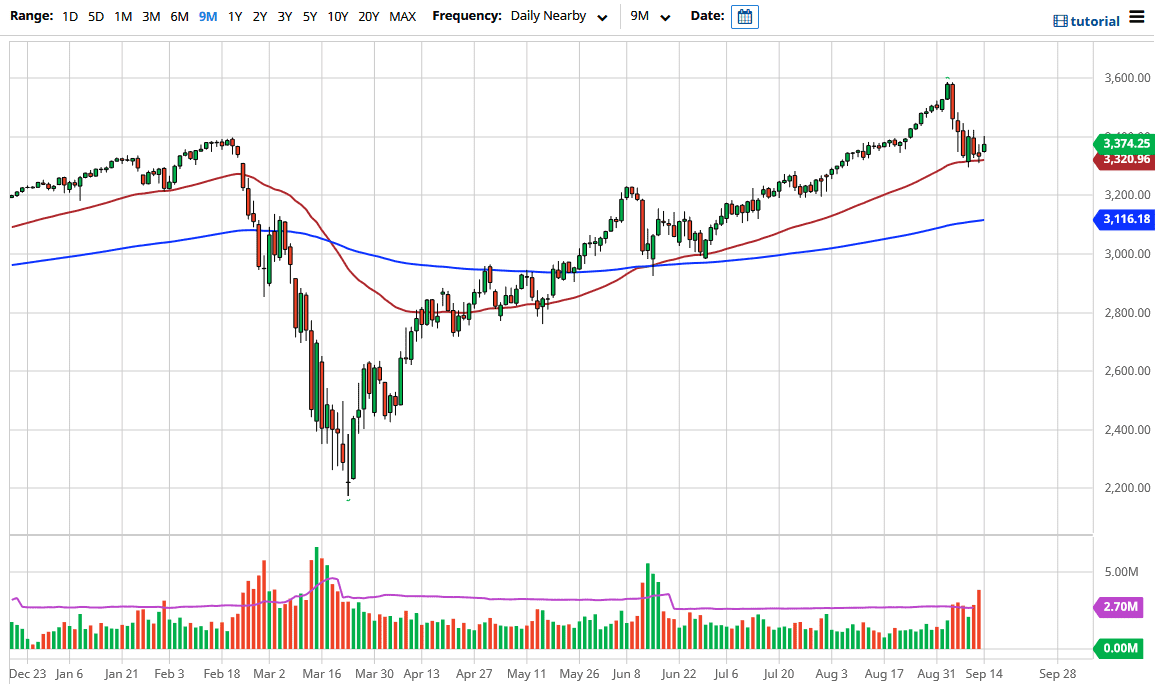

The S&P 500 has rallied quite significantly during the trading session on Monday, reaching towards the 3400 level before giving back those gains. We did end up positive, but certainly are starting to see a lot of pressure at the 3400 level to keep the market down. The 50 day EMA underneath at the $3320 level offers pretty significant support as well though. The question is not so much as to where the barriers are, but which direction do we break out of?

If we break down below the 3320 level, then it is very likely that we will go looking towards 3300. A break of that level almost certainly opens up a move down to the 3200 level, which is more structurally important based upon the previous trading. I think at this point, there would be a lot of support coming into the picture, and therefore it is worth paying attention to and perhaps picking up a little bit of value. This will be exacerbated by the fact that the 200 day EMA will be heading in that general direction as well.

If we turn around and break above the 3400 level, then it is very likely going to be a scenario where the market simply goes back to the highs again. However, it is a bit difficult to suggest that is going to be easily done, based upon the back and forth action that we have seen as we chop back and forth. I do think that the market is trying to figure out its next move, and at this point, it is difficult to understand which direction is more likely than not, but looking at the overall long-term trend, it will make sense if we rally. However, you also have to keep in mind that the market has been a bit frothy as of late. Although the S&P 500 has been a bit more realistic than the NASDAQ 100, the reality is that it still is an extremely high levels, despite the fact that the underlying economy is not. In fact, there are some recessionary headwinds out there so it will be interesting to see whether or not the Federal Reserve has to come back in and pick things up again. I suspect that we have a 10% drop, Jerome Powell will jump back into the market and push everything to the upside. We have various levels to pay attention to, but right now we are essentially in “no man’s land.”