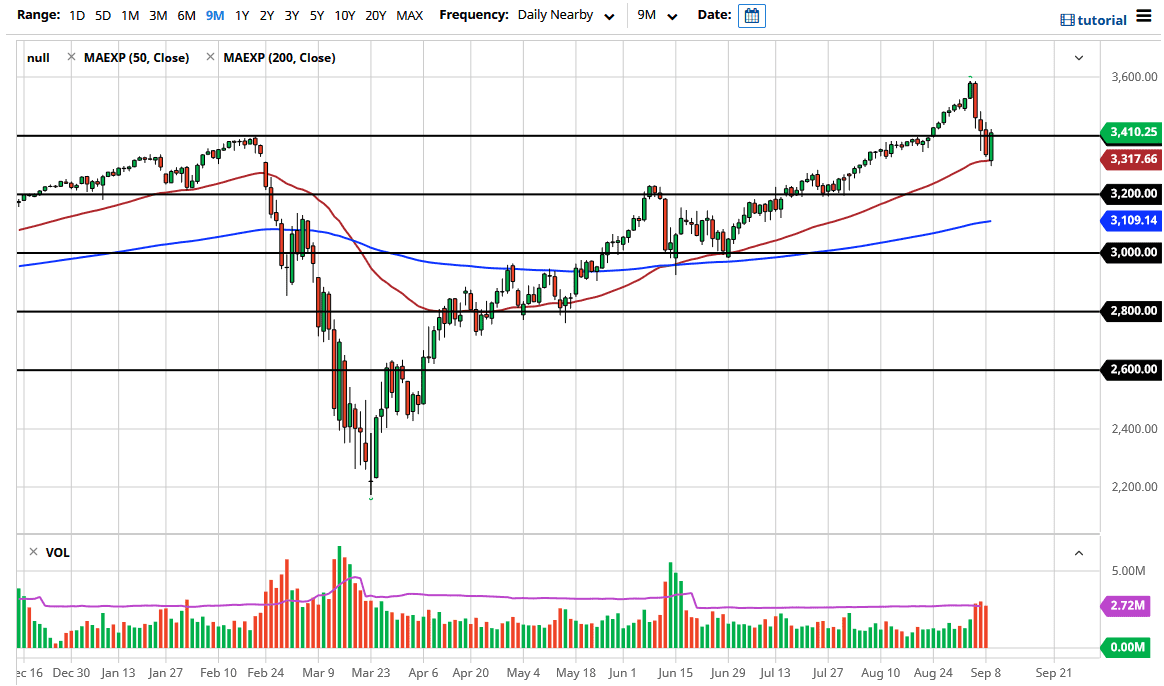

The S&P 500 has bounced from the 50 day EMA on Wednesday, as the market looks to save itself from a massive selloff. We recaptured the 3400 level which is a psychologically important level. However, we still have a long way to go to take out all of the losses, as we are still 200 points from the highs. Typically, when you get some type of bounce like this there is a process to rebuilding the overall trend, and therefore I would not be surprised at all to see some choppy action over the next couple of days.

The height of the candlestick is somewhat impressive, but when you look at the candlestick from the previous session, we did not even break above the highs from that day. In other words, although things look good for a short-term perspective, there is still a lot of convincing to do before the market can feel completely safe. Furthermore, it is better to see this market go sideways and try to build up momentum that it is to see a sudden “V-shaped bottom” that would be a bit too much for the market. Ultimately, I think that if we break down below the 50 day EMA, then it could open up the market to reach down towards the 3200 level.

If that happens, then I would anticipate even more support in that area, as the market may look at market memory as a potential reason to rally. Furthermore, the 200 day EMA is starting to stretch towards that area so I think that is probably about as far as we go to the downside unless something drastically changes.

In the short term, expect a lot of back-and-forth trading action and choppiness as there are a lot of concerns out there when it comes to an overbought circumstance. That being said, most of the overbought froth in the market seems to be in the NASDAQ 100, so it does make a significant amount of sense that the S&P 500 might be a bit more stable as the acceleration to the upside was not so ridiculous, pushed on by Softbank and it is shenanigans in the options market. I suspect that the next couple of days need to be stable, and that is the best-case scenario for a continuation of the longer-term trend.