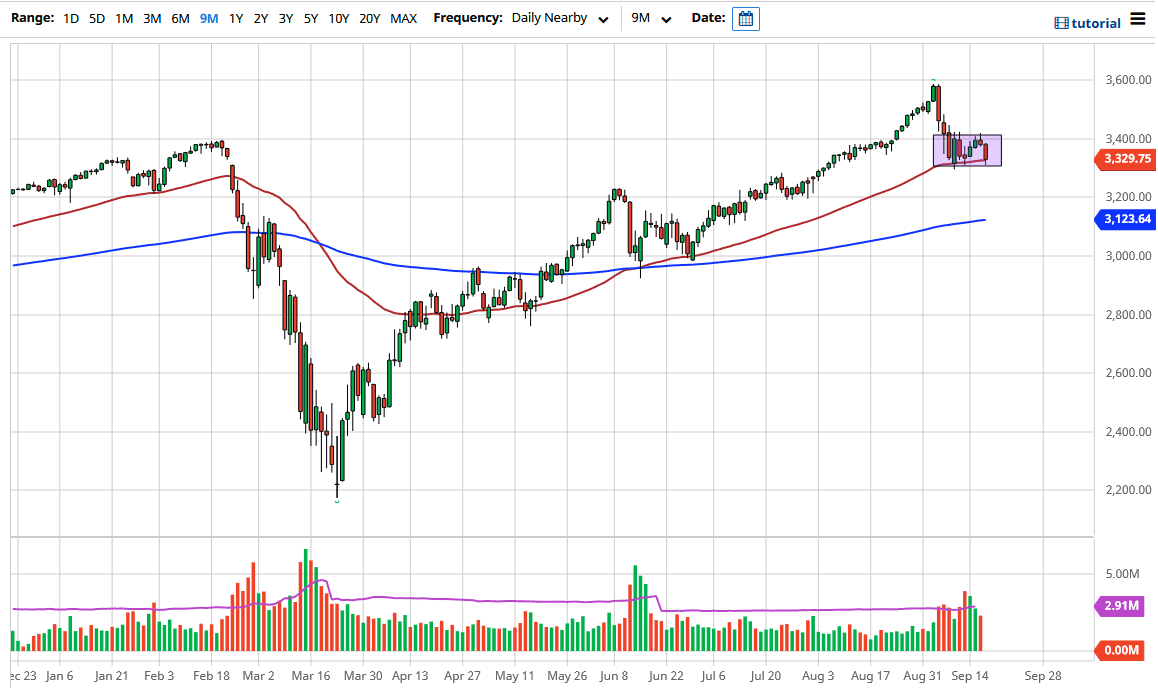

This is an area that attracts a lot of attention for multiple reasons, not the least of which of course has been that it is a large, round, psychologically significant figure. This area has offered support a couple of times recently, so it does make sense that the buyers would be interested in defending this area. Having said that, it has been tested a couple of times, and it needs to hold. If we do not hold that area, then it is very likely that the S&P 500 will lose another 100 points.

At that point, the 3200 level comes into focus which was previous support and resistance, so one would have to assume that it will appear there as well. We also have the 200 day EMA underneath there that is trying to get to the 3200 level, so those are both areas that sellers may be trying to target. That being said, it is difficult to short indices, because the Federal Reserve will step in and save them, and of course they are not equal weighted. In other words, it is the handful of “Wall Street Darlings” that propel most of the gains or losses, as it is not represented of the entire market.

On the other hand, if we hold this area then it is very likely we go looking towards the 3400 level above. That is a level that has been resistive several times now, but the one thing that a bit different about the Thursday candlestick is that we are closing towards the bottom of the candlestick again. You can see that the previous candlestick for the week were smaller, and much less rattled. With that being said, I do think that we are getting ready to see a continuation of negativity, and that in and of itself is something worth paying attention to. However, I am the first person to switch gears if we can close above the 3420 level on a daily candlestick and start buying again as it would be a very bullish sign. One thing I think you can count on is that we are going to continue to bang around in this box until we get the next catalyst for the macroeconomic picture.