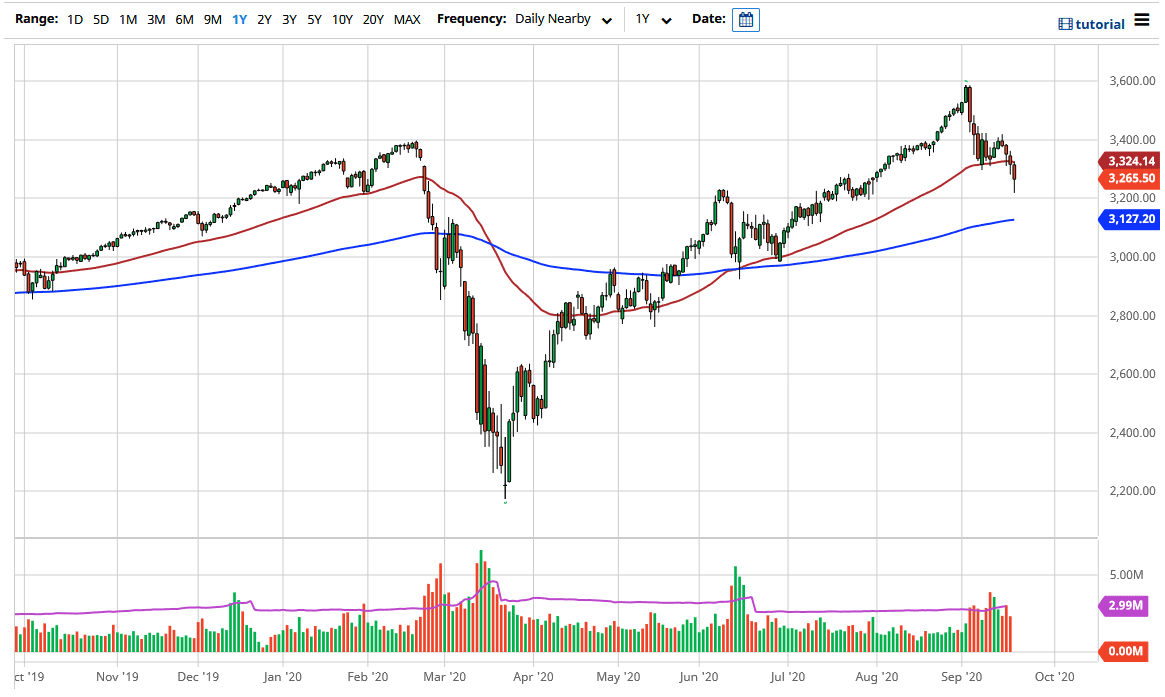

The S&P 500 has fallen rather significantly during the trading session on Monday, reaching down as low as 3220, an area that I remember from a couple of months ago as being crucial. That being said, we have bounced significantly from there and it shows that perhaps we are trying to build a bit of a base after the massive selloff during the day. After all, the US dollar skyrocketed, and that typically is toxic for stock markets.

The 50 day EMA sits above the candlestick during the trading session on Monday, which looks a little bit like a hammer, but all things being equal it is still a rather negative candlestick, and if we continue to see the US dollar strengthen it is likely that the S&P 500 will fall hard. Breaking below the 3200 level could open up a move down towards the 3200 level, which is a large, round, psychologically significant figure. It is an area where we have seen previous support and resistance, so therefore it would make quite a bit of sense that we would bind the market attracted to that area.

Underneath the 3200 level, it is likely that the 200 day EMA comes into play and probably attracts a lot of attention as well. It is currently at the 3127 level in the E-mini contract, so it is worth paying attention to. Underneath there, the market goes looking towards the 3000 level which I think is about as low as this market goes unless something drastic happens.

If we were to break above the top of the candlestick from the session on Monday, then it would be a hammer that kicks off a potential recovery of the 3400 level, and if we can break above there it is likely that the market goes looking towards the 3600 level. All things being equal, this is a market that has had a nice pullback, and at this point, it could still be a nice buying opportunity in a market that is most certainly in an uptrend. I do believe that there is still a lot of concern out there, and as a result, it is likely that the volatility will pick up, and therefore the S&P 500 will continue to be very difficult to navigate in the short term.